October has sped by and things don’t look to be slowing down! The Election is over and we will have a new Government formed within the next week or so. Normally, New Zealand holds its breath during the months leading up to the Election. Not this time!

Businesses continue on their recovery plans, we