Kia Ora!

In this newsletter –

Hot tip of the month – Turn knowledge into power

Did you know –Your everyday bank account could be making you money

First-home buyer tips – Is a vendor-provided building report enough?

Property – The worm is on the turn; now’s the time to look for your next property

Investments –Why you need to care about portfolio balancing

Banks – Going directly to the bank doesn’t pay

Reserve bank – How low will it go? Will the OCR drop by 0.5% or 0.75%?

Insurance – Ideal versus affordable – what cover do you actually need?

Hot tip of the month

Turn knowledge into power

“Knowledge is only potential power. It becomes power only when, and if, it is organized into definite plans of action, and directed to a definite end.” – Napoleon Hill.

Elise was reminded of this as she reviewed her 2024 plan. She hit many of her goals and had a few stumbles. She realised that she didn’t achieve some goals in the set timeframe because she didn’t put time aside to follow the breakdown of actions in her plan. She knew what she needed to do but did not make the time.

What knowledge have you gained from 2024 that you will put into action in 2025?

Did you know?

Your everyday bank account could be making you money

If you have a mortgage, your everyday money should be saving you interest on your mortgage. If it isn’t, you need to talk to Elise!

If you don’t have a mortgage, then your everyday money could be earning you interest. Banks don’t typically charge you fees for having money in your everyday account, but you also don’t earn interest in that transactional account. Your everyday savings accounts may be earning you up to 3% interest if you are lucky.

Booster Savvy is a non-bank savings and transaction account system that does everything your bank does (including debit cards), except provide credit. The difference is that in every stack (bank account), you earn 4.25% interest and are taxed at your PIE rate, which is often better than being taxed at your income tax rate.

Put any tax obligations into a Booster Savvy* account, and your tax will earn you further income until it is paid to the IRD on the 31st of March each year.

First-home buyer tips

Is a vendor-provided building report enough?

When a vendor puts their property on the market, they typically supply a building report. So, do you still need to commission a building report yourself? In a word, yes.

If you purchase the property with just a vendor’s building report and find that something was missed in the report, it will likely cost you money to rectify. But you have no recourse as you did not commission the report.

The vendor-supplied report is still helpful in deciding whether to proceed with your own due diligence. Often it’s not a choice as to whether to get your own report done; some lenders require it, especially for older houses or those with monolithic cladding. In those cases, it is likely to also be a requirement for the insurance company.

Note that a building report will pick up something – they always do – so don’t panic if the report comes back with issues. Instead, identify the cost of rectifying any issues and take that into account when making an offer.

Also note that a standard report won’t pick up everything, as building reports are not invasive there are limitations.

If you have less than a 20% deposit and the building inspection finds issues, the lender will deem the property a higher risk. To get approval for the purchase, you will need quotes and proof of funds to rectify the issues.

Thoughts from Elise

Rebecca, Gordon, and I are back in the office after the Christmas break and are excited about the year ahead. Rebecca had a good break, and Gordon chilled out at home. I went to Australia and reunited with my siblings and some of their kids for the first time in nine years. It was a joy to have time with my two nieces, who were meeting in real life for the first time. Going to the beach daily and having family time reminded me why I do what I do!

January seems to have whizzed by, and the pace at which everyone is working is impressive; I am hoping that the lenders and providers we work with continue to support us as efficiently as they have in these first 3 weeks back.

Interest rates are coming down, which is taking some pressure off many, but the effects of the long period of sustained high inflation are still evident in the cost of living, and the job cuts are continuing; some may not be out of the woods just yet.

Having completed my review of 2024 and planning for 2025, I am excited about the year ahead. I look forward to working with you to help you achieve your goals this year.

Property

The worm is on the turn; now’s the time to look for your next property

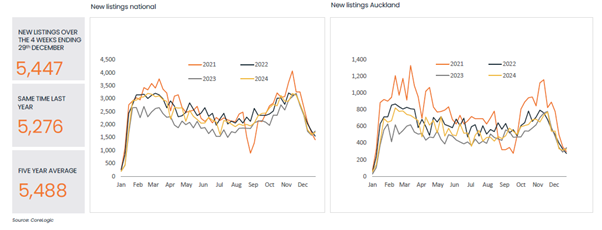

The amount of housing stock on the market for sale is increasing, with the number of new listings exceeding sales. New listings are up on last year’s figures and are close to the five-year average. This shows that the property market is alive and well. The reduced bright-line test (back down to two years) allows investors to sell earlier, and ease cash flow issues caused by tax changes and high interest rates.

Good properties continue to be snapped up. Last week, plenty of properties were auctioned at a property auction in Christchurch, and active buyers were bidding.

Investments

Why you need to care about portfolio balancing

You may think you don’t have a portfolio, so why would you care about balancing? But if you have an active KiwiSaver fund (which we hope all under-65s do), you have a portfolio.

There is risk when investing. How you structure your portfolio depends on how much time you have before you need to access the funds and how you balance your risk and return. You must also consider what is happening in the market and protect against the inevitable downturns.

