Hi there!

Do you feel like you’re into the swing of 2021 yet? A month in, and the pace is picking up. Here at Building on Basics, we seem to have started the year at the same run we finished 2020.

Infometrics’ recent update suggests that the economy is in a much stronger position for the next 12-18 months than previously predicted. A year ago this COVID-19 thing was only just kicking off, and we’ve had a big year of unpredictability and guesswork to say the least.

While this year is unlikely to see a straightforward return to “normal” pre-COVID life, the path ahead certainly looks more positive than it did a few months ago.

The housing market isn’t slowing, but consumer spending is still down with the exception of food and liquor retailing (up 10%), and home and recreation retailing (up 1.3%). Supply chain issues are still causing disruption in many industries, particularly with additional hard lockdowns in many countries, and it doesn’t help to have stock unable to be unloaded at the Auckland wharf in a timely manner.

Many businesses have been unable to get stock on their shelves or into their warehouses to be able to deliver to customers, and this is having a flow on effect for other businesses and for consumers in general. 2020 was the beginning of a new way of doing things and 2021 is going to require us to continue to be flexible – to work with whatever we have and be creative.

KiwiSaver

Just 5 months to hit your target of $1042.86 to ensure that you get the full government contribution (it’s free money!) of $521.43 paid into your KiwiSaver. If you are unsure of how to check your contributions, get in touch. We can help you with that.

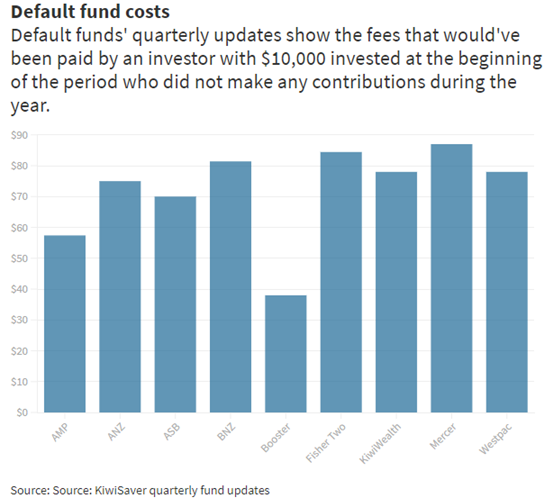

The changes to the KiwiSaver defaults (defaults changing to balanced rather than conservative funds, coming into effect from July) may mean that providers change some of their fees. The expectation is that KiwiSaver providers will drop fees on most funds, whether or not they are default KiwiSaver providers. This should not be affecting you as we have made sure you have selected the appropriate fund based on your risk profile and your financial objectives.

I do love to see Booster out performing the other agencies with the lowest fees for the default scheme.

Property Market

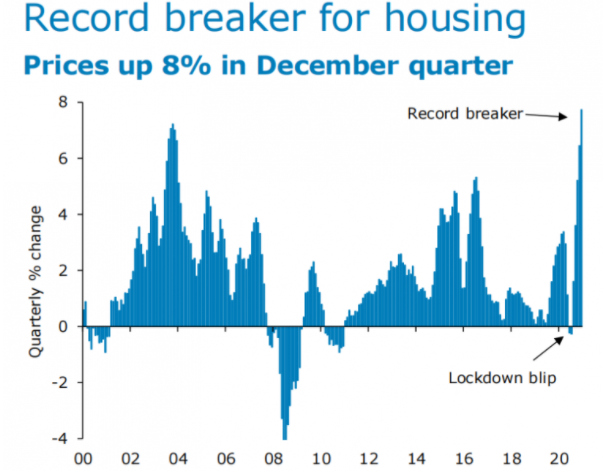

Well, it’s the same story – lots of people wanting to buy, and not enough houses to go around. The “perfect storm” .

In the bank’s latest Property Focus publication, ANZ senior economist Liz Kendall, senior strategist David Croy and chief economist Sharon Zollner say the perfect storm we’ve seen in the housing market has combined: A fear of missing out (FOMO), scarcity of properties and expectations that house prices will get further out of reach – all at a time when interest rates have been falling and bank funding has been readily available.

“This dynamic is expected to contribute to further price gains in the short term at least. We expect the housing market will cool in time, but exactly when is highly uncertain, given that momentum in the market can be slow to moderate, she says.

Strength in the housing market through the second half of 2020 was “unprecedented”, the economists say, with prices rising 16% since May.

“Increases like that are unsustainable in the context of incomes that have been stable at best.”

Banks and Finance

Just 8,300 home loans were still on deferred payments as of 20 Jan 2021. Lots of factors have contributed to this, not least the very low interest rates making repayments more affordable.

ANZ, BNZ, ASB, Westpac and TSB have all lowered their one-year mortgage rates to just 2.29%. ANZ is offering this “special” to customers who have an ANZ transaction account with salary direct credited, and a minimum 20% equity. Other banks are offering around the 2.5% mark.

Gareth Kiernan from Infometrtics suggests that mortgage rates are unlikely to go much lower, amid fears of pushing house prices further out of reach. That said, Co-operative Bank have just announced that it has just cut it’s First Home Buyer “special” rate, taking it down to a very low 2.09%. Nice one, Co-op!

RBNZ

After all the speculation last year about the OCR heading into negative territory, the chance of further cuts to the OCR this year have diminished. With the CPI (consumer price index) inflation figures firmer than market and RBNZ expectations, ASB’s view is that the OCR is unlikely to move up from it’s current 0.25% in 2021, but the low rate won’t be around forever.

Dominick Stephens from Westpac has this to say in a recent OCR forecast update “We expect annual house price inflation will peak at 20% later this year, which is not an environment conducive to further OCR cuts.”

In explaining the reasons for the change in call, Stephens cites the much better than expected recovery in the GDP, disruptions to global supply that might boost inflation as well as gains in oil and other commodity prices – and the rising house market.

Stephens says the housing market “has outstripped even our very bullish expectations”.

An update from us.

There’s not much to report from us! We’re back into our routines after the festive season, and enjoying getting stuck into our work. 2021 looks to be a busy year and we are excited to work with you all to make your financial dreams your reality!

Take care, and get in touch if you want to discuss your options.

– Elise and the team