How do I know when should I fix my loan, and for how long?

Let’s start by understanding some loan terminology.

Fixed rate / Fixed Home Loan

Interest paid on a mortgage can be either a fixed rate or a floating rate, which means it either stays constant for a time or moves up and down variably. For a fixed rate loan, the interest rate is set at the date we take out our loan and remains the same throughout the agreed term, irrespective of whether bank interest rates rise or fall.

When you apply for a mortgage the term (length of time you have to repay the loan) is typically 30 years, but you will want to pay it off faster than that to save interest costs.

So, you ask, when should I fix my loan, and for how long? Within the term of the mortgage you can choose to fix all or a portion of your loan for a period of 6 months, or 1, 2, 3, 4 or 5 years. The interest rate for each term will be dependent on what the bank sees the reserve bank setting the OCR (Official Cash Rate) at over the course of the term. If the banks, as they are predicting at the moment, think that the official cash rates are going to increase then the longer-term rates will be high and the short term (less than 2 years) will be lower.

Now that we understand that let’s get back to the question, when should you fix your loan? Well, it comes down to these main factors.

-

How much certainty do you need in your cashflow? A fixed rate means you know how much you will be paying each week.

-

Are you expecting to receive any significant lumps sums during the term you are fixing the loan for? We are talking about bonuses, or gifts or large commission payments.. sorry, lotto is excluded here.

-

Does your crystal ball expect interest rates to rise over the term you are looking to fix your loan?

-

Are you looking to sell your property during the period you are looking to fix the loan?

-

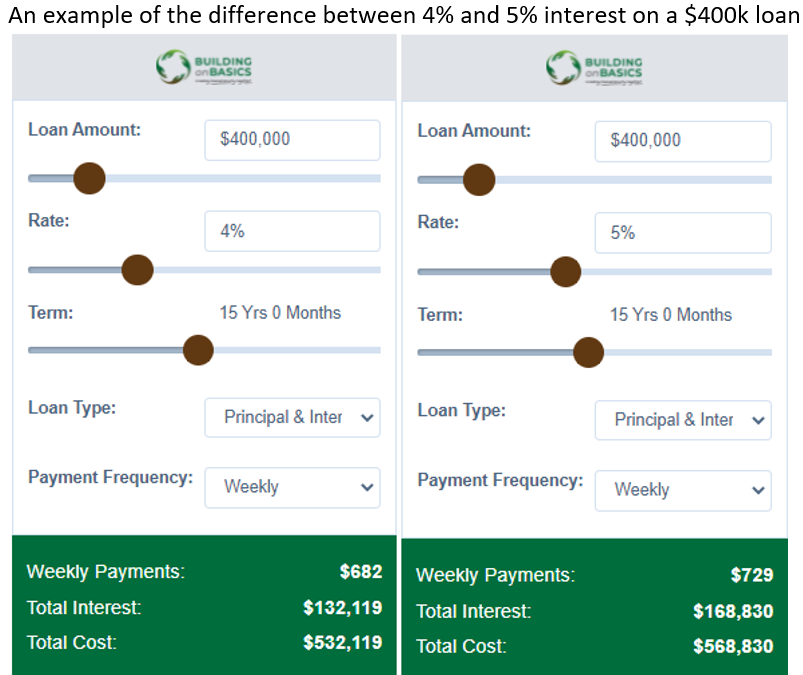

Can you afford the loan repayments if the interest rates do go up? A 1% increase in the interest rate could mean paying an extra $50 a week on your loan. Have a play with our Repayment Calculator to get an idea of what that might look like for you.

-

Are you looking to change your income and decrease your hours or income in the coming timeframe.

-

Are you likely to need more money for something which may require you to change banks?

Answering these questions are the starting point for determining when and how long you should fix your loan.

Be aware that asking your bank will not be particularly useful as they are keen for you to have the loan for as long as possible… and for you to pay as much interest as they can squeeze out of you.

A Financial Adviser will look to save you interest and help guide you on the factors that will drive the interest rates up or down as well as give you guidance and recommendations on the best way to split your loans and fix or float different amounts to save you interest costs.

Everyone’s situation is different, and we need to take into account your risk profile as to what is likely to happen for you in the coming months and years.

Our goal as Financial Advisers is to see you get the debt repaid as quickly as possible.

We’re working with you to get the most out of your money, rather than just doing as the bank recommends and paying all that extra interest over the term of your loan. We hope that gives some clarity about when you should fix your loan, and for how long.

Get in touch with us for a no obligation chat.