Kia Ora!

In this newsletter:

Hot tip of the month – Review your risk profile and protect your finances

Did you know – Insurance is an ancient tool

First-home buyer tips –3 Things the banks look for when checking your deposit

Property – First-home buyers are still the winners in this market

Investments –Make the most of your money: how to choose a KiwiSaver provider

Banks – Fix short or long? The question on all homeowner’s minds!

Reserve bank – OCR nothing to see here – but let’s consider digital cash

Hot tip of the month

Review your risk profile and protect your finances

You’re only as old as you feel, the saying goes. When it comes to mindset, we totally agree, but not when it comes to financial risk. Your stage of life directly influences your risk profile. As you progress in years and your risk profile changes, you need to regularly consider whether your finance setup suits you today. This means checking the types of investments you have in KiwiSaver and other funds, the amount of insurance you need, and the type of insurance you need.

For example, if you’re close to buying your first home, you would set your KiwiSaver to conservative or defensive to protect your deposit; if you have just purchased your home and have more than ten years to retirement, you would put your KiwiSaver in high growth or aggressive funds.

Did you know?

Insurance is an ancient tool

The concept of insurance can be traced back to ancient civilisations. In the 3rd millennium BCE, merchants in the city of Babylonia (modern-day Iraq) would distribute their goods across multiple ships to mitigate the risk of loss due to shipwrecks or piracy.

This practice is considered one of the earliest forms of risk management, which eventually evolved into the modern insurance we use today.

First-home buyer tips

3 Things the banks look for when checking your deposit

Most people these days use their KiwiSaver as their main deposit source. The banks will look at that as a great start and then also look at the following:

- Have you been saving outside of KiwiSaver? This will show you can manage your savings even when the money is accessible.

- Is the savings outside of KiwiSaver around 5% of the deposit? This shows long-term savings and sound money management habits.

- Is the deposit made up of gifts from your family?

Gifts from family are absolutely acceptable. But if the gift and your KiwiSaver are the only source of your deposit, the bank will be cautious about lending over 80% as they may have concerns about your money management character.

Thoughts from Elise

April has flashed by with two public holidays; now we have a month to wait until the next one. Term 1 is complete, and the kids are back at school after the school holidays. We are well into autumn, and in Christchurch, the streets are at sea with the leaf fall.

Lest we forget the ANZACs and those who sacrificed to give us our freedoms. I am grateful for the relative peace that we live in here in New Zealand, and I’m mindful of others worldwide who are still fighting for peace and freedom.

The Budget is coming out this month, and the government has been working to get a tax cut through at a significant cost to the public sector. The redundancies will help to lift the unemployment rate, but only artificially. Wage inflation has slowed to something sustainable, and while more people will be looking for work, there are still skill shortages in certain areas.

Inflation is still high, and the downward trend will be slow, which will continue to put pressure on households. Please reach out if you need help. This all sounds rather negative, but there are opportunities for people willing to do what is necessary and make some tough calls.

Property

First–home buyers are still the winners in this market

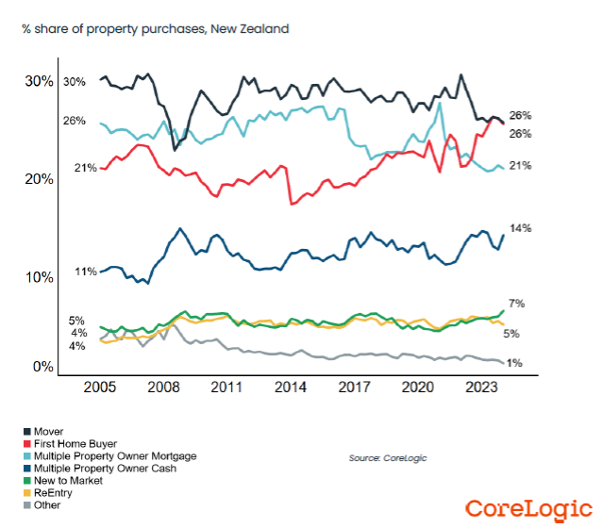

First–home buyers are still the primary purchasers in the property market. Their ability to borrow at higher LVR and use their KiwiSaver for their deposit gives them the edge. Some property investors are selling properties to pay their tax bills as they can’t access the equity. These ex-rental properties are opportunities for first-home buyers.

Good properties coming onto the market are being snapped up, and we are seeing multi-offers on those properties. Problem properties are still taking some time to sell as lenders are being fussy about the securities they are taking on.

Investments

Make the most of your money: how to choose a KiwiSaver provider

Your KiwiSaver provider matters. They manage the money that will fund your first home and/or your retirement. So, it pays to take the time to make an informed choice.

