Kia Ora!

In this newsletter:

Hot tip of the month – The transaction account that makes you money

Did you know – Disabilities are common, let’s look after each other

First-home buyer tips – Bothered by building inspection costs? Think of the cost of not doing one!

Property – Property values on the move

Investments – Risk versus rewards – how do I decide?

Reserve bank – The OCR is steady – but we have been warned

Business – Customer testimonials are a powerful tool to get new business

Insurance – So many types of insurance! What do I actually need?

Hot tip of the month

The transaction account that makes you money

Currently, the banks don’t pay interest for any funds in transaction accounts. But now Booster Investments are changing the game with their new product, Savvy!!! Elise has been trialling it for the last five months and loves it. With Savvy, you get a debit card, can set up automatic payments, and split your funds into separate accounts, all of which will earn interest.

For more info go to https://www.boostersavvy.co.nz/

Did you know?

Disabilities are common, let’s look after each other

One in four New Zealanders have a physical, sensory, learning, mental health or other disability. More than 35% of disabled people are over 65, which is over 370,000 people.

Only 9% of disabilities are caused by accidents, which leaves a whopping 91% of disabilities caused by genetics or illness. 75% of those with disabilities want to work, but according to the 2013 census, only 25% of disabled people participate in employment.

So, what are some things we can all do to support those dealing with disabilities?

- Avoid making assumptions about a person’s abilities or limitations.

- Ask before giving assistance.

- Be inclusive; avoid segregating or isolating people unintentionally because of their disability.

- Be aware of physical barriers and make accommodations where necessary.

- Understand that not all disabilities are visible. Conditions such as chronic pain, mental health, and autoimmune diseases are often not noticeable.

- Respect the personal space of those who use mobility aids or service animals. Avoid distracting service animals.

First-home buyer tips

Bothered by building inspection costs? Think of the cost of not doing one!

Your home is almost certainly your biggest purchase ever. So, due diligence before you buy is a must. When you purchase a property, you want to be aware of any maintenance that needs to be done and the importance and urgency of the work. If you do buy the property, you can then ensure that you have the cash when the work needs to be done.

Every property will have faults, even new homes. While most are minor, some faults can be fatal financially, so it is essential to get the property checked by a qualified property inspector. It can feel annoying to pay for an inspection of a property before you have bought it, but lenders often require it as a condition of finance. In the worst cases, the cost of unexpected repairs can be catastrophically high.

If the roof is faulty, the cladding is failing, or there are issues with the foundation, then the repairs can be extensive and expensive. Replacing the roof and recladding the property will not add value to the property and should be considered when deciding how much to offer.

If you are a first-home buyer who qualifies for the First Home Grant, there can be no more than $10K of maintenance required for the property to meet the conditions of the grant.

Thoughts from Elise

We finally have a government, and the initial list of policies that are proposed will be coming into effect quickly. Regardless of who you voted for this is the Government that we have for the next three years.

Interest deductibility for investment properties is coming back in and investors will be able to claim 60% this tax year, 80% in 2024/25 and 100% in 2025/26. The personal tax brackets will be reviewed.

These changes will have a big effect on property investors. The interest deductibility will help to put a lid on many of the rent increases but will not help with the lack of availability of housing. Meanwhile, the expected tax cuts will put cash back in everyone’s pockets during a time of high living costs.

We will be closing the BOB office from 22nd December to 7th Jan and wish everyone a safe and happy holiday season.

How to Choose the Right KiwiSaver Provider

KiwiSaver is vital to preparing for retirement, so choosing the right KiwiSaver provider matters!

The Power of Compounding Interest

When planning for retirement, compounding interest is one of the most significant factors influencing your financial future.

