Kia Ora!

In this newsletter:

Hot tip of the month – Hate the thought of a budget? We have a Jedi mind trick for you!

Did you know –Unravelling the mystery: The world’s oldest stock exchange

First-home buyer tips – Why you need a pre-approval

Property –Moving from a buyers’ market to a sellers’ market

Investments –Riding the green wave: profiting from the renewable energy revolution

Banks – Opportunities for cashback!

Reserve bank – The OCR is holding at 5.5% – what does this mean?

Business – Who is your market? Build it and they will come?

Insurance – Insurance for age and stage – what stage are you at?

Hot tip of the month

Hate the thought of a budget? We have a Jedi mind trick for you!

Most of you will have heard Elise say you earn money for one reason: to spend it. You’re going to spend it now or later, or it will pass on to someone else to spend! Savings are just future spending money. It’s about having the money ready when you need it.

The best way to manage your money is to… manage your money! But budgets are like diets for most people and feel restrictive. Having a ‘spending plan’ instead can be freeing. By viewing it as a plan for what you can spend and when, your whole mindset on budgeting can change. It becomes a positive, goal-oriented exercise, rather than a limiting one.

There are two common mistakes people make with their spending plans:

- Using their pre-tax income when allocating their spending and forgetting about those annoying taxes.

- Not including the quarterly, half-yearly and annual items. It’s a surprise to many when Christmas and birthdays come, and they remember they need to buy gifts.

Develop a spending plan without self-judgement; it’s about what is best for you and your situation. Look at the essentials and any obligations first and then decide how to use the left-over funds. We will soon announce an exciting offering for those who want to better handle their cash flow. In the meantime, get in touch for personalised, expert advice.

Did you know?

Unravelling the mystery: The world’s oldest stock exchange

The Amsterdam Stock Exchange is considered the world’s oldest stock exchange. Established in 1602 by the Dutch East India Company, investors and traders would gather at a coffeehouse in Amsterdam to buy and sell company shares. This was the birth of a formalised marketplace for securities.

To put it in perspective, 1602 was during Queen Elizabeth I’s lifetime, so the fact that the exchange is still going today is impressive. It illustrates the enduring legacy of stock exchanges, which have been pivotal in shaping global financial systems over centuries.

First-home buyer tips

Why you need a pre-approval

To get an idea about how much you can afford to borrow, we can help you get a pre-approval from the bank. A pre-approval is a conditional authorisation that requires checks on your character and ability to make your mortgage payments.

Lenders check your character by doing a credit check and looking at your bank statements to see your financial habits. They check your affordability by looking at the transactions to confirm what we say your spending is and then determine how much debt, if any, you can afford.

If you pass these checks, they will give you an idea of what you can borrow. A pre-approval will only ever be for lending up to 80% as this is the ideal safety, even though lenders have products where you can borrow up to 90% and even 95%.

But remember – what they have NOT approved is for you to buy any property you like! The lender will have conditions for the property you purchase, likely requiring a valuation and possibly a building and/or weather tightness report and confirmation of suitable insurance. This is especially the case for older properties.

Pre-approval is vital for knowing what you can borrow before making offers on properties. So, if you think you’re ready to buy but haven’t already got a pre-approval, get in touch and let’s get your pre-approval underway.

Thoughts from Elise

February has been a massive month for the team at Building on Basics, as we have been working on some significant initiatives. The CRM system implementation has been a distraction, but we hope to see the benefits very quickly.

We have been getting consistent requests for additional support with cash management, so we’ve been working on some tools to help. These tools are already proving useful, and we hope to officially announce them in April.

The most exciting news for us is that we will be moving out of the home office and into an office in Lyttelton. The local accounting business, LyttelSoft, has rented us a space with access to a meeting room and moving day is today!! It shouldn’t take us long to get set up; we look forward to welcoming any clients stopping by.

Property

Moving from a buyers’ market to a sellers’ market

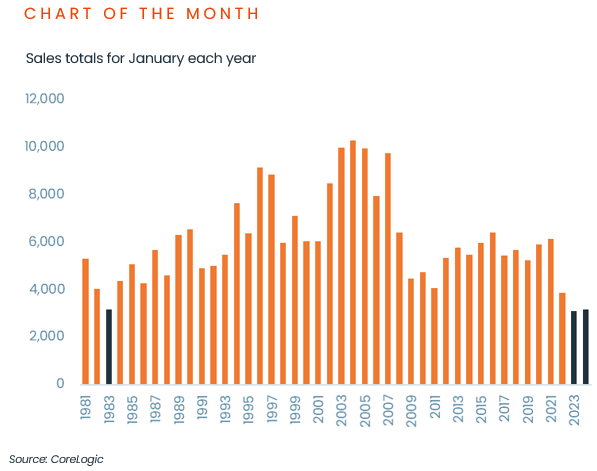

For the second year in a row, sales volumes are down in January and at levels not seen since 1993. Low sales indicate a buyers’ market, meaning that buyers have more room to negotiate terms and conditions – including price.

