Important Information

(Disclosure Information)

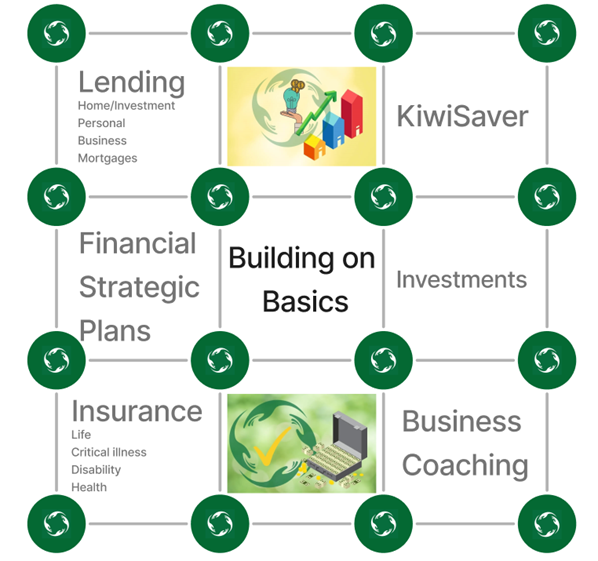

Welcome to Building on Basics.

Important information that you might like to know about us before we begin our journey together.

How We Help

Building on Basics Limited, FSP769111, (BOB, Building on Basics) is dedicated to helping you turn financial knowledge into a brighter future. We believe everyone can reach their goals, no matter where they start, and we’re here to support you every step of the way. With a friendly, non-judgmental approach, we empower you through clear financial education and personalised planning in lending, KiwiSaver, investing, and insurance.

Research shows that working with an adviser makes a difference: 69.9% of advised New Zealanders feel secure about their financial future, compared to just 38.9% of those without advice. At Building on Basics, our advisers work as a team to ensure the pieces of your financial life fit together, helping you make the most of your resources with confidence and a smile.

Our Services

About Our Financial Advisers

Elise Vine FSP609289

Financial Adviser, Strategist & Coach – Lending, Personal Risk, Investments & Business Planning

Elise Vine is a dedicated financial adviser who finds joy in helping people reach their goals through effective financial strategies. With a background as a Property Lending Specialist and over two decades of experience in property investment and wealth coaching, Elise brings both expertise and a strong commitment to client success. At Building on Basics, she offers a comprehensive financial strategy service, delivered with honesty, a sense of humour, and a passion for enriching her clients’ lives.

- elise@bob.kiwi.nz

- 0299737911

Gordon Bell FSP133564

Financial Adviser – Insurance and Claims Specialist

Gordon Bell combines diverse experience and a dedication to guiding clients toward financial stability. Based in Christchurch, his background includes roles in restaurant ownership, customer service in Australia, and a solid foundation in teaching and financial services. As a financial adviser, Gordon is committed to providing clients with clarity and confidence in managing unexpected health events, ensuring a seamless claims process. Outside of work, he stays active through fitness, gardening, beekeeping, and volunteers with the Red Cross and Citizens Advice Bureau.

- gordon@bob.kiwi.nz

- 0225039094

Our Contact Details

Building on Basics Limited, FSP769111

Address: 8a Norwich Quay, Lyttelton

Phone: 0224651623

Email: support@bob.kiwi.nz

Website: https://www.buildingonbasics.co.nz/

“The team at BoB help you pull the jigsaw pieces of your finances together. Maximising your results by utilising your lending, investments and, insurances.”

How we care

Building on Basics Ltd, and anyone who gives financial advice on our behalf, have legal duties relating to the way that we give advice.

We must:

- give priority to our clients’ interests by taking all reasonable steps to make sure our advice isn’t materially influenced by our own interests;

- exercise care, diligence, and skill in providing the advice;

- meet standards of competence, knowledge and skill set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure that we have the expertise needed to provide you with advice); and

- meet standards of ethical behaviour, conduct and client care set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure that we treat you as we should and give you suitable advice).

This is only a summary of the duties that we have. More information is available by contacting us, or by visiting the Financial Markets Authority website at www.fma.govt.nz

How We Get Paid

BoB’s Advisers are generally paid by the product providers in the form of commission when the Client takes out a BoB managed mortgage, loan, joins or transfers KiwiSaver scheme and/or managed fund or purchases an insurance policy following BoB’s advice. A generalisation on these commissions is as follows:

KiwiSaver Commission Schedule

Up-front Commissions

Generate – Building on Basics Ltd may receive an introduction fee of between $0 and $300 on each KiwiSaver application based on the value of your fund.

Milford – Building on Basics Ltd will receive an Initial Advice Fee of $150, this agreed as part of the sign-up process.

NZ Funds – Building on Basics Ltd will receive an Onboarding Fee of $150 and a 9-Month Service Fee of $150.

Pathfinder – Building on Basics Ltd will receive an Initial Advice Fee of up to $200.

