Compounding interest is a simple concept. It describes the earning of interest on both your initial investment and any previously earned interest. That means your money makes money, which then earns more money and so on.

An illustration of compounding interest’s potency

Let’s take two hypothetical investors, Annie and Zane. They each have $100,000 to invest for their retirement. Annie chooses a balanced fund with an expected annual return of 5%, while Zane opts for a growth fund with an expected 8% annual return.

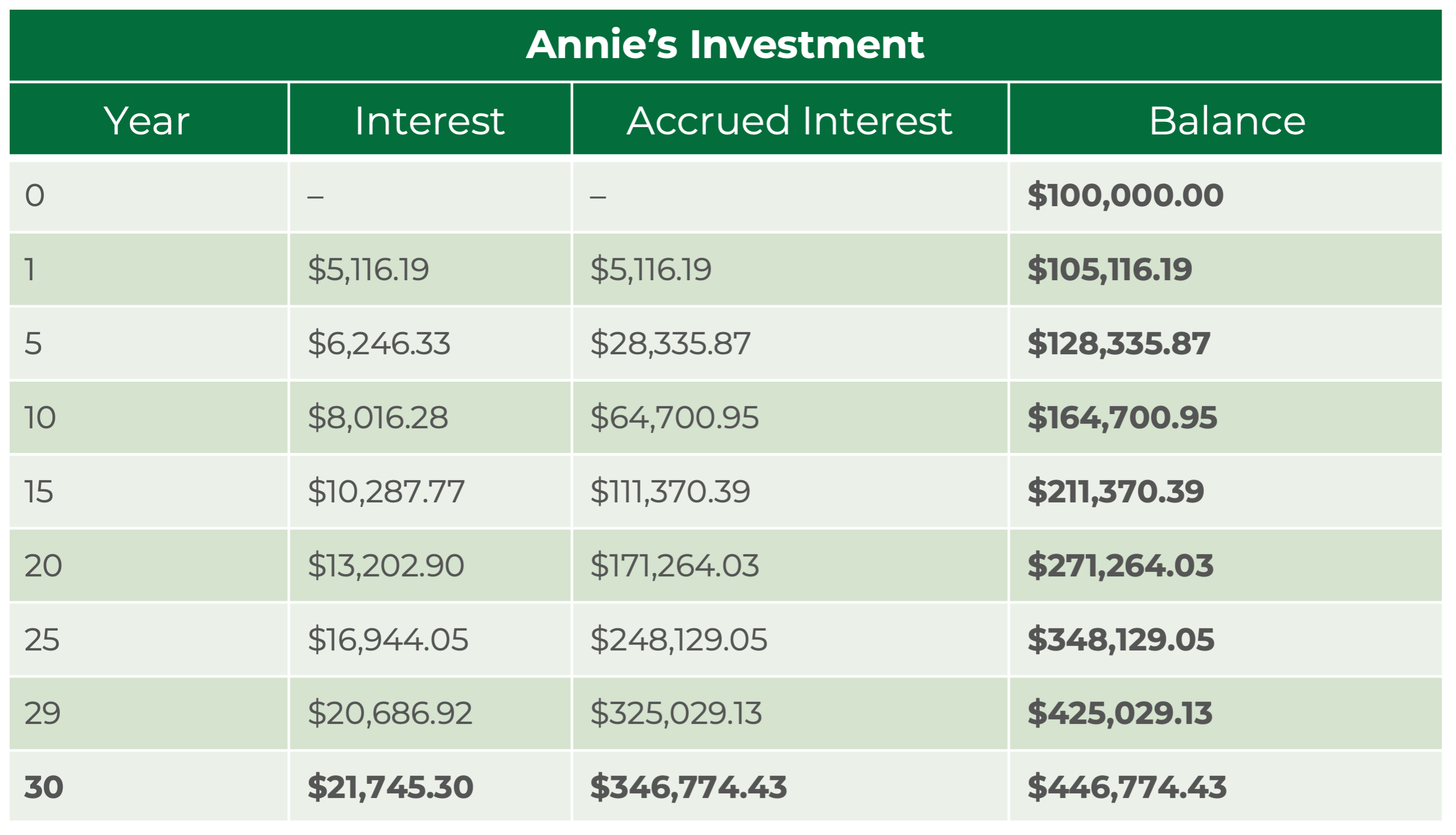

Annie’s balanced fund

Balanced funds have a mix of assets designed to balance growth and stability. Over the long term, they offer modest but steady returns. With a 5% expected annual return, Annie’s investment would grow to approximately $446,774 over 30 years (not allowing for tax).

