Kia Ora!

In this newsletter:

Hot tip of the month – Information is power – keep track of your dosh

Did you know – An Advanced Care Plan speaks for you when you can’t speak

First-home buyer tips – Earn interest on your everyday account

Property – Sales are still down, but with signs of movement

Investments – FMA taking civil proceedings against Booster – what does this mean?

Banks – 2nd Tier Lender Resimac is leaving the NZ Market, but not to worry

Reserve bank – When are we going to finally see a shift in the OCR?!

Business – Ensure you can recover your collection costs

Insurance – Which is best for you – standalone or accelerated?

Hot tip of the month

Information is power – keep track of your dosh

Are you one of the many people who do the work of creating a budget… and then go on spending without tracking against your budget? Did you do a budget (or, as Elise likes to call it, a spending plan) and set up different accounts or ‘buckets’ to manage your funds but found that they are not big enough due to the increased cost of living?

Elise is working with the team at Sortme, who have a cool tool for automatically categorising your spending so you can see where your money is going! It will also help you identify all those sneaky subscriptions you’ve forgotten you’re paying. Sign up for the free account using Elise’s Sortme Referral Link. This link will allow Elise to support you with your budget.

There is a Sortme version that costs approximately $10 per month, but Elise’s advice is to wait to sign up for it. The Sortme team have some tweaks they’re working on to get the paid version worth the cost.

Did you know?

An Advanced Care Plan speaks for you when you can’t speak

An Advanced Care Plan (ACP) is a document that gets registered with Te Whata Ora (Health New Zealand). It informs hospitals what treatments and interventions you do and do not want. An ACP can be created with a nurse at your local GP, or you can do it yourself.

Use this link to read more about ACP and get it sorted; it is never too soon to complete a plan, as it is relevant if you end up in hospital due to sudden illness or an accident.

Your ACP can be updated anytime and replaced as you go through the ages and stages of life and as new procedures and treatments become available. Putting a plan in place will massively help your Health Enduring Power of Attorney (EPoA) make the right choices for you. The EPoA cannot override your wishes as made in the ACP unless they can prove that you changed your mind. So if, for example, you don’t want to be tube fed, they can’t authorise health care workers to tube feed you. We love the idea of having your say when you can’t have your say!

First-home buyer tips

Earn interest on your everyday account

Saving for your first home got a little harder with the removal of the First Home Grant. You can still use your KiwiSaver towards the deposit if you have not used it previously and don’t currently own property. Saving small amounts regularly will compound over time, and you are all familiar with the concept of saving accounts. But what if you could earn interest on the funds that are sitting in your everyday account or the account where you have set aside funds for your bills? With Booster Savvy (https://www.boostersavvy.co.nz/), your funds do exactly that currently earning *5% annually, calculated daily using your account balances. Even with small balance amounts you will earn interest that is paid monthly. Every dollar of interest you earn is a dollar less you have to work for!

Using Booster Savvy and Sortme to be conscious about your spending will help you to be able create that deposit a little sooner. The key is to enjoy the challenge and be conscious about your spending.

*The interest rate may change from time to time. Booster takes a fee for providing this service based on the income it earns over and above what it pays you.

Thoughts from Elise

Hard to believe we are halfway through the year and past the shortest day. I am hoping you all had the chance to enjoy Matariki and took the time to honour the past and celebrate the future. It’s the perfect time to reflect on what the last year and consider what you want to make happen in the coming year.

Matariki is not just a day of celebration. Matariki is the 7-8 days in the Tangaroa lunar period that the Matariki star cluster rises and is visible before the darkness of the new moon. This year Matariki is from June 29th to July 6th.

I hope everyone got their dosh in to get the full Government KiwiSaver Contribution for the 2024 financial year. To ensure you get the full amount without stressing when the deadline approaches, make sure that you are putting an average of $21pw into your KiwiSaver, through voluntary or employee contributions from your wages.

At Building on Basics, we are excited to have Gordon up and running and working with you. We have been working on some cool initiatives, such as the Sortme tools to help you get a better handle on your finances and are thrilled to be starting to share these with you.

On a personal front, I’m not a fan of the cold, so I’m focusing on indoor projects over the winter, including installing insulation in our attic space. Oh, the fun jobs!

Property

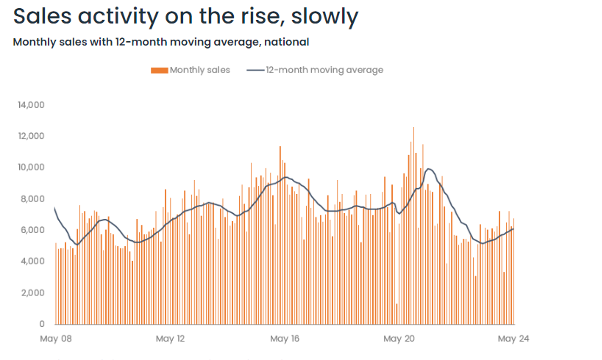

Sales are still down, but with signs of movement

CoreLogic reports that sales are still well down from the peak (aka madness) of 2020-2021. There are signs of growth, and more buyers are coming into the market. However, there are still difficulties with getting deals done. Two factors affecting sales are:

- Banks – either not lending or too slow with the assessments.