Did you know that there are different KiwiSaver funds? They are Conservative, Balanced, Growth, or Aggressive. You don’t need to have all your money in one type of fund. You can split your funds across different risk and return profiles.

It can be worth having accessible funds outside of KiwiSaver to soften your approach to retirement. These savings are also part of your portfolio.

As you near retirement, you may think it is just a matter of moving all your investments to a conservative fund. But you may have 20+ years of retirement ahead of you, so you need your funds to continue working for you.

Think of balancing your portfolio as a financial tune-up — keeping it in check so it performs efficiently, no matter the market conditions.

Banks

Going directly to the bank doesn’t pay

In December, it was faster for some folks to go directly to their bank because the banks could give their customers an answer within a couple of days, and our adviser channels were taking almost three weeks: too slow for you and us.

But what we know about working directly with the bank is that they DO NOT provide advice! They sell you a loan, insurance or investments. They do not look at your overall picture and recommend how to structure your situation or where the products they sell fit your strategy.

In December, we had three clients who went directly to the bank to get finance in time. We found that they could get the finance at their current bank, but they would have the debt for longer and couldn’t take advantage of their good savings habits.

Thankfully, in 2025, the banks increased their resources to handle the volume of work from advisers, so we are empowered to help clients get finance promptly. Work with Elise to review your loan structures and maximise your funds, reduce your debt quickly, and be able to invest outside of your KiwiSaver for your retirement.

Reserve Bank

How low will it go? Will the OCR drop by 0.5% or 0.75%?

The economy is still struggling, and New Zealand is officially in a recession. However, inflation has fallen to 2.2% and is now within the Reserve Bank policy target range.

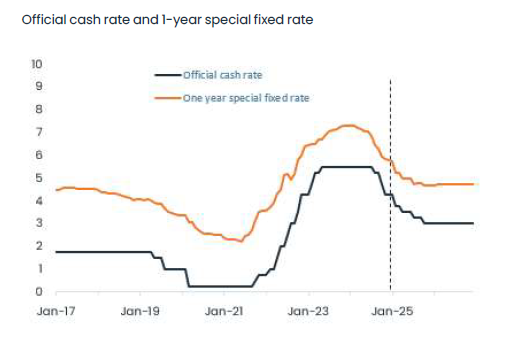

In an effort to stimulate the economy, the Reserve Bank has consistently dropped the official cash rate (OCR) since August 2024, down a total of 1.25%. The OCR is currently sitting at 4.25%.

The next OCR announcement is due on February 19th. Many economists expect another 0.5% drop, while some push for a 0.75% drop. Elise anticipates that the RBNZ will continue to be conservative and only drop the OCR by 0.5% this round, bringing it down to 3.75%.

Many lenders are already anticipating a drop and have dropped the short-term rates by 0.1%.

In this graph, we see the interest rates falling alongside the OCR. Another OCR drop means more money in your pocket and less money lining the pockets of the banks.

Insurance

Ideal versus affordable – what cover do you actually need?

At Building on Basics, we talk about quality-of-life plans in case of the unexpected. Insurance is not about making pots of cash when something goes wrong; it is about maintaining your dignity and giving you some control.

As we learn about you, your desires, concerns, goals, and what is important to you, we find incredible heart and vision. You have big goals and care deeply for your family. We love this!

We then go away, do the research and come back with your plan. It may be that the ideal cover that 100% protects your vision and family is ridiculously unaffordable. Insurance is not cheap, but it is an essential part of our financial strategy to secure you and your family’s future. It’s about finding that sweet spot that balances affordability and cover.

Deciding what to prioritise can feel challenging. We love to help you work through the options and find a solution that protects the quality of life for you and your family at an affordable rate over the long term. We allow for the different stages of life when you no longer need as much cover, such as when the children have grown up and left home or you have paid off your debt.

If you want to maintain your quality of life regardless of what happens, contact Gordon Bell at 022 503 9094 for a free insurance review.

Business

Your business is built on your brand

So, you are in business. First of all, congratulations on being one of the 612,417* SMEs (businesses with fewer than 20 employees) that make up approximately 97% of the business in NZ!

The importance of your business name, tagline, and a defined brand will depend on what your business is and what you want from it. Is it just you? Do you want it to be more than just you? When you close your business, do you want it to be an asset you can sell?

A brand is more than just the name and logo. It is the perception people have of a business, product or individual. What do people think and feel when they hear your business name?

As an example, think about Building on Basics. While the name came from Elise’s love of building, Building on Basics is about more than just Elise. It’s a brand that encompasses the BoB team’s work to build our clients’ knowledge, security and wealth. We believe that everyone has a basic knowledge that we can build on. And, of course, when BoB’s your adviser, we can fix it!

One of the keys to long-term success is to work with someone to ensure your business is named and branded to maximise your leads, reputation, and opportunities. Defining your brand is a key part of your marketing strategy.

* As at Feb 2024

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team