Kia Ora!

In this newsletter:

Hot tip of the month – Why you need an accountability partner

Did you know – Are you an average spender?

First-home buyer tips – 5 reasons why lawyers are worth the expense

Property – Markets are on the move and volumes are still down

Investments – Is do-it-yourself KiwiSaver the way to go?

Banks –Debt to Income (DTI) – does it affect you?

Reserve bank – Inflation is high with conflicting speculation from economists. So what?

Business – How much can I take for drawings?

Insurance – It won’t happen to me, 3 not so good reasons to not have insurance

Hot tip of the month

Why you need an accountability partner

Everyone needs help with motivation sometimes. The phrase ‘a problem shared is a problem halved’ is a cliche for good reason; it’s often true. We’re not suggesting that you share your bills with others (unless it’s appropriate!), but sharing a challenge with a friend can keep you motivated and help you do the necessary work. This approach can help with all areas of your life; exercising, learning a language, eating better, drinking less (or more if it’s water 😊), saving for a holiday, or maybe spending a little less on the takeaway coffees.

You don’t need to be in a relationship to have an accountability partner. For some relationships, having that accountability partner as someone other than that special person in your life is better. Your accountability partner can encourage you, celebrate with you and help you stay on track. Turning up for someone else is always easier than holding yourself accountable when you feel tired or down. We can be part of your accountability team.

Did you know?

Are you an average spender?

Inflation has been rampant and is still high. If you’ve been feeling the pinch, Statistics NZ has the proof that your dosh is not going as far. Their recently released survey of household spending over four years ending 30 June 2023 has some interesting results. Although the period covered is nearly a year old, its findings are relevant today.

- The average weekly expenditure for households in Aotearoa was $1,598 (net figure after deductions from sales, trade-ins, and refunds are accounted for).

- The average weekly household expenditure increased by 18.4 per cent in the four-year period.

- Regionally, Auckland had the highest average weekly household expenditure at $1,823.

- Housing and household utilities remained the largest expenditure group at 24.9 per cent of net average weekly household expenditure.

- One-person households ($808), ‘one parent with dependent child(ren) only’ households ($1,115), and all other ‘one parent with child(ren) only’ households ($1,231) had significantly lower average weekly household expenditure than the New Zealand total.

*data from Stats NZ

First-home buyer tips

5 reasons why lawyers are worth the expense

The moment we mention the word lawyer, you probably think of the word ‘expensive’. But the important point is that the cost of not choosing a good lawyer will be even more expensive. When purchasing a property, your lawyer is your risk manager. Remember, you’ve spent three or more years saving for your deposit and you will be putting that at risk when you sign a sale and purchase agreement.

So, what will your lawyer actually do for you? For starters, your lawyer will check:

- The title and any easements and covenants. An easement is the legal right for someone to have limited use or access to the property you are purchasing, and a covenant is a legally binding agreement about rights and obligations relating to the property.

- The LIM for anything that may affect your use of the property.

- Any caveats attached to the property that may affect the vendor’s ability to settle.

- There are no defects on the title, which means that it is not clear what you are buying.

- There are sufficient clauses in the agreement to allow you to complete your due diligence without losing your deposit.

The title is key; a defective title can mean that the property is not worth as much, as the cost to fix it can run in the tens of thousands. An easement for council or shared drainage may stop you from being able to build on part of the site. There may be heritage requirements that are costly to maintain.

Along with the property checks they will also check that you are ready to go with relationship property agreements, your will and enduring powers of attorney. If you are in a relationship, they will counsel you to consider getting a relationship property agreement, especially if family gifting is involved. Your lawyer is your risk manager who has your back. The actual conveyancing is the least of what they do.

Thoughts from Elise

We are a quarter of the way through the calendar year, and today is the start of a new financial year.

Inflation is still high compared to the target level, and we are technically in a recession as we have had two negative GDP quarters. The bigger problem is stories in the papers about businesses retrenching staff, and this includes the massive staffing cuts to government services.

The way out of a recession is spending. With job cuts and reduction in spending by the government, it is going to be a long and slow ride out of the high inflation and interest rates. Hang in there! It’s going to take some different thinking and actions to get through this.

Mandy and I love our new office, and it has been great to have clients pop into the office for meetings and to get their paperwork sorted.Building on Basics was proud to support the community Big Screen in Lyttelton for watching the SailGP on the weekend of the 23rd. It was great to see the dolphins win Day 1, and sad not to see the big boats in action, but Day 2 did not disappoint.

Property

Markets are on the move and volumes are still down

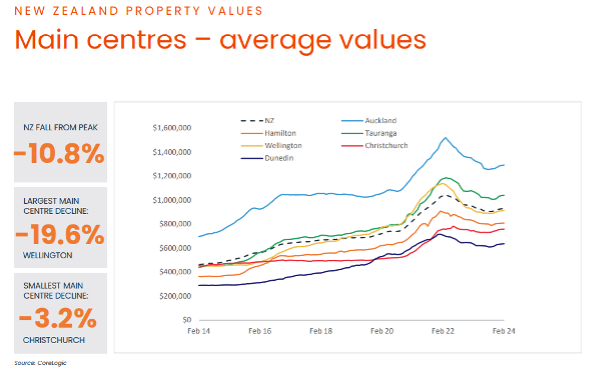

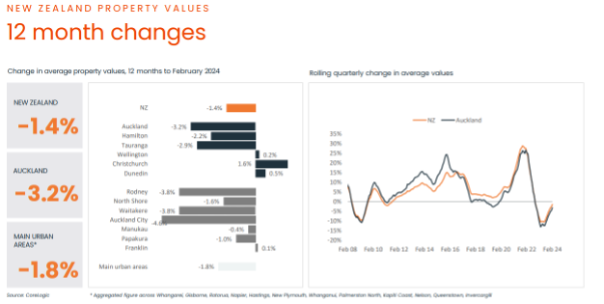

The increases that we were hearing about in January are showing in the stats this month. Property values are on the rise, but the volumes are still down.