- Insurance – insurance cost and future insurability concerns for homes with old wiring or Dux Quest pipes.

As with the GFC (Global Financial Crisis), we have had a couple of bumps getting back on track and it will continue to be a slow rise out of this recession. More investors that bought at the peak of the low rates are likely to put investment properties they can no longer afford on the market after 1 July, while some investors are waiting in the wings for these distressed vendor deals to come onto the market.

Investments

FMA taking civil proceedings against Booster – what does this mean?

The Financial Markets Authority (FMA) are the main ‘cop’ of the financial services industry. In June they announced they have taken civil proceedings against Booster. The FMA charges relate to what they say are improper declarations of 3rd party dealings between some of the key personnel in Booster and the Booster TAHI and Booster Wine Group. The alleged improper disclosure happened between 2017-2022.

Booster disputes the allegations. It could take 2-3 years before the Civil proceedings are heard, and Booster intends to fight the charges. Any costs associated with the defence by Booster will be managed out of Booster resources and will not affect your investments, nor should you expect to see an increase in your fund management fees.

Elise is happy to discuss this more with you, as are the Booster team, should you have any questions. Elise still has some of her funds through Booster and the funds continue to perform.

Banks

2nd Tier Lender Resimac is leaving the NZ Market, but not to worry

Resimac is an Australian-based company that has been operating in Aotearoa since 2012 and in Australia since 1985. In a shock announcement earlier this month, Resimac has decided to stop writing new business in New Zealand from 1 July. They will still provide lending for any deals in the pipeline that were approved or pre-approved.

If you have existing loans with Resimac, there is NO NEED to do anything!! Your loans are safe and will continue to be supported by the team at Building on Basics and we will be working with the Australian Resimac team.

It is not uncommon to see lenders come and go at this time in the market, and while Resimac is departing, Elise has had two new funders approach her as lenders we can utilise for clients.

Main banks have been slow to process applications and are picky about the deals that they do.

Banks continue to offer cheap rates for Green Loans (loans for solar, insulation and heating).

Reserve Bank

When are we going to finally see a shift in the OCR?!

The Official Cash Rate (OCR) is still at 5.5%, with the next review on 10 July. The Gross Domestic Product (GDP) figures came out in June, with a rise of 0.2%; still within the margin of error for recession. Let’s put our rose-tinted glasses on and be hopeful.

In July, many of the redundancies from the Government cull will come through. This is a good sign for the RBNZ, as getting unemployment levels up is one of the indicators that they are looking for.

Meanwhile, the number of companies going into liquidation is increasing, as is the number of mortgage sales and owners behind in their loan repayments. People are still in the hurt locker financially. Company liquidations are a concern as this affects the owners, staff, and suppliers and can have a roll-on effect to tip other companies over.

Kiwibank economists predict that the OCR will start decreasing in November, but Elise suspects they are still too hopeful. But she would love to be wrong!! ASB, on the other hand, are predicting February as the start of the OCR lessening. If anyone has a fix for the crystal balls to give us more certainty, they will be sitting on gold.

Business

Ensure you can recover your collection costs

Elise has talked about these in the past, and at this time of the market, it is more important than ever to tick all the boxes to ensure you receive the money for your work.

Remember these key things to do:

- Have terms of trade and get these signed before you start work for the client.

- When you do quotes for projects/jobs, make sure you get an email or written evidence that the quote has been accepted.

- Reference the terms of trade on your quote and specify payment expectations, including the fact that any collection costs are charged to the client.

- Communicate clearly about variations, including getting the variations agreed in writing.

Insurance

Which is best for you – standalone or accelerated?

Insurance is not all about the level of cover. When making insurance decisions, always remember that insurance is about providing you with control, dignity and certainty in case of the unexpected so that you can take care of yourself and those you care about.

When considering life insurance, think about what support your family will need when you die. It may involve paying off your mortgage, so your family have somewhere to live without a financial burden.

An accelerated life insurance policy means the payment of your life cover is ‘accelerated’ to pay out if you have a critical illness (Trauma Cover) or are unable to return to work (Total Permanent Disablement – TPD). If as part of that accelerated TPD or Trauma claim you have repaid some or all your debt, your life cover needs are reduced, as the debt has been repaid.

Your premium will be lower by having the option to pay out your life insurance sooner, as an accelerated claim on your life cover for TDP or Trauma. This does not suit everyone, but it is an option. Otherwise, your Trauma and TPD cover can be what we call stand-alone products, entirely separate to your life insurance cover.

To determine what cover is best for your circumstances, get in touch with Gordon at gordon@bob.kiwi.nz or 022 503 9094. Gordon will do a free review of your existing covers for you.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team