Kia Ora!

Alongside the blossoms of spring and the lengthening of daylight hours, September was an eventful month for Aotearoa New Zealand.

September 14th marked the 50th anniversary of the day the Māori language petition was delivered to Parliament by representatives of Ngā Tamatoa and Te Rōpū Reo Māori/Te Reo Māori Society. With over 30,000 signatures, the petition called on the government to actively recognise te reo Māori and to support it being taught in schools. This moment is seen by many as the start of the significant revitalisation of te reo Māori. The growing use of te reo is great to hear.

On September 8th, Queen Elizabeth II died at the impressive age of 96. She reigned for 70 years, the longest of any British monarch. New Zealand of course has a complicated relationship with the crown due to the problems created by colonialisation. But while the Queen enjoyed a privileged life of riches, she lived her life in service to the Commonweath. She worked until her final days, always in the full glare of the public eye. To live so long, with so many demands on her time and person is a significant service. Whether or not one agrees with the monarchy, we can recognise her efforts and the comfort she brought to many people.

New Zealand is in the midst of local government elections. Standing for local council service takes courage, and there is a lot for representatives to tackle in the coming three years. Voting closes 8 October, make sure you take the time to vote. Every vote counts!

Looking to the economy, like many in the industry we have warned of the building financial stress for households. This is now being reflected in the stats reported by Centrix (Credit Bureau of New Zealand). Centrix reports debt information each month and recently reported that more and more people are unable to meet their repayment obligations for personal debt. Arrears on consumer debt rose 13% in the last year, while arrears on unsecured personal loans rose 7.9%.

Given the above, it’s timely that World Financial Planning Day is coming up on the 5th of October. This day is held to promote awareness of the importance of financial planning and is an opportunity for experts to educate the public on how to manage their finances.

In this newsletter we are going to talk about:

In September Elise attended the Financial Advice NZ Conference in Christchurch and a professional development day with members of Prosper Group Limited. She heard from some great speakers and industry leaders. One speaker spoke to the worrying statistic that nationally schools are experiencing up to 55% truancy. If this trend continues there’s going to be a generation with low literacy and numeracy skills, which will lead to low financial literacy. Building on Basics believes strongly that all tamariki should be able to get a good education. To that end, we are a long-time supporter of the Kids Can Trust. It’s issues such as this that fires our passion and is key to our vision.

Daniel is no longer with the Building on Basics team and so Elise is in recruitment mode. In the interim she has a team around her, supporting her to continue to look after your needs. Elise has also restarted her Investment Strand study. She’s completed the course work and now just needs to complete the 2 assignments.

Building on Basics is sponsoring the “Lithe and Nimble” Team in the Spring Challenge 2022. The team did a 9.5hr training run in September and came through unscathed so they’re feeling ready for the big adventure this weekend. Elise’s partner Sarah is one of the intrepid team members, while Elise has been happy to provide transport and stick to the side-lines!

Lithe and Nimble team: Marj Vermaat, Kate Smith and Sarah Wilson

Congratulations to our client Luke Rushton from Rangiora. Luke completed the Sky Tower Challenge back in August, coming in at a very respectable 247 of 589. He’s already back in training to improve his placing for next year, we look forward to hearing how he does.

4 Things to Consider Before Refixing Your Mortgage

Mortgage refixes are not often top of mind for people. When it pops up – seemingly out of nowhere – it can be tempting to refix for the same period at the going rate without giving it a thought.

Why is it important to get financial advice for my KiwiSaver?

KiwiSaver is the most significant investment many Kiwis will ever make. It’s often the defining factor in whether a deposit for a first home is possible or whether you can retire in comfort.

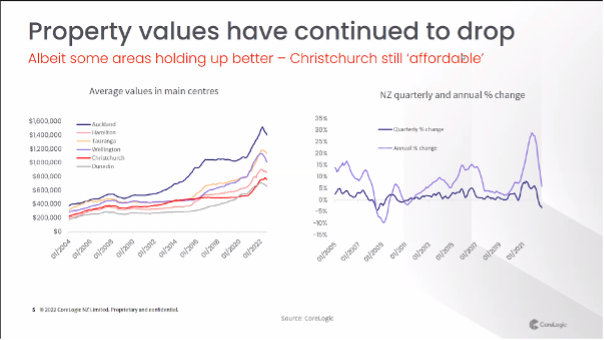

Property

Property values drop in 80% of New Zealand suburbs

CoreLogic NZ’s interactive Mapping the Market tool, updated quarterly, shows more than 80% of suburbs nation-wide have seen a drop in property values in the last three months.

However, supply and demand rules still apply. A good property can still sell above the expected value, especially if there are few other good properties on the market in the area. And while prices have dropped, they have by no means gone back to prices seen before the drastic price rise of the last couple of years.

Given the trend of property values dropping, the banks are nervous about accepting current property values. They’re putting in place tighter restrictions on what they will accept in the valuation reports. Meanwhile, valuers are struggling to find comparable sales.

KiwiSaver

If you don’t already regularly contribute to your KiwiSaver, it’s time to start. Many people put a lump sum in just before year end to ensure they get the government contribution. But doing small regular contributions is better than transferring a lump sum at the end of the year. This approach means your money is invested sooner and therefore benefiting from returns sooner.

