Kia Ora!

In this newsletter –

Hot tip of the month – How to keep safe on autumn roads

Did you know – ANZAC Day is a chance to reflect and be grateful

First-home buyer tips –You may be ready sooner than you think!

Property – The market is still trending upwards

Investments – What the experts are predicting in an unpredictable market

Banks – New legislation brings floating rates down faster

Reserve bank – OCR dropped in April, good news for interest rates

Insurance –Protect your income to keep your dreams alive

Business – 3 “gotchas” to avoid when seeking a business loan

Hot tip of the month

How to keep safe on autumn roads

As autumn settles in and cooler mornings become the norm, driving conditions can change significantly. Frosty roads, fog, and wet leaves are common hazards during this season. Here are some tips to keep in mind:

- Prepare your vehicle: Before setting off, ensure your windshield is clear of frost. Keep an ice scraper and de-icer handy for those chilly mornings. DO NOT use hot water.

- Adjust your driving style: Reduce speed and avoid sudden movements, especially on frosty or leaf-covered roads. Smooth braking and gentle turns can help maintain control.

- Improve your visibility: Foggy mornings can reduce visibility, so use low-beam headlights and keep your windows clean to minimise glare.

- Check your tires: Cooler temperatures can affect tire pressure, so check them regularly. Proper tread depth is also crucial for grip on slippery surfaces.

Autumn mornings can be beautiful but require extra caution on the road. Be safe out there!

Did you know?

ANZAC Day is a chance to reflect and be grateful

Anzac Day (25th April) is a powerful blend of gratitude and reflection. We pause to honour the sacrifices of those who served and the freedoms their courage has secured. It’s a day to express heartfelt thanks—not just for the lives given but for the enduring values of resilience, mateship, and unity that continue to inspire us.

Reflection deepens this gratitude, as we consider the ripple effects of their actions—the families forever changed, the communities shaped by loss and strength, and the lessons of perseverance passed down through generations. It’s a moment to connect with the past, appreciate the present, and commit to carrying forward the spirit of the ANZACs in our own lives.

With two significant wars being fought right now, ANZAC Day is a timely reminder of how fortunate we are to live in a place of peace.

First-home buyer tips

You may be ready sooner than you think!

During the last month, we have seen several clients who approached the bank to see if they could buy their first home. They had some great savings and a good KiwiSaver as a base. The bank said “No,” but didn’t clearly explain their reasons.

On talking to these clients, some may have been declined for a specific property the clients were seeking to purchase, rather than the clients themselves. However, this was not the case for all of them. Disheartened by the bank’s rejection, the clients blew some of their savings, thinking their dream of a home was unattainable.

Working with these clients, we could see that with some minor changes to their money management, and the clearing of some buy now pay later and other credit facilities, we will have them ready for house hunting. For those who spent savings as they thought they couldn’t buy a home, there may be a bit of work to get back to where they were.

Don’t give up on your dream of home ownership, talk to us to help get you ready, you may be ready now and just don’t know it!

Thoughts from Elise

Last month I did a tiki tour down south, going through Franz Josef, Hawea, Wanaka and Dunedin before coming home. The trip was a mix of business and pleasure, spending time with clients, friends and family. Highlights included doing a little reno project with a friend, 21st and 91st birthdays, spectacular scenery on the drive and taking some time to pause and reflect between work.

April brought a bit of a pause on our house renos at home, although some good planning was completed.

As per usual, I have been working with various investment fund managers and lenders to stay up to date with what is happening in the markets and how to support you best and help you manage your way through the uncertain markets.

Lenders are still taking their sweet time responding to applications and requests, which is very frustrating for us all. But the final outcomes are typically worth the wait. I am off to Wellington from the 7th to the 11th to see my mum, who is over from Australia, and for my niece’s birthday. If you want to catch up while I am in Wellington, let me know.

