Kia Ora!

In this newsletter:

Hot tip of the month –Energy efficiency loans (AKA cheap money for three years!)

Did you know – The account you thought you closed… isn’t

First-home buyer tips – Get a pre-approval so you know what you can spend

Property – Been waiting and watching? Now’s the time to buy!

KiwiSaver – Using KiwiSaver for tenancy bonds – good idea or bad idea?

Banks – Rates are continuing to rise, don’t be a casualty!

Reserve bank – OCR steady at 5.5% for how long?

Business – The power of the external team can increase your profits

Hot tip of the month

Energy efficiency loans (AKA cheap money for three years)

A BRANZ House Condition Survey in late 2022 shows 49% of New Zealand homes have visible mould, which can significantly harm health. With this in mind, the government created the Warmer Kiwi Homes Programme. It has been around for a while, but there are still opportunities for grants for insulation and heating. Check out your eligibility here. https://www.eeca.govt.nz/co-funding/insulation-and-heater-grants/warmer-kiwi-homes-programme/

On top of this, some banks offer 3-year loans at 1% to fund energy efficiency projects and clean transportation upgrades.

If you want to get finance for:

- Heat pumps

- Insulation

- Double glazing

- Electric vehicles

- Electric bikes

You can use your home as security to fund these home and transport improvements. Get in touch, and we’ll make it happen.

Did you know?

The account you thought you closed… isn’t

In the last 6 months, we have seen more instances where clients have declared that they have closed cards or paid outstanding accounts, and when we run their credit report, we find the accounts are not marked closed, or the debt is not marked as paid.

So what? Well, if you are seeking a personal loan or unsecured lending this can mean that you needlessly pay a higher interest rate due to a lower credit score. Sometimes the accounts have been closed for years or are facilities that you assumed would be closed when you made the last payment. If these facilities aren’t closed the banks may think that you have failed to disclose information – they don’t like it when you lie or omit something, even unconsciously! Fact is you weren’t lying it is just your request has not been actioned.

If something was sent to debt collection you may need to deal with the originating source of the debt and the debt collection agency. Collect written evidence that the debt has been paid and cleared. You will need to keep running your credit report and chasing them to ensure that the debt is marked paid and cleared.

Typical culprits for accounts you requested to be closed are some of the buy now pay later schemes and store finance facilities. Some of which have fees for maintaining the account, so you could find that you owe fees on a debt or facility that was paid and closed.

Banks are also ratbags with their guarantees for lending; when you have finished paying off your mortgage, they will leave the mortgage in place “just in case” you need to borrow more money from them, and they will also leave the guarantees in place. They justify it by saying it will save you legal fees if you need to reactivate the lending.

First-home buyer tips

Get a pre-approval so you know what you can spend

A pre-approval from a lender will let you know the maximum amount you can borrow. The lender will only agree to an amount they believe you will be able to “service”, meaning keeping up with payments. So, what decides your pre-approval?

We’ve talked previously about pulling together your deposit. Your deposit helps us determine your Loan to Value ratio (LVR). Banks like as much deposit as possible, and for homes, the preference is a minimum of 20%. In a hot property market, when property values are rising quickly, the banks are willing to accept a deposit of as little as 5%. Right now, depending on who you ask, the property market is either flat or still down a little, so for a 90%+ loan, you need an incredible cash flow to offset the lender’s risk.

Servicing is far more complicated to work out; partly it is about what you earn; after that there are several complex formulas for assessing your expenses. You declare your expenses – fixed (essential) and discretionary (optional). The bank will then calculate whether your spending is above or below the benchmarks they are using. Each bank’s process to assess your expenses is different, and it becomes even more difficult when you are self-employed.

The pre-approval is valid for 90 days, but you can get an extension to up to 180 days. After that you’ll need to complete a full new application.