Property

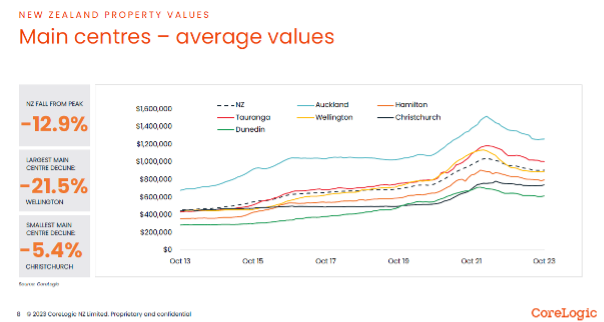

Property values on the move

More properties are coming back onto the market but there is a huge demand from buyers. The scarcity of properties is driving values up, and we can expect to regain some of the value lost over the last two years. But hopefully we won’t get back to the blistering pace of 2020 and 2021!

Page 8 of the CoreLogic November report

Investments

Risk versus reward – how do I decide?

Investment risk is defined as the risk of losses due to the performance of the financial markets. The investments you choose depend on your comfort with sustaining losses and the time available before you need to access the funds.

Markets go up and down, and depending on when you are expecting to withdraw the funds you should consider the level of risk that you are comfortable with. Selecting a lower-risk fund such as a conservative fund when you have 25 years to go to retirement could mean that you retire on around $136pw*, whereas if you choose a high-growth fund you could retire on $214pw*

*Assumptions: 25 years until 65, live until 90, 4% contribution, and $80k salary with $25K in your current KiwiSaver.

Choosing the right fund will greatly affect the amount you have to live off in retirement. Have a chat with Elise and the team to ensure you are in the right fund.

Banks

Rates are up and down

The banks have been doing the job of increasing rates saving the Reserve Bank from needing to put the rates up.

The banks cannot seem to agree on what will happen with interest rates and how long the OCR will remain high. However, they agree that the rates will stay high in the short term and it will be at least two years before we are back to a normal range of 5-6% interest. Westpac are the first to look to reduce their 3,4- and 5-year rates.

If you have a mortgage account about to come off a fixed term rate, contact Elise for advice on refixing your rate.

Reserve Bank

The OCR is steady – but we have been warned

November saw the OCR stay at 5.5%, with another warning by the Reserve Bank that another rise may still come. The next review and announcement is on 28 February 2024.

The new government has indicated that it will change the mandate of the Reserve Bank to exclude managing employment levels. In some ways, this will make little difference to the way that the Reserve Bank works, as employment levels directly impact inflation and inflation is still the mandate of the Reserve Bank.

Business

Customer testimonials are a powerful tool to get new business

Now that you have calls to action in your marketing, we need to make the most of the business you are doing. Client testimonials not only reflect your company’s commitment to excellence but also serve as a compelling tool for attracting new customers.

In this digital age, online presence plays a pivotal role. Google business reviews emerge as a cornerstone for building credibility and trust. Requesting a Google business review from satisfied customers amplifies the impact of positive testimonials, as it enhances the visibility of a company in search results and helps prospective clients make informed decisions. Harnessing the authentic voices of happy customers through testimonials fosters a sense of community and positions your business as a reliable and customer-centric business in a competitive marketplace.

Clients are often unsure of what to say in a testimonial. Help them with prompts such as:

- What did (the business) do for you?

- Overall experience

- What problem did (the business) solve for you?

- Specific feature, if applicable – eg aspect of the product or service that you found beneficial

- Ease of use of the service or purchase

- Before and after scenarios

- Favourite aspect of the interaction with (the business)

- Value for money

Your client’s feedback is not just a review; it’s a celebration of a partnership between you and your client. To leave us a review, use this link https://g.page/r/CUbsOoPqb_jmEAI/review

Insurance

So many types of insurance – what do I need?

Elise was recently working with a client who is single with adult children. The client was pleased with their current cover, as their life insurance meant their family would be taken care of if they died. Great, said Elise, but what if you live?

If you have an accident, then ACC will pay up to 80% of your current income. But if you have a medical event, then you will be reliant on the public health care system and Work and Income to support you. The benefit will be nowhere close to what the client was living on and wouldn’t be enough to meet their normal commitments as well as provide in-home support (this is especially important for single people).

This realisation was a big shock for the client as they realised they were relying on good fortune to protect their lifestyle. We are now in the process of changing their cover so they can safeguard their finances.

If you need insurance advice, Elise can help. Email elise@bob.kiwi.nz for a consultation.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team