Property

The market is still trending upwards

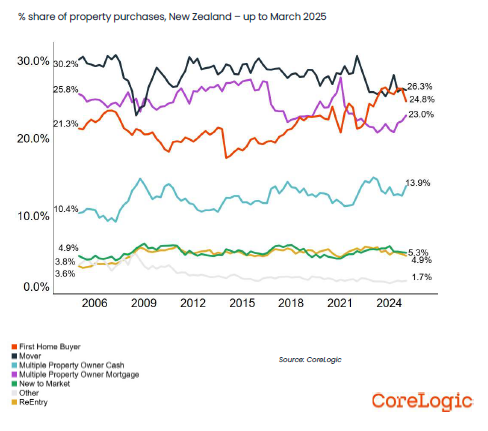

The latest CoreLogic update shows the property market is steadily improving. Sales in March were up 11% compared to last year, and property values rose 0.5% nationally. Falling mortgage rates are boosting buyer confidence, although high listing levels mean price growth is expected to stay moderate. Overall, CoreLogic forecasts a national property value rise of about 5% in 2025.

As seen in the graph above, first-home buyers remain active, while movers are less active than usual. However, it is suspected that the share of movers in the market may rise in the coming months as there is some pent-up demand. Investors are starting to return as rental yields improve. Yields are now sitting between 3% and 5% across the main cities in New Zealand.

Good homes are still in demand and will command good prices. Still, with the banks being more picky about the securities they are taking on, any issues with a property may limit the sale price, which could be an opportunity for you or investors.

Investments

What the experts are predicting in an unpredictable market

Trump’s “Liberation Day” tariffs, announced on April 2, 2025, have stirred significant uncertainty in global markets. These tariffs, aimed at addressing perceived trade imbalances, have led to volatile stock movements and concerns about inflation. Economists and investors are grappling with the unpredictability of these policies, which have impacted sectors like technology and automobiles.

The ripple effects extend beyond the U.S., with countries like China and the European Union responding with countermeasures. This has heightened economic instability and raised questions about the long-term implications for international trade. The impact has been significant for investments, including KiwiSaver.

Economists and investment managers are taking two positions:

1 – The markets will recover in 6 to 8 months, with some uncertainty during this time. This is the optimistic view, as an event (“Liberation Day”) has created the downturn.

2 – The markets will take 12 to 24 months of ups and downs to recover. Recovery time will largely be dependent on the reaction of others to Trump’s tariffs and any further reaction from him to their responses. This is the pessimistic view.

Talk to us if you have any questions. We can review your portfolios to ensure you are in the right ones for achieving your goals.

Banks

New legislation brings floating rates down faster

The Conduct of Financial Institutions (CoFI) Legislation is now live! So what? This new legislation mandates that banks, insurers, and non-bank deposit takers establish and maintain fair conduct programs. This is good, but it will take some time for the full benefit of this new legislation to really make a difference.

Meanwhile, we have already seen some benefits of the new legislation with the OCR dropping; many banks in the past have been slow to pass on the drop in the OCR to the floating rate for their customers. This time, we saw the OCR drop translated into lower floating rates much faster, although there is still room to improve. The media and the FMA (Financial Markets Authority) are going to be able to hold these financial institutions to account.

As advisers, we are working on your behalf to get you lending and give you advice to help you achieve your goals and dreams of home ownership, investing in property and getting finance for your business. This legislation will help us get lenders to be more responsive to us so that we can better support you.

Day to day, we are seeing the floating rates coming down, with some lenders offering floating rates in the high 5% and many with 6 to 24-month rates just under 5%. These are all good signs. The 3 to 5-year rates are still holding as they depend more on overseas swap rates.

We are also seeing good opportunities to refinance to take advantage of better rates, structures, and cash back. But there is a cost to restructuring, so it’s rarely a first option!