First-home buyers are still the active majority in the market, and many of these are migrants with good deposits. Some investors are back after the interest deductibility announcement. With interest rates still high and properties yet to return to 2022 values, servicing and deposits are still a challenge for many looking to buy.

Being pre-approved is important to get a jump on any opportunity when you find.

Investments

Is do-it-yourself KiwiSaver the way to go?

We love Sharesies for the opportunity it has given people to invest in the share market and to learn more about money and investments. Sharesies is also disruptive technology that has reduced fees and made share market investing open to everyone, not just the wealthy. This is great!

Sharesies has a KiwiSaver option, where you can choose where to invest your money. They have plans in which you can add or subtract from a list of over 100 companies to tailor-make your portfolio.

This option is amazing if you are a seasoned investor, know how to read the company reports, and have time to monitor your portfolio. The risk is that if you are a long-term growth investor, you panic when a company’s share drops in value and swap it out for something else when you should have just ridden the wave.

The fund managers that manage general investment funds and KiwiSaver funds have decades of experience and work in large teams that access massive research pools of information. They understand risk and have thought-out and proven strategies. KiwiSaver is a long-term investment and, for many, an essential part of retirement. By all means, invest some funds outside of KiwiSaver, but unless you really know what you are doing, keep your KiwiSaver with a team that knows what they are doing.

Banks

Debt-to-Income (DTI) – does it affect you?

Loan-to-Value (LVR), is pretty commonly understood. It is the amount of debt compared to the value of the property. This is most important at the time of purchase and when selecting interest rates.

Income servicing is the magic formula that the bank uses to determine your capacity to service the debt and how much uncommitted monthly income (UMI) you have.

So, what is debt-to-income (DTI)? The Reserve Bank is looking at another way to control people’s total level of debt by controlling the amount of debt you have compared to the income you earn. This is called debt-to-income (DTI).

The proposed rules are:

- 6 x your income for an owner occupier purchase

- 7 x your income for an investment property purchase

If you are rent-reliant, then this will stop some of the full-time property investors. For most people, it will not make a difference.

Reserve Bank

Inflation is high with conflicting speculation from economists. So what?

The Gross Domestic Product (GDP) was -0.3% in September 2023 and -0.1% in December 2023. In New Zealand, we measure recessions as two negative quarters, so technically, we are in a recession. To a degree, we needed a recession to help reduce inflation, and this could bring the timeline forward for OCR rates to be cut sooner than the mid-2025 timeline indicated by the Reserve Bank.

But because there are so many other factors that affect inflation, economists coming to different conclusions based on their interpretation of the data.

So what? For now, plan for the rates to stay high. At a minimum, the next OCR announcement will keep the OCR steady, and in the worst case, it will go up again.

Elise’s broken crystal ball says the OCR will stay the same for the April 10 announcement, we’ll see!

Business

How much can I take for drawings?

You have $2K per month of personal bills, so you’re just going to take $2K per month from your business to pay those bills. No problem… or is there?

The $2K you have pulled from the business must be taxed. As a shareholder or sole trader, you also need to pay ACC. These are just two of the many issues that can come from pulling money randomly from the business.

Does your business have sufficient cash flow to pay its bills and still have some in reserve for a market that is moving into a recession? What if sales slow down and/or your regular work reduces?

It’s critical to run your profit and loss to ensure you are setting aside adequate money for ACC, tax, and GST. Turnover (the sales you make) does not equate to profit.

Insurance

It won’t happen to me; three not so good reasons not to have insurance

No one likes paying for insurance but are relieved to have a payout and/or support when something goes wrong. If they’re underinsured, they may even regret not having more insurance!

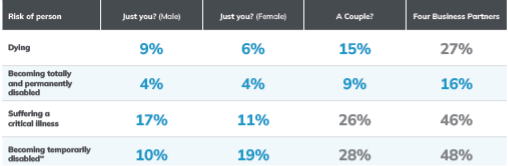

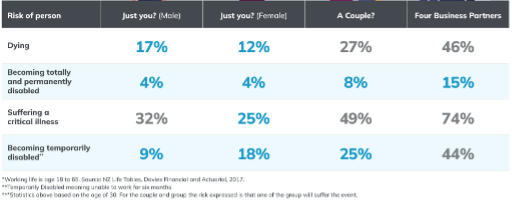

The three main reasons that people don’t have insurance are:

- Can’t afford it. The irony of this situation is that when you can’t afford insurance is typically when you need it the most, as your resources are limited.

- “It won’t happen to me!” Sure, but the stats say it is happening to someone and why not me or you?

Non-smokers

Smokers

Statistics and images are from Quality Research Limited

- “I just haven’t got around to it yet”. This thinking is closely aligned with #2; because it is unlikely to happen to you, there is no urgency for thinking about it and getting it sorted. But the longer you delay, the higher the risk that you will discover a condition that may reduce your chance of getting cover or will cost you more to get cover.

Really there are two reasons to have cover:

- When something happens, it makes your life easier.

- When something happens to you, those that you love can be taken care of or have support to take care of you.

The Financial Service Council research revealed that New Zealanders are underinsured for the four types of life insurances, with just:

- 39% holding life insurance cover

- 22% holding trauma/critical illness insurance

- 20% holding income protection insurance

- 17% holding total and permanent disability insurance

Where do you fit? If you need insurance advice, Elise can help. Email elise@bob.kiwi.nz for a consultation.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team