Kia Ora!

In this newsletter:

Hot tip of the month – Interest-free loans for energy efficiency projects from Westpac

Did you know – You could be eligible for government support

First-home buyer tips – Impress lenders by living as if you have a mortgage

Property – Want to know the real value of your property?

Investments – PIE funds save you between 1-5% compounding!!

Banks – Access to funds is difficult, here’s why

Reserve bank – Economy on the turn

Hot tip of the month

Interest-free loans for energy efficiency projects from Westpac

Last month, we talked about cheap money for energy efficiency projects such as double glazing, insulation, and solar. This month, Westpac announced they are stepping up their environmental support by offering 5-year interest-free loans for electric vehicles, double glazing and other good energy solutions. That certainly helps with cash flow!

This offer is only available to Westpac customers; give Elise a call to find out more.

Did you know?

You could be eligible for government support

Covid and inflation have hit hard, and you may find yourself on struggle street.

ASB has done the hard work to identify the different government support options so that you can approach the right departments for help.

Use this link to suss out any extra help that may be available to you and your family. It’s not a guarantee that you will get the support; the devil will be in the details of the next stage.

First-home buyer tips

Impress lenders by living as if you have the mortgage already

The first few years can be unsettling as you can no longer rely on your landlord to fix any issues that may arise such as dripping taps or mould. These are now your responsibility, and you will need to fund them.

Your rent may be equivalent to your mortgage payments, but on top of the mortgage payments you will need to pay for:

- House insurance on top of your contents cover

- Rates

- Property maintenance and;

- Renovations (our favourite) to create your dream property, whether it be a new colour scheme or updating the kitchen and bathroom.

Set up your budget so that you are already living as if you are paying for these things, and you will enhance your savings for the deposit and give the lenders confidence to lend you what you need.

Thoughts from Elise

We are six weeks away from the election, and all the political parties are making grand statements with their policies. This election will be hard-fought by all parties, and we will be back to having a coalition government. This will mean a slower pace of change due to the need for collaboration.

Migration has increased, easing some employee shortages in some areas, while also putting pressure on the housing markets for both owner-occupied and rental properties. Meanwhile, tourism is coming back, helping hospitality and tourism companies alike.

I have had to stop reading the general media recently as I was becoming annoyed at the negative commentary around property investors. The reality is that private property investors are needed. The government doesn’t have sufficient funds or stock to support everyone who needs rental accommodation, even with the current private investors supplying rental stock. The number of people living in cars because there is NO emergency housing available is scary, as is the number of families living in emergency housing, unable to settle the children into regular schools.

As the days are getting longer, I have been working on collecting and splitting firewood for next year and will refocus on the house renovations this coming weekend.

Credit Card Crisis? A Credit Card Balance Transfer May Be Your Answer

Whether you’re deciding on the structure of your 1st mortgage or your 10th, it’s worth thinking things through. It could save you from a mortgage unfit for purpose, costly restructuring fees and even thousands in interest over the long term.

5 Things to Think About When Structuring Your Mortgage

Whether you’re deciding on the structure of your 1st mortgage or your 10th, it’s worth thinking things through. It could save you from a mortgage unfit for purpose, costly restructuring fees and even thousands in interest over the long term.

Property

Want to know the real value of your property?

Real estate agents have their fingers on the pulse for what is happening in their areas, whereas valuers need to rely on sales recorded with the Land Register. A sale is often recorded 2-3 months after an offer was made and accepted on a property. This is due to the time lapse between an accepted offer and settlement day.

This means that media reports on any numbers and trends are using data that is months old. By the time they catch up with what’s happening, property values are often already well and truly on the move.

Your local real estate agent is an excellent resource for up-to-date predictions. Contact them to find out what your property could get in the market in real time.

Investments

PIE funds save you between 1-5% compounding!

Any income will be taxed at your personal income tax rate when you invest directly. When you invest in a managed fund that uses a PIE (Portfolio Investment Entity), you pay tax at your PIR rate. Your PIR rate is typically 1-5% less than your personal income tax rate. The returns from your PIE investment are automatically taxed. In contrast, direct investments require you to pay the tax from the interest earned.

The 1-5% difference in the tax rate will make a long-term difference with a compounding impact on your returns. When comparing investments, you need to consider the return in terms of:

- The interest rate and whether the return is before tax or after

- Which tax rate is being used (your personal tax rate or your PIR rate)

- The risk (based on your risk profile and your need to protect or grow your capital).

