Kia Ora!

In this newsletter –

Hot tip of the month –KiwiSaver is also for kids

Did you know –Government benefits and minimum wage are increasing

First-home buyer tips – 5 things a financial adviser does to get you ready for your first home

Property-The market is recovering

Investments –Decades away from cashing in your KiwiSaver? Then go for growth!

Banks –Opportunities to spend and to save!

Reserve bank –Inflation under control for now, will it last?

Insurance –If insurance feels like a drain, try a different mindset

Hot tip of the month

KiwiSaver is also for kids

KiwiSaver is a great way to teach kids about investing and the power of compound interest, while helping get them into their first home!

We ran some scenarios assuming a consistent 6% return compounded annually. Contributing just $20 a month over 20 years ($4,800) could give a child over $8,800 towards a deposit. $40 a month over 20 years ($9,600) could give them a balance of over $17,600!

With the cost of living and other financial factors, a regular contribution may not be possible. But even small sporadic deposits add up and give children a real example of how savings and investment work.

Note that the government contribution doesn’t kick in until your child turns 18, but the KiwiSaver account is a great place to stash some of the birthday and Christmas cash they may receive. If they start a job before they turn 18, they can still contribute to their KiwiSaver automatically, and some employers contribute even though they are not required to do so. It all adds up, and the compounding effect of earnings on the earnings and the contributions made can give your child a head start towards their home deposit.

For more information, check out this Inland Revenue fact sheet.

Did you know?

Government benefits and minimum wage are increasing

From 1 April 2025:

- the adult minimum wage will go up from $23.15 to $23.50 per hour

- the starting-out and training minimum wage will go up from $18.52 to $18.80 per hour

- most government benefits and NZ Super will increase by around 2%.

All rates are before tax and any lawful deductions, such as PAYE tax, student loan repayment, and child support. The increases are not enough to cover the increased cost of living, but it’s a start.

The living wage remains at $27.80, which equates to a salary of $57,824 p/a. Given recent inflation and cost of living this is still not a lot.

First-home buyer tips

5 things a financial adviser does to get you ready for your first home

Last month, we mentioned talking to a financial adviser as soon as possible to get you started on your preparation for buying your first home.

This is because a good financial adviser will:

- give you tips and guidance on how to build your deposit quickly and get your funds working for you

- help you set up systems to have access to funds for emergencies as well as for doing due diligence

- help protect you from buying a dud by helping you to understand the due diligence process

- connect you to a team of experts to complete due diligence and all the other professional support you need when you buy a house

- oh, and they get you the funds to purchase the home! More than that, they ensure that the mortgage is structured to suit your financial situation and so that you pay it off as fast as possible. They also help you with a quality-of-life plan to retain your home in the event of the unexpected.

Thoughts from Elise

Today is the first of the new financial year, and daylight savings finishes on the 6th of April. This month is going to seem super short with all the public holidays. There are three days between Easter Monday and ANZAC Day, so I plan to take the time to head away (like many others, I suspect). While away, I will catch up with some clients down south in Wanaka and Franz Josef before returning home via Dunedin. Be safe on the roads if you are out and about.

Our house renovations have progressed, with the shed lined, painted, and the flooring installed. We will start shifting things out from under the house as we begin preparing for the next stage.

As for the industry, there is plenty of craziness around the markets. With the dropping interest rates, the banks’ lead times have blown out again, and their service levels have been frustrating to work with. Summer has seen the usual lift in activity, and investors are back in the market and competing with first-home buyers. In Christchurch, some out-of-town investors are adding to the competition.

I am seeing more people who went directly to the banks, where I have been able to make quick changes to save them thousands of dollars.

