Kia Ora!

In this newsletter –

Hot tip of the month –Protect your things with My Thingz

Did you know –The origin of autumn colours

First-home buyer tips –At what stage do I contact a financial adviser?

Property- Property investment is on the rise

Investments –What should you invest in, and where should you invest?

Banks –When to fix and for how long?

Reserve bank –OCR dropped to 3.75% with another drop planned

Insurance –Find your delicate balance

Business – Who are your clients? Hint: “everyone” is not the answer!

Hot tip of the month

Protect your things with My Thingz

Each year on the 22nd of February we reflect on the Christchurch earthquakes. At the time, many people found themselves locked out of their homes and places of work. So, when they tried to make a claim, many could not prove what they had or the value of the items. At such a distressing time, finding proof of possessions and their value caused even more stress and sleepless nights for those affected.

We can recommend a great tool to save you from the risk of ending up in this situation. MyThingZ is an app where you can record your assets quickly and easily. Snap a pic of your things, complete with serial numbers and the receipts to show proof of purchase, and in the event of a burglary, fire, flood, quake or loss of any sort, you can prove ownership and potential value. It also connects with the Police for reporting the theft/loss.

Did you know?

The origin of autumn colours

One of the nice things about heading towards autumn is seeing trees’ leaves change colour.

Deciduous trees change colour as their leaves die off in the lead up to winter. They do so to save energy and to conserve moisture within their trunks. It also allows wind to blow through the branches, putting less strain on the tree during storms, gales and snow.

Autumn fashions reflect the reds, yellows, oranges and browns of autumn leaves.

First-home buyer tips

At what stage do I contact a financial adviser?

Many first-home buyers wait until they have saved what they think is enough for their house deposit before talking to a mortgage or financial adviser.

But working with a financial adviser before you’ve saved your deposit could get you into your first home months earlier. We can share systems and tools to accelerate the building of your deposit.

Getting the lending is only part of the journey, securing your asset and maintaining your quality of life is just as important, along with building your market knowledge for when you are ready to purchase.

So, at what stage do you contact us? The answer is… now!

Thoughts from Elise

Changes to the interest rates, banks changing their lending test rates, and the sting of the cost-of-living crisis are generating a lot of discussion with our clients.

Rebecca, Gordon and I have been busy working on some of our systems to improve efficiency. This will give us more time with you and help us keep up with the many changes (especially from the banks).

On the personal front, the shed is now watertight and has the guttering going into the storm water tank. It feels good to be getting close to being onto the next wee project at home.

March is the last month of the 2025 financial year. As the FY year nears the end, we continue to reflect on our goals for what we want to do in the business and with you, our clients.

The days are getting noticeably shorter, and we have five weeks of daylight savings left. I hope you can all make the most of the longer days while they last.

Property

Property investment is on the rise

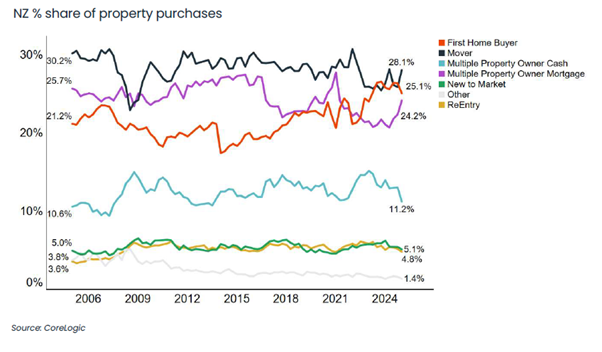

As shown in the graph below, in recent years first-home buyers (orange line) have been purchasing a larger share of property than property investors (purple line labelled multiple property owner mortgage).

But, looking more closely at the end of the graph, we see property investors have increased their activity in the market and are now buying at a very similar rate as first-home buyers.

What does this mean for the property market? First-home buyers are still capitalising on lower property prices. However, competition seems to be increasing as more property investors re-enter the market.

Investments

What should you invest in, and where should you invest?

We had an interesting conversation last week at a business networking meeting. The topic was: What should you invest in, and where should you invest?

The meeting included two real estate agents (one commercial and one residential), an investment adviser specialising in direct investments, and an accountant, just for starters.

So, what was the advice? You are right if you guess the advice varied depending on the person’s area of interest!

The real estate agents suggested residential or commercial property, and the commercial agent even suggested investing in a business. The investment adviser suggested equities, managed funds, property portfolios, and other options, depending on your risk profile.

The accountant said they are not a financial adviser, they can only see if you should be investing, and to talk through the tax implications of any of the investments you are considering. The lawyer said I am not a financial adviser, but I can see what entity you need to invest in to protect your assets from creditors, etc.

As for us, we consider your situation, age, stage, and goals. We discuss the different options and connect you with the team to set up the best solution for you. Everyone should have investments, no matter where you are on your journey. The sooner you start, the better, even if this is just in the form of KiwiSaver.

Talk to us and we can help you with building the team for the investments that are right for, your risk profile and to help you achieve your goals.

Banks

When to fix and for how long?

With rates trending downwards, are you pondering what to do with your loans as they come up for renewal? Unfortunately, there isn’t one answer for all. It depends on your situation, intentions, and future plans.

Here are some of the things to take into account:

- Do you have any funds coming your way? You may expect an inheritance or bonus and want to reduce debt within the fixed period you’re considering.

- Are you anticipating a change in your regular income? Perhaps you are planning to reduce your work hours to study, moving to a single income due to maternity leave, getting a pay rise.

Refixing isn’t just about choosing a length of time and rate. You also need to consider:

- Have you been saving and getting the best return out of your funds?

- If your interest rate will drop, can you maintain your current repayments to clear the debt sooner?

- Do you need to restructure your lending to take advantage of different products or existing bank products?

Talking with Elise can ensure your mortgage is structured to suit your needs and potentially save you thousands in interest costs by better utilising your funds.

Reserve Bank

OCR dropped to 3.75% with another drop planned

On the 19th of February, the Reserve Bank dropped the OCR by 0.5% basis points to 3.75%. This is the 4thdrop in a row.

The Reserve Bank based its decision on inflation sitting at 2.2%, weak economic activity, and increased unemployment. Economic activity is expected to improve as the year progresses, which will encourage job growth.

The RBNZ has indicated they are seeking to have the OCR back down to 3% by the end of the year. The next update is on the 9th of April 2025.

Insurance

Find your delicate balance

Your health is integral to earning an income and fulfilling your goals. Insuring your health and your income is ultimately insuring your quality of life.

However, ideal cover is typically not affordable and while many Kiwis are under insured, the cost-of-living crisis has meant many have had to review their insurance. This is where expert advice is so important. At its core, insurance advice is about helping clients find the delicate balance between cover and cost.

To find that sweet spot, we look at your lifestyle, age and stage, finances, dreams and goals. We love doing this work. Your quality of life is important to us, and we want you to achieve the life you want. We then identify the cover you would benefit from and help you balance that against the cost and ability to pursue your goals.

To understand more about your delicate balance and maintain your quality of life regardless of what happens, contact Gordon Bell at 022 503 9094 for a free insurance review.

Business

Who are your clients? Hint: ‘everyone’ is not the answer!

New business owners often fall into the trap of thinking that any business is good business. But if some types of clients or services are less profitable than others, spending time on those things is costing you money, which is not good business!

As part of your planning and projections, look at your client base and the type of work you get from your clients. Is your work profitable, and are some clients or services more profitable than others? Which clients and or services are the most profitable?

When you’ve answered those questions, you’ve found where to focus on growing your business! Getting more of the most profitable business should be integral to your marketing strategy.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team