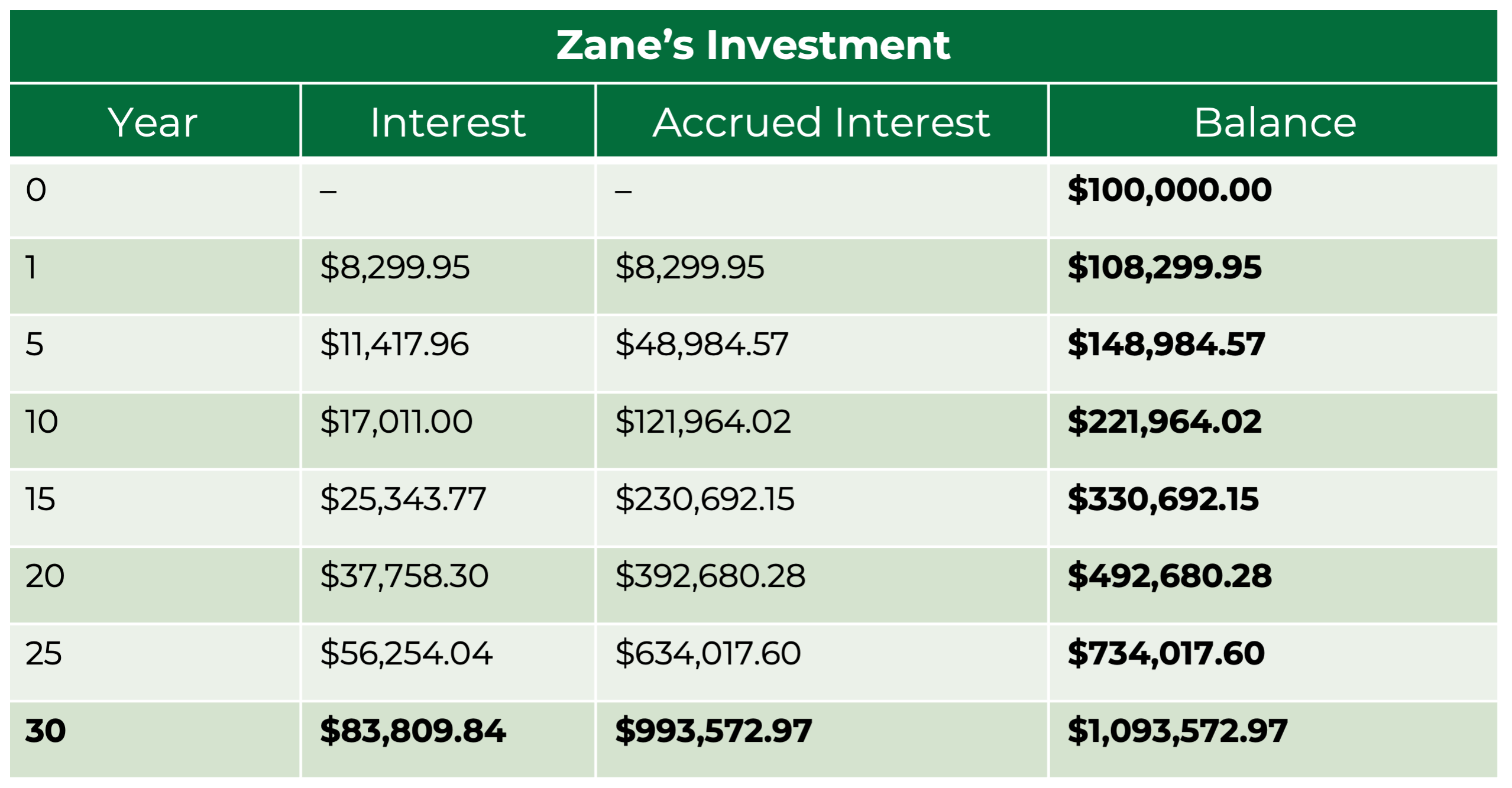

Zane’s growth fund

Growth funds are designed to maximise profits. The investments can be more volatile but offer higher potential returns over the long term. With an 8% expected annual return, Zane’s investment would grow to approximately $1,093,572 over the same 30-year period (not allowing for tax).

The significant difference between Annie’s and Zane’s totals comes down to the impact of compound interest.

The Role of Risk

It’s important to note that the difference in expected returns between balanced and growth funds comes with varying levels of risk.