KiwiSaver investments are all PIE funds and make the most of your PIR rates. The IRD will notify you if they think you’re on the wrong rate.

Banks

Access to funds is difficult, here’s why

It might feel like we keep banging on about the stress test rates! But at 8.7-9.15%, it’s difficult for borrowers to meet the criteria to service the new debt. If you go to restructure your existing debt, you may no longer meet the service requirements for your current level of debt.

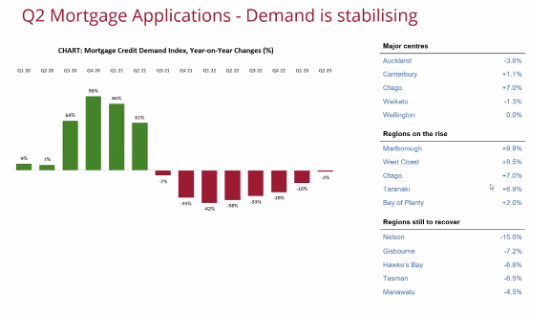

The Equifax graphic below shows that when the CCCFA came into effect, new lending stopped almost overnight. Tweaking the CCCFA rules helped a little, but the combination of the CCCFA and the increasing interest rates caused lenders to increase their stress test rates. The result is a reduction in lending from both mainstream and alternate lenders.

Source: Equifax

Reserve Bank

Economy on the turn

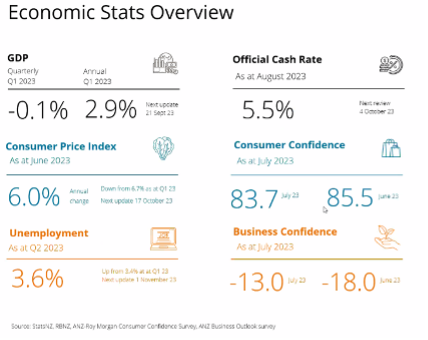

The Reserve Bank has continued to hold the OCR at 5.5% and is looking to keep the OCR at this level for the next 12-15 months.

Inflation has dropped from 6.7% to 6%, which is a good sign, as is the increase in unemployment; both are indications that the economy is on the turn.

In the short term, the upcoming election is having some effect on business confidence due to the uncertainty of who will be in power and which policies will continue or change.

Business

How do you know you are on track?

You get into business for a variety of reasons, such as:

- Flexible hours

- More money for your effort

- Independence and autonomy

A plane taking off from an airport needs a flight path, sufficient fuel and a clear destination. Along the way, the pilots will need to check that they are on track, and they will adjust their controls to make sure they reach their journey’s end. You can see where we’re going with this!

Many businesses start with a scrap of paper that outlines the business purpose and maybe some business goals. But without defined goals and preset markers, how will you know if you’re on track?

To safely navigate your business, you need to:

- Have a budget for your expenses

- Have projections for your sales

- Have a plan for delivering the sales, including the resources in the form of team members and capital.

Every month, you then measure whether you are on track or off track by running profit and loss reports, sales reports, pipeline management and tracking the progress of projects.

By consistent monitoring you can identify when help or a change is needed to get the results you want – before you find yourself in a crisis.

Insurance

Do your insurance premiums always have to go up?

In short, the answer is no, but the lowest possible premiums might not be the best solution for you. It depends on where you are on your financial journey.

The premium for personal risk covers such as life and disability can be set in two ways:

- Rate-for-age (also known as stepped); or

- Level for a period.

With rate-for-age premiums, the premium will increase on each anniversary, slowly at first and then rapidly as you get older (when you are most likely to need the cover). The risk at that time is that the cover is no longer affordable.

With level premiums, you pay more at the beginning. After a period, the premiums will be cheaper than the rate for age equivalent. A level premium will still increase if your cover is based on the Consumer Price Index (CPI). This allows both your cover and your premiums to keep up with inflation.

As an example, say you took out cover for $300K in the late 1990’s and the CPI equivalent today was $375K. If you had been accepting the CPI increases, your cover would be $375K and your level premium would have increased slightly.

You don’t always need to accept the CPI increase, and if you no longer need the level of cover it would make sense not to.

NOTE: Level premiums relate to life and disability insurance, but not health insurance. Health insurance premiums always increase with age.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team