Property

The market is recovering

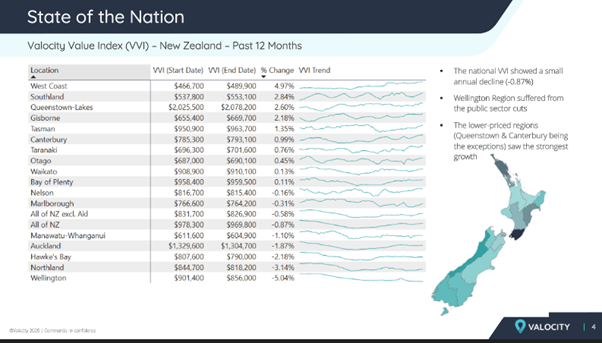

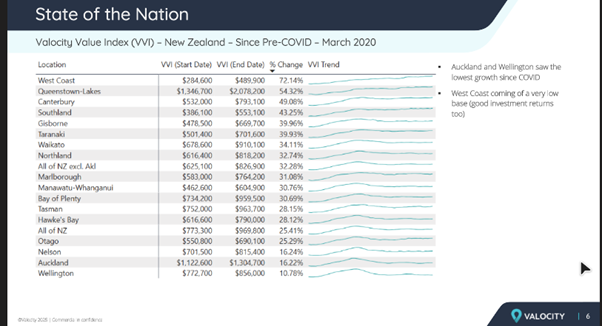

ANZ, in conjunction with Valocity, provides us with regular updates on the property markets. In the March update, we got the good news that (except for Wellington) most regions are starting to recover. Wellington has been hit hard by the public sector cuts, with more cuts still to come.

Property is a long-term investment, and gains and losses over 12 months are only relevant to determining whether an investment yields capital gains for the year.

The recent downturn is partly a market correction after the property market was overstimulated post-COVID. The super low interest rates and the return of many Kiwis from overseas increased the demand from an already under-supplied property market.

While prices have dropped since that spike, property values across all regions are still above their March 2020 pre-COVID levels.

Investments

Decades away from cashing in your KiwiSaver? Then go for growth!

We recently worked with a client who is aged 34, has a $65K salary, and their employer matches their 3% KiwiSaver contribution. They purchased their home a while back and have managed to get their KiwiSaver funds back up to around $25K. They were in a balanced fund.

Based on a balanced risk profile, they would have $214,889 in their KiwiSaver funds at age 65. If they were to try to extend their funds to last until they were 90, that would give them approximately $396 per fortnight to supplement their government pension. This sounds pretty good. But we know, according to the retirement expenditure guidelines, a single person in a metro region will need between $690-$770 per week for a no-frills or limited-choice lifestyle. Given this, the addition of the pension to this KiwiSaver investment is not going to be enough.

However, if we moved their funds to a growth fund – which would stretch the client’s risk tolerance – they would have approximately $476 per fortnight. At their age, they have plenty of time to ride the market’s highs and lows before they can access their KiwiSaver at 65. *

Ultimately, the client agreed with our advice, and they’re now in a growth fund. We also moved them to a better-performing fund, which will also help them achieve better results. Ultimately the client should substantially benefit from these changes when it comes time to retire.

*Assuming they don’t have the unusual situation of meeting the stringent criteria to access the funds sooner due to hardship, etc.

Banks

Opportunities to spend and to save!

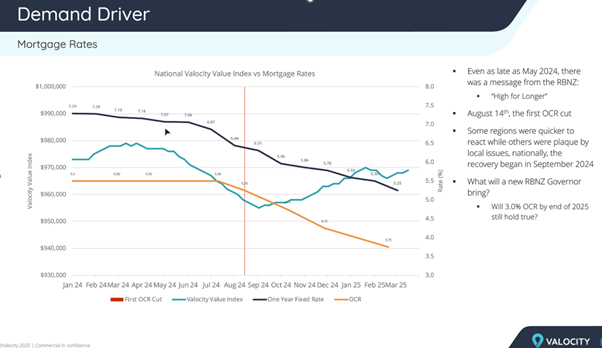

If you put your property plans on hold in recent years due to high interest rates, now could be the time to make your move. Interest rates are coming down, and with that, the lenders’ stress-test rates. As a result, borrowers can borrow more. Lenders are offering cashback of between 0.8-1% as they compete for your business.

Many people are making the most of the improved offerings, so the banks are extremely busy. ANZ is resourced to manage up to 2,000 refixes per week but recently has received over 5,000 requests weekly. The banks are gearing up for the incoming flood of work, but the increased demand happened a little faster than they anticipated.

In short, this means that turnaround times are very slow, not just for refixes and restructures but also for loan applications. To help the lenders manage their workload, they are limiting applications to live deals only.

For current homeowners, as interest rates come down, your minimum required payments will also reduce. But if you can continue to sustain the higher repayments, you will pay your debt down faster, which will reduce your interest repayments.

Some of our clients have taken the opportunity to refix their long-term loans under 3.5% but retain the same payments as when they were paying 6%, ultimately paying off their mortgage faster.