Reserve Bank

OCR dropped in April, good news for interest rates

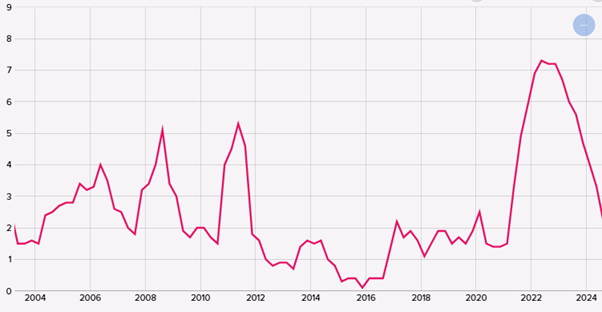

At their last meeting, the Reserve Bank lowered the Official Cash Rate (OCR) to 3.5% on April 9th. Inflation has eased to 2.5% year-on-year, comfortably within the Bank’s 1–3% target range.

The graph from the Reserve Banks’s website clearly shows the sharp rise and fall of inflation over the past couple of years.

Economic indicators show cautious optimism: while unemployment remains at 5.1% and company liquidations are still rising, stability seems to be returning. The Reserve Bank’s latest forecasts suggest that they are aiming for a long, steady period of OCR stability around 3%, provided global shocks or local pressures don’t force their hand.

While international markets remain volatile, especially with ongoing trade tensions, New Zealand’s GDP growth and a slight uptick in housing activity are positive signs. The Reserve Bank is keeping a close watch but, for now, no major surprises are expected.

Insurance

Protect your income to keep your dreams alive

Life is full of surprises. While we can’t predict the future, we can prepare for it. Your income is the cornerstone of your lifestyle, supporting your home, family, and dreams. But what happens if you can’t work due to illness or injury?

If you’re injured, ACC may cover up to 80% of your income while you recover. That is a good safety net. But be aware that ACC only covers accidents, not illnesses. As we get older, ACC tends to pull the degenerative condition card and not cover injuries that were triggered by an accident. Navigating this can be complex if you are self-employed.

If you’re unable to work due to illness, the government support available is much lower. For example, the Supported Living Payment for a single person aged 18 or over is $411.14 per week (net weekly benefits are after tax at “M” tax code).

Could you maintain your current lifestyle — your mortgage/rent, groceries, power, insurances, and family commitments — on $411.14 a week? For most people, that would mean significant financial stress and tough choices. Other allowances may be available through MSD, but you will likely still be on a much-reduced income. On top of that, going through the MSD system at a time when you are unwell or injured is stressful and exhausting.

This is why disability income covers are important. It ensures that if you can’t work due to illness or injury, you’ll continue to receive a meaningful portion of your income, helping you keep your lifestyle steady while you recover.

Your dreams and responsibilities don’t stop because of an accident or illness — and neither should your income.

To find out how income protection insurance can help secure your future, contact Gordon Bell at 022 503 9094 for a free insurance review. Let’s keep your dreams moving forward, no matter what life throws at you.

Business

3 “gotchas” to avoid when seeking a business loan

Whether seeking funds to pay a tax bill or to grow your business with new equipment or resources, getting business finance can be complex, time-consuming and stressful.

So, when securing funding for your business, it’s essential to watch out for these three key “gotchas”:

- Minimised income to reduce tax

While minimising taxable income might seem smart, it can backfire when applying for finance. Banks and lenders assess your ability to service a loan based on declared income. So, if your earnings appear artificially low, it could limit borrowing capacity. Always balance tax efficiency with financial credibility when preparing financial statements. - Unrealistic financial forecasts

Overly optimistic projections can lead to trouble. Lenders expect to see realistic forecasts reflecting genuine cash flow trends, industry conditions, and possible downturns. Avoid inflating revenue expectations; being conservative in your estimates demonstrates prudence and builds trust with lenders. - Lender scepticism

Banks and lenders are naturally cautious, especially in uncertain economic conditions. They scrutinise business plans, financial records, and risk factors closely. To overcome scepticism, present transparent, well-documented financials, highlight stability in revenue streams, and ensure your application aligns with realistic business growth plans.

We have a great range of short-term, quick-response lenders who can help with cashflow situations and can help you navigate growing your business through finance. Would you like help refining financial strategies and getting finance? Get in touch!

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team