The pre-approval will typically be conditional on several factors such as:

- Whether the bank accepts the property that you’re buying as security

- An acceptable building inspection or weather tightness report

- An acceptable value, especially if you’re borrowing more than 80%

- Adequate insurance on the property

The pre-approval will allow you to get confirmation of your finance faster, which means if you compete for a property, you will be able to confirm the offer faster. This can make your offer better than other purchasers.

Thoughts from Elise

We are still at least nine months away from seeing any downward trends in interest rates. In the meantime, there is more competition for the properties listed on the market.

Several new builds are being resold as they reach completion, as the original purchasers cannot make the final payment due to the properties dropping in value, or they can no longer service the debt at the higher interest rate levels.

So, if you’re interested in a new build but want to avoid going through the ups and downs of building, this is an excellent time to pick up a finished new home.

6 Things to Do Before Making an Offer on a Property

Buying a property is likely the biggest purchase you will ever make, so taking the time to understand the process and check all the boxes is essential. It’s about reducing the risk of missing out on a great property and the chance of buyer’s remorse after settlement day.

Are you looking at your KiwiSaver all wrong?

Checking your KiwiSaver balance can be a bit addictive, especially when there is movement in the market. But if you’re not close to withdrawing money from KiwiSaver and are making regular contributions…

Property

Been waiting and watching? Now’s the time to buy!

Property is a key part of the New Zealand household wealth plan. Whether it be via a home or an investment property.

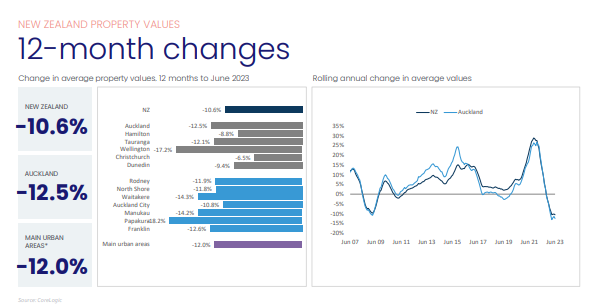

Over the last 12 months the property values have been down. The number of properties coming onto the market is steady but not increasing, which could be expected for the winter market

While the listings are down, Kelvin Davidson from CoreLogic reports that the sales volumes are up. With fewer properties coming on the market and demand increasing, this will begin the drive of property values up with anecdotal evidence of multi offers on quality properties. Migration is adding to the housing shortage as more people need rentals and homes. The number of permanent visas that are being granted is bringing more first-home buyers into the market.

So, for those waiting for the bottom of the market, (while there are no guarantees) expert advice is that now is the time to buy.

KiwiSaver

Using your KiwiSaver for tenancy bonds – good idea or bad idea?

KiwiSaver has not been around for long, but long enough for politicians to float ideas on other ways we can use our KiwiSaver over and above retirement. As we draw nearer the election there are all sorts of promises being made. One of the ideas being floated is to allow KiwiSaver to be used for rental bonds. With rents continuing to go up, coming up with 4 weeks bond can be a burden that young renters struggle with. Some go into debt to be able to afford the bond, which is a dangerous road to go down.

A rental bond needs to be paid to Tenancy Services and is refundable when the tenant moves out – assuming they leave the property in good condition and owe no rent. They can then use that bond for their next rental or towards a deposit on their first home. Otherwise, hopefully they will have the commonsense to put it back in their KiwiSaver.

The devil will be in the detail, but it isn’t a bad concept. We would be keen to hear your thoughts.

Banks

Rates are continuing to rise, don’t be a casualty

The OCR has flattened at 5.5%, with no change in the rate for the first time since October 2022. The banks however have been increasing the rates since Sept 2022 in anticipation of the Reserve Bank’s moves.

Stress testing rates are going up and down at various banks but continue to remain high in the 8.75-9.1% range, limiting the amount that you can service.

Mortgage delinquencies continue to grow with 19,500 people behind in their mortgage payments, up 34% on the same time last year. 51% of all mortgages will come off a fixed term in the next 12 months, most of which will be on much lower rates.

If you have a mortgage account due for refix, contact us to talk through the options. If you are at risk of defaulting on a loan payment, please let us know as soon as possible – the earlier you address it, the more options we can give you.