On-going Commission Rates – calculated on your KiwiSaver balance.

| Provider | Balance up to $200k | Next $200-$500k | More than $500k |

| Always Ethical | 0.20% | 0.20% | 0.20% |

| Booster | 0.50% | 0.35% | 0.25% |

| Generate | 0.20% | 0.20% | 0.20% |

| GoalsGetter | 0.20-0.50% | 0.20-0.50% | 0.20-0.50% |

| Koura | 0.30% | 0.30% | 0.30% |

| Milford | 0.20-0.50% | 0.20-0.50% | 0.20-0.50% |

| NZ Funds | 0.40% | 0.40% | 0.40% |

| Pathfinder | 0.20% | 0.20% | 0.20% |

Investment Commissions Schedule

Milford – A trail fee between 0-1% of the investor’s FUM as the ongoing advice and administration fee within Investment Funds.

Generate – A trail fee of 0.25% p.a of the investor’s FUM. Option to add on servicing adviser fee of up to 0.75% p.a. which comes out of the clients Managed Fund account.

NZ Funds – An ongoing administration payment of 0.4% p.a. on account balance is paid monthly, subject to service delivery.

Pathfinder – Advice Fee (paid by client) of 0 to 1% (Adviser will nominate) of the investor’s FUM.

Always Ethical – AE shall pay the adviser a trail fee of 0.25% of the investor’s FUM.

Booster

- Income Securities Portfolio – Call Class and Term Class 0.50% p.a. Paid by manager as part of swap agreement.

- Innovation Fund – Potential upfront fee of 3% of any funds introduced in a one-off payment. Booster will pay this fee, not the fund or client. Subject to change.

- Private Land and Property Portfolio – Adviser fee (paid from Management fee) of 0.25% of client’s FUM.

Home Loans Commission Schedule

The commissions are between 0.55% and 0.85% of the value of the mortgage. The amount will depend on which bank and what type of mortgage you choose. In addition, we receive a commission of between 0% and 0.2% of the remaining balance each year.

Lenders: SBS Bank, ANZ Bank, ASB Bank, Westpac NZ, Co-Operative Bank, Heartland Bank, Bank of New Zealand, Kiwibank, Liberty Financial, Speirs Group, Go Home Loans, Avanti Finance, Unity Credit Union, Cressida Capital, First Mortgage Trust, Prospa, BizCap, Scot Pac, BaseCorp Finance, Pepper Money NZ, DBR Limited, Plus Finance, CFI Finance, Finbase, Fund Tap, Lend Capital, Simplify, Zip Business Capital, Ilender, Metro, OnePartner, Fico Finance, Better Mortgage Management, ASAP Finance, HomeSec Business Finance, FundTap.

Fees for business lending may apply and will be discussed where applicable.

Personal Insurance Commission Schedule

The commissions are between 25% and 220% of the first year’s premiums of your policy. The amount depends on which insurance company and which insurance policy you choose. I also receive a commission of between 5% and 25% of the premium for each year the policy remains in force.

Other Fees

| Service | Fees Charged | Payment Terms | Conditions |

| Initial Meeting – 1 hour | Free | N/A | |

| Property Purchasing Support (home or investment) | $500 + GST | 7 days from invoice | All fees agreed prior to charging. |

| General Financial Advice | $250 + GST per hour | 7 days from invoice | All fees agreed prior to charging. |

| Personalised Strategic Plan | Variable | 7 days from invoice | All fees agreed prior to charging. |

| Pre-approval application | $1800 + GST per hour | 7 days from invoice, upon application submission | Charged if applications are completed by Building on Basics and then you get your own finance |

| Application support | $1800 + GST | 7 days from invoice, upon application submission | For support with lenders the adviser cannot work with |

| Early Repayment/Cancellation fees | Variable | 7 days from invoice | Refer to Early Cancellation Fee section below |

| Simple Wills | $149 + GST | Payment due on invoice | No legal advice supplied. Only available where client meets Simple Wills conditions |

All fees are payable within seven (7) days of being invoiced to the Client. The Client will be

responsible for late payment and debt collection charges applied if applicable.

Referral Commissions

Building on Basics may be paid a referral commission for the likes of a referral for Fire and General insurance or to other Personal and Key Business Insurance Advisers. We may receive up to 10% of the upfront policy fees and up to 10% of the renewal policy fees. We may receive other referral commissions for working with other advisers with you.

Building on Basics may be paid a referral commission (one-off $50 referral fee from Booster) if the client signs up for Savvy and maintains an average balance of $500 over 6 months. This is a referral payment, not a fee for financial advice, and no ongoing trail commission applies. This referral fee is paid by Booster Building on Basics and does not come out of the client’s account.

More specific details on remuneration will be included with our written recommendations.

Early Repayment/Cancellation Fee (Clawback)

The commission received for implementing a financial services product pays for completing research and analysis of your information to ensure we select the most suitable product for you. The commission also covers the cost of my administration team that assist the BoB Advisers to make the entire process efficient and stress free.