Talk with Elise to ensure your mortgage is structured to suit your needs. By better utilising your funds, you can potentially save thousands in interest costs.

Reserve Bank

Inflation under control for now, will it last?

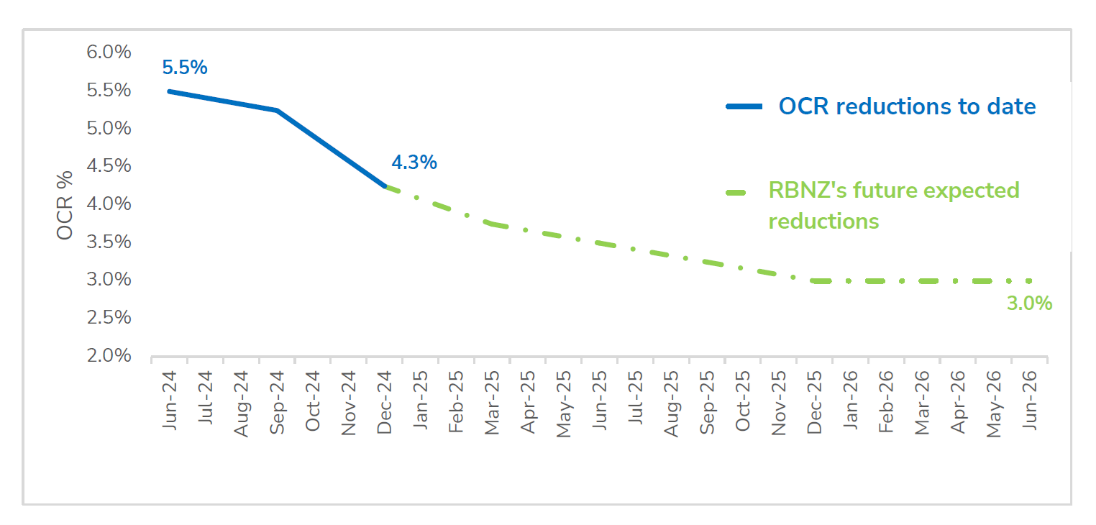

The OCR announcement on April 9th reduced the OCR to 3.75%, and the Reserve Bank has indicated that the economy is tracking towards 3% OCR by late 2025. The next announcements are due on May 28th and then July 9th.

Unemployment is at 5.1%, and the number of company liquidations is rising. There is a tariff war and uncertainty in the global markets. The good news is that GDP growth was 0.7% in December, taking us out of a recession, and we are seeing some signs of life in the property markets.

The graph shows the Reserve Bank’s prediction as of November 2024. The Reserve Bank likely needs the economy to stabilise to maintain or decrease inflation further. They are not predicting a bumpy ride at this stage and are keen for a long, flat period around the 3% mark.

Insurance

If insurance feels like a drain, try a different mindset

Insurance is there to maintain your quality of life should the unexpected happen. You pay a premium for having the covers in place to give you that peace of mind.

The premiums can be seen as a cost or an investment. We know from anyone who has had to make an insurance claim that they are grateful for that cover when it is needed and no longer see it as a cost! They then prioritise continuing their cover whenever possible.

Many insurance providers now provide mental health assistance, nutritional guidance, diagnosis support, and other reward-type schemes that provide benefits without requiring you to make a claim. Insurance companies have figured out that the healthier they keep you, the fewer claims they need to pay! We love that the providers are proactive and give you access to resources that potentially prevent or minimise health issues. These benefits help make your insurance a valuable asset.

To learn more about maintaining your quality of life regardless of what happens or to understand the proactive benefits of your cover, contact Gordon Bell at 022 503 9094 for a free insurance review.

Business

Profit First – put on your own oxygen mask

Elise has been reading and implementing the principles of Profit First by Mike Micahalowicz. She shares her experience below:

I first read this book 18 months ago and loved the approach and the simplicity of the systems.

Did I do anything about it? Of course not! I wasn’t ready! Taking the ‘profit first’ principles and implementing them into my business is taking a bit of time, but I am ready now, and the difference in my mindset as I use the tools and systems is making a difference.

The system is simple and eliminates worries about having funds to pay your taxes and manage your expenses. It also gives you the funds you need to grow your business. If you want to find out more, let’s chat.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team