Reserve Bank

OCR steady at 5.5% for how long?

When the Reserve Bank made its announcement on 12 July, it summed up its view as:

The lagged effects of previous monetary tightening is still passing through to households as more households move off lower fixed rates.

Average mortgage rates on outstanding loans have increased from about 3% in early 2022 to about 5% currently. Based on current commercial bank pricing, average mortgage rates are expected to reach around 6% in early 2024.

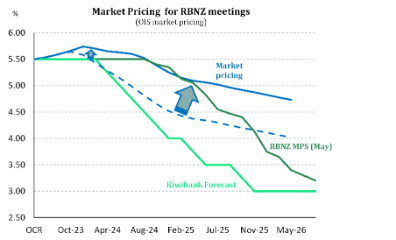

Most banks have continued to increase their short-term and floating rates despite the OCR holding at 5.5%. The OCR is expected to be kept flat until at least the first quarter of 2024 before gradually reducing to 3%. The target rate is between 1% – 2%, and many banks are expecting it to resettle at the higher rate of 3%.

Business

The power of the external team can increase your profits

It is impossible to run a business solo. There are too many necessary areas of expertise to know and do it all. Not all of your team need to be employees or to work full time in your business. Many of your team will be sub-contractors or external providers you engage to supply a service that you don’t have in-house.

Typical external providers include:

- IT specialists – cyber and other IT support

- Accountants – monthly reporting, GST and end of year financials. Experts in financial legislation and best practice methods for managing money and taxes, they provide expert advice and assurance that you’re operating within the rules.

- Lawyers – terms of engagement and other specialist contracts legal support

- HR specialist – employment agreements, HR support, performance reviews

- Mentors / Business Coaches – strategic planning and accountability

If you try to learn it all and do it all yourself, you will spend a lot of time understanding and managing all areas of your business. Learning something new or dealing with a situation yourself may be rewarding; however, the chances that you miss something important or make a costly mistake are high.

But the greater cost is that you are not focusing on your core business of completing the operational or sales work that generates your revenue. Turnover is the key; typically, small business owners are the ones at the coal face that generate sales or deliver the service.

Doing the books is the most common time-wasting task for business owners. You hate doing the paperwork, so spend hours procrastinating or agonising over doing the work. What takes you 3-4 hours, a bookkeeper could do in 1-2 hours or less per week. What income could you generate during the time you would save?

Insurance

It pays to have insurance, as these stats show

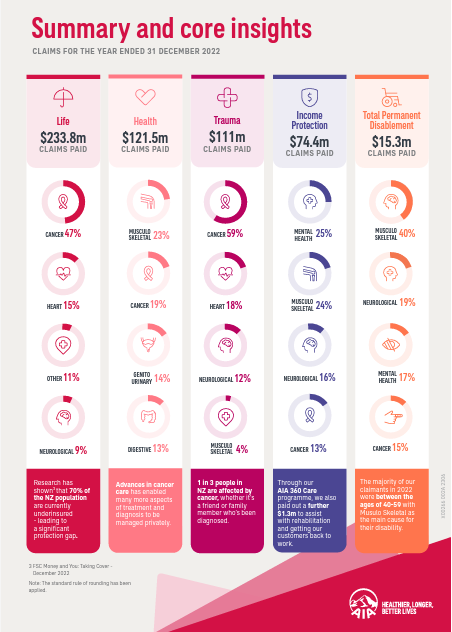

It won’t happen to me, right? Over 70% of New Zealanders are underinsured!

Each year, providers report the claims over the last 12 months. A picture paints 1,000 words; check out the statistics from AIA for the 12 months ending Dec 2022:

The standout statistics are that 1 in 3 people in NZ are affected by cancer, and that the majority of claimants in 2022 were aged between 40-59. Asteron has policies for over 815,000 New Zealanders, providing these policyholders and their loved ones with peace of mind in the event of a bad diagnosis.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team