Things to consider when choosing your KiwiSaver provider:

- What sort of funds do they have to support you through the different stages of your investment lifecycle, from starting out to making your first home purchase, leading up to retirement, and beyond?

- Where are your funds invested? You may have personal values that preclude investment in specific industries.

- What are the fees? Consider any fees in conjunction with the returns; higher fees are not a bad thing if the fund is regularly returning better results.

- Remember that past performance does not guarantee future returns. But it is still helpful when deciding on a provider. You want a provider that is regularly in the top 5-7 for multiple categories, not just one category. This is the best indication of sound investment strategies.

- What is their service like when you want to talk to someone or get answers to questions?

As with any big financial move, it is best to work through an adviser. They can examine your whole financial situation and advise you on which providers would best suit your needs.

Banks

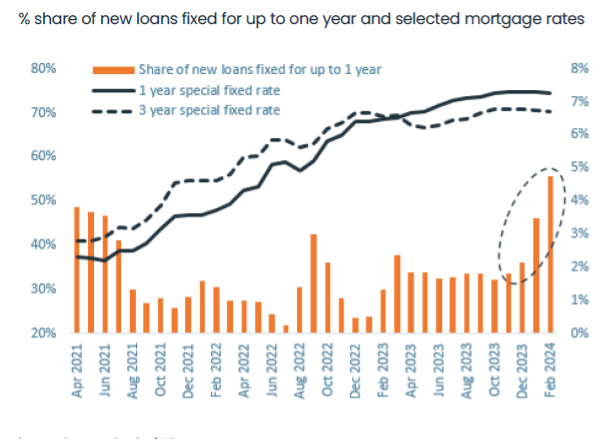

Fix short or long? The question on all homeowner’s minds!

Loan-to-Value (LVR), is pretty commonly understood. It is the amount of debt compared to the value of the property. This is most important at the time of purchase and when selecting interest rates.

Income servicing is the magic formula that the bank uses to determine your capacity to service the debt and how much uncommitted monthly income (UMI) you have.

So, what is debt-to-income (DTI)? The Reserve Bank is looking at another way to control people’s total level of debt by controlling the amount of debt you have compared to the income you earn. This is called debt-to-income (DTI).

The proposed rules are:

- 6 x your income for an owner occupier purchase

- 7 x your income for an investment property purchase

If you are rent-reliant, then this will stop some of the full-time property investors. For most people, it will not make a difference.

Reserve Bank

OCR nothing to see here – but let’s consider digital cash

The Reserve Bank’s next OCR announcement is on 22 May, and we expect no change. The economists are still at odds with when the OCR will begin to drop. The only thing they can agree on is that it will not come down as fast as it went up.

Cryptocurrency is a continuing trend in investment, and the Reserve Bank wants to get on board. They’ve started discussing what they call “Digital Cash”. It won’t replace cash but will be an alternative and will be the start of the government getting some regulation in place to manage the crypto currencies which are seen as banking disruptors.

Check out this article for more information.

Business

Terms of trade – get the money rolling in

You go to all the trouble to get a sale and do the work. But make sure that you can collect the money for your effort. Working hard and not being paid is very uncool!

5 key things you need to do as part of your sales process are:

- Produce the quote and include your terms of trade or terms of engagement

- Get the client to sign or acknowledge in writing the quote and payment terms

- Promptly send the invoices for the work that you have completed

- Follow up to get payment

Insurance

Get checked. It may save your life.

According to a December survey by NIB, which surveyed 1,000 people about their thoughts on health checks, almost half (47%) were behind in their general health examinations, yet the majority believe they are in good health.

63% of those asked had never received dental checks, and 55% had not received eye checks. For serious health screenings, 84% were not up to date with skin checks, even though NZ has one of the highest rates of melanoma in the world. Even with national health screening programs in place, people are behind in accessing screening for prostate cancer checks (60%), cervical smears (44%), bowel cancer screenings (37%), and breast cancer screenings (28%).

Reasons for not getting checked were people didn’t think they needed to (38%) and cost (36%), with 19% being anxious about what the tests may reveal.

There are countless examples of early intervention saving lives and instances where conditions left unchecked result in early deaths. Take the time to find out what checks are available to you and get them done. Talk with loved ones about whether they are doing the same. If you need support, ask for it, and if a friend or family member is feeling anxious, offer to make the appointment for them and attend the appointment as support.

Remember that many conditions don’t have noticeable symptoms in the early stages, so if you feel good, that’s great – but get checked anyway!

Insurance can give you access to specialist tests and more treatment options, faster. If you need insurance advice, Elise can help. Email elise@bob.kiwi.nz for a consultation.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team