To avoid the fee being charged, you can discuss your new requirements prior to cancellation, reduction or changes with your Adviser. The BoB Adviser will be happy to restructure your cover to meet your changed circumstances, working with the insurance provider or lender as appropriate.

The following circumstances may result in an Early Cancellation Fee:

If a loan is repaid early either partially or in full.

- This fee applies if the Client repays the loan, BoB helped arrange for the Client within twenty-seven (27) months from the time of its initial draw down/settlement date. The most common situation where this occurs is when the property is sold and the loan is either partially or fully repaid, or where the loan is refinanced to another lender.

If an insurance policy is cancelled early.

- This fee applies if the Client cancels, alters the terms, or reduces any insurance BoB helped arrange for the Client within twenty-four (24) months of the policy inception.

If the lender or insurer charges Building on Basics Ltd with a commission clawback, Building on Basics Ltd will charge the Client a fee to recover the costs of the advice and services BoB’s Advisers provided to the Client. The clawback fee will not exceed $4,140 (including GST) and has been calculated based on:

- Twenty (20) hours of advice work at BoB’s hourly rate of $250 per hour plus GST.

- Negotiations with providers.

- Administration costs to complete and submit the Client’s loan/insurance application to the provider and provide the required service and advice.

All fees are payable within seven (7) days of being invoiced to the Client. The Client will be responsible for late payment and debt collection charges applied if applicable.

The Client will not have to pay a Clawback fee if:

- Building on Basics Ltd were unable to obtain a financing approval on the Client’s behalf.

- The Client has paid an upfront agreed fee for the required service.

- In BoB’s opinion, the early repayment of the mortgage or insurance cancellation was caused by an exceptional change of circumstances for the Client, such as hardship, and the Client communicated this to Building on Basics Ltd as early as the Client could

Conflicts of Interest, Commissions and Incentives

Our financial advisers are remunerated by way of a salary or on a commission basis, with the adviser commission based between 50-75% of the commission received from the provider.

To ensure that Building on Basics Ltd’s financial advisers prioritise each client’s interests above their own, they follow an advice process that is designed to ensure their recommendations are made on the basis of the client’s circumstances and financial goals and are suitable for the client. Building on Basics Ltd also:

- has a quality assurance programme in place to monitor the advice our financial advisers provide;

- actively monitors compliance with our conflicts policies and procedures; and

- ensures training is provided to all Building on Basics Ltd financial advisers about how to manage conflicts of interest.

Privacy Act 2020

Privacy Act 2020 information can be found on the BoB website: https://www.buildingonbasics.co.nz/privacy-policy/

Use of personal Information

Building on Basics Ltd and I comply with the Privacy Act 2020.

It is understood that any information gathered for this service and used in any associated advice reports is personal and will be kept confidential and secure.

- Information provided by you or any authorised representative, will be used by me and any members of my staff for the purpose of providing advice to you and may also be used by:

- Our external compliance service providers or dispute resolution scheme, who may need access to such information; and

This information will be held by us at our business address provided earlier in this document.

Termination of Engagement

This agreement will remain in place until it is terminated by either party giving the other at least thirty (30) days’ written notice. The clawback clause remains in effect post termination of this contract.

Complaints Handling and Dispute Resolution

Even with the best of intentions, complaints sometimes arise. Building on Basics Ltd is committed to ensuring that all client complaints are handled and resolved in a professional, fair and timely manner in accordance with our Client Complaints Policy and associated procedures. If you are not satisfied with our financial advice services, you can make a complaint by contacting us at:

Building on Basics Ltd

7 Selwyn Road

Lyttelton

Attention: Elise Vine

T. 029 973 7911

W. buildingonbasics.co.nz

When we receive a complaint, we will consider it and let you know how we intend to resolve it. We may need to contact you to get further information about your complaint. We aim to resolve complaints within 10 working days of receiving them. If we can’t, we will contact you within that time to let you know we need more time to consider your complaint.

We will contact you by phone or email to let you know whether we can resolve your complaint and how we propose to do so.

If we can’t resolve your complaint, or you aren’t satisfied with the way we propose to do so, you can contact Insurance and Financial Service Ombudsman Scheme (IFSO), an approved dispute resolution scheme who provide a free, independent dispute resolution service that may help investigate or resolve your complaint.

You can contact Insurance and Financial Service Ombudsman Scheme at:

Insurance & Financial Services Ombudsman Scheme

PO Box 10-845

Wellington 6143

NEW ZEALAND

T. 0800 888 202

E. info@ifso.nz

W. www.ifso.nz

Contact Details

You can contact us at:

Elise Vine

Building on Basics Ltd

7 Selwyn Road

Lyttelton 8082

T. 029 973 7911

We are building for good!

Creating financial security together is more than just a ‘tag’ line to the team at Building on Basics. We’ve partnered with B1G1 (Buy1Give1) to provide opportunities for so many more to have the chance to achieve their financial goals. We are building for good!