However, in the last few weeks, real estate agent anecdotes indicate that the market is moving from a buyers’ market to a sellers’ market, as more multi-offers are coming through on properties. Migration is strong, with people coming to New Zealand with a lot of funds for deposits and with people moving around within the country, buying in places where they can get more for their money than previously. The prevalence of remote working opportunities also allows people to move around more than ever before.

All the above will begin to put pressure on property prices, and in our local Lyttelton, we are seeing some sale values well above expectations.

Investments

Riding the green wave: profiting from the renewable energy revolution

With the increasing focus on sustainability and the global transition towards clean energy, the renewable energy market is ripe with investment opportunities. The spotlight is on key sectors such as solar, wind, and energy storage.

Going green with your investment not only brings your investment in line with being environmentally conscience but also taps into a sector with significant potential for financial gains as the world shifts towards cleaner and more sustainable energy sources.

For some people, it allows them to make a difference without the inconvenience of making big changes. The cool thing is that investing in green does not mean that you need to sacrifice returns.

Banks

Opportunities for cashback!

Before the OCR announcement, the banks’ economists had conflicting opinions on whether it would go up or down. Now, they are all in agreement that for the short term at least (i.e. the next six months), we are in for more of the same – rates lingering at these high levels with small movements downward.

In the last two weeks, most of the banks had been reducing the two, three, four, and five-year rates. The one-year rates are largely still around the 7.3% mark. While the banks are being picky about the business they take on, they’re keen to buy the business they want with cashback offers.

Now is the best time to take advantage of short-form refinances and to structure your lending to clear the debt as quickly as possible.

Reserve Bank

OCR Announcement – holding for now

Elise has found, like many in the finance sector during these unprecedented times, that the crystal ball was faulty, and the OCR remains at 5.5%. Despite the rumblings of concern from the RBNZ throughout January and February, the vote of no change indicates that while they believe they need the restriction to keep a lid on inflation, they have left their gun in the holster for now.

The Reserve Bank noted, “The Committee remains confident that the current level of the OCR is restricting demand. However, a sustained decline in capacity pressures in the New Zealand economy is required to ensure that headline inflation returns to the 1% – 3% target. The OCR needs to remain at a restrictive level for a sustained period to ensure this occurs.”

One reason they may hold off doing the increase now is that while the property market has been quiet and new lending is at steady levels, the migration increase is impacting the housing markets. The number of new permanent residency visas over the last wee while will lead to more new migrants being able to purchase homes.

So, in short, Elise’s view is we are not out of the woods just yet.

Business

Who is your market? – build it and they will come?

Build it and they will come… or will they? Business startups are often based around someone with an idea or a passion wanting to get out of their day job and into something that they love doing.

They get started on developing the product or service and can get a long way down the track, often with some dollars thrown at the project, only to find that no one wants the product or service, or worse, that the opportunity is too expensive to deliver at a price the market will pay.

It is a good idea to do your market research at the start. Check out who may be your competitors, what they offer, for how much, and whether they have a niche market. Do some surveys with friends and families or a market to test your thoughts with a group of potential purchasers.

Putting your idea out there is a risk to your ego, but it’s better to take a knock emotionally and use it to guide you before investing energy, time and money. If the idea isn’t viable, you’d get the emotional knock anyway when the market gives its feedback the hard way.

Insurance

Insurance for age and stage – what stage are you at?

Making sure you have the right cover depends on your age and circumstances. Here are some good starters to think about:

- 20s-30s: Lay the Foundation – Prioritise health and disability insurance. Consider starting a retirement plan with life insurance elements for long-term benefits.

- 40s: Family Focus – Secure comprehensive life insurance for dependents, covering major expenses like mortgage and education costs.

- 50s: Nearing Retirement – Reevaluate life insurance needs, considering long-term care options to protect retirement savings.

- 60s and Beyond: Legacy Planning- Use life insurance for efficient estate planning, covering taxes and ensuring financial security for surviving family members.

Remember to always tailor your insurance to your age and stage, ensuring the right coverage at every step of your financial journey.

If you need insurance advice, Elise can help. Email elise@bob.kiwi.nz for a consultation.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team