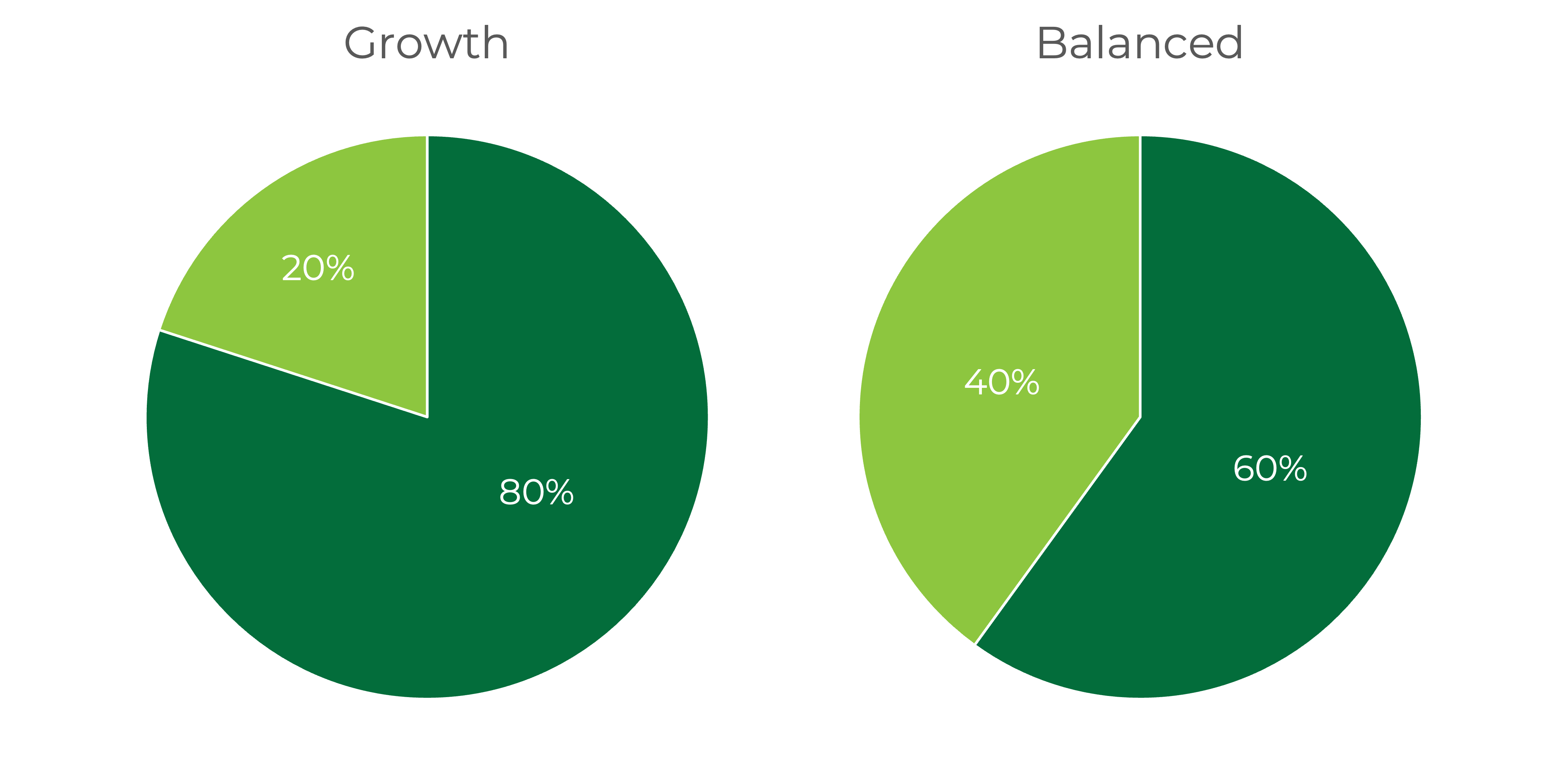

Growth funds are riskier due to their higher exposure to the stock market, which means they can experience more significant fluctuations in value. Both positive and negative. A typical growth fund consists of 10-20% income assets and 90-80% growth assets such as stocks and other high-risk assets.

Balanced funds are more conservative and are typically 40-60% income assets with the remainder of the investment’s growth assets, which can provide stability but will almost certainly result in lower returns in the long term.

Often, we see clients who are too conservative and do not realise they will not achieve their retirement goals just because they have selected a fund that is too-conservative. It is possible to split your retirement savings to give you the best of both worlds.

Plan now for your future

Ultimately, the key to a successful retirement plan is to find the right balance between risk and reward, keeping in mind the enormous benefits of compounding interest over time.

If you need to review your KiwiSaver or other retirement investment plan, get in touch. We can give personalised financial advice to get you on your way to an easy retirement.