The Financial Services Council’s annual conference last week included a panel discussion on what KiwiSaver might look like in 2050. During the discussion, Retirement Commissioner Jane Wrightson called for KiwiSaver to be made compulsory and the minimum contribution rate ramped up to 5%. Without these changes, she believed the scheme will not be fit for purpose in future years. Check out the Good Returns’ article for a summary of the session.

Banks

Living costs and interest rates are high and continue to rise. As a result, the banks are continuing to increase their service testing ratios. Several of the banks are now using over 8.1% to test an applicant’s ongoing affordability. While this will affect the amount you can borrow, the banks are being cautious to ensure they are lending responsibly in a time of increasing costs for families.

While still being very choosy about who they give finance to, the banks are also fighting for business. Offers of cash back incentives are currently very common.

A reminder for all self-employed people. If you’re seeking finance, you need to have filed your 2022 financials. Note that this is required for top-ups and restructures as well as new mortgage applications.

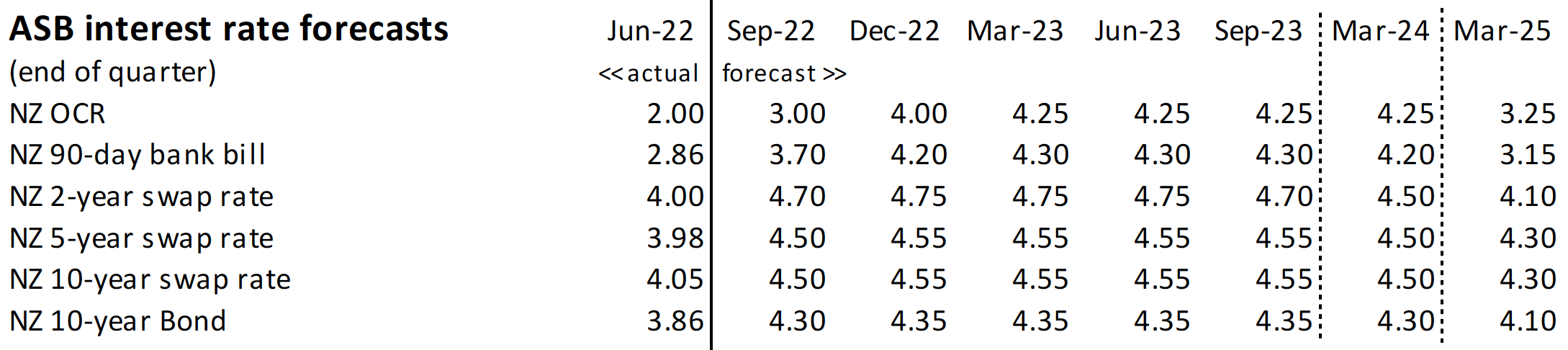

Reserve Bank

The next OCR review date is coming up on the 5th of October. Nick Tuffley the ASB Chief Economist predicts the following:

Source: ASB Economic Weekly 27 September 2022

Many of the banks have already reacted to the expected increase in the OCR when determining their mid-long term fixed term rates. Meanwhile, the short term fixed and floating rates are expected to continue to rise.

Hot tip of the month

Gaspy is a nifty free app that helps you save on petrol. You enter your location, and the app tells you which stations are offering the cheapest petrol in your area.

The app relies on drivers to log fuel costs, and others to confirm the results. With over 800,000 users helping keep the information up to date, it’s a great tool to save some money.

Oil shortage concerns due to the continuing war between Russia and the Ukraine have sent petrol prices skyrocketing. Even before this was the case, petrol was regularly on the rise and already a significant cost for many households. Consistently finding the cheapest rates can make hundreds of dollars difference over the year. And as always, consumers have power when acting collectively; if petrol stations lose business due to competition, they may revisit their own charges.

Did you know?

Negative equity is when you owe more than the value of your property. If you’re in this position but continue to meet your loan repayments, you are meeting your obligations and your lenders will not be concerned. However, they will be monitoring your payments, and should you wish to restructure your lending they may request you make a lump sum repayment.

Negative equity becomes an issue if you need to sell. You would need to repay all the debt on the sale of the property before the bank will release the security. This situation should be avoided if possible. Talk to your Financial Adviser about ways to retain the property should your situation change so that you don’t need to realise the loss.

Remember, riding the property value wave means ups and down, just like the share market. The losses and gains are only realised on the sale of the asset.

First Home Buyer Tips

You’re probably aware that the Government has the First Home Buyer Grant, but did you know that you get a bigger grant if you’re buying a new build?

If you’re buying an existing home, and you’re eligible for the grant, you would get $1,000 for each year you’ve been in KiwiSaver, up to a maximum of $5,000. That amount doubles if you buy a new home or land to build on, so $2,000 per year in KiwiSaver, up to a maximum of $10,000.

The grant is per person, so if you buy a house with a partner, together you could receive up to $20,000 towards your deposit, a significant amount

If you’re eligible for the grant, it’s worth looking into new build opportunities in your area to get the greatest benefit.

To be eligible for the First Home Buyer Grant you need to:

- Meet the deposit requirements.

- Have contributed at least the minimum amount to KiwiSaver for 3 years or more.

- Have an income within grant limits for the last 12 months.

- Be purchasing a property that meets the grant’s criteria. Find out more about the property criteria here.

- Be a first home buyer or equivalent. Previous homeowners in New Zealand or overseas may still qualify if you don’t currently own a property and have not previously received the grant or its predecessors.

For more information on eligibility, go to the government page Check you are eligible for the First Home Grant.

We are always available for a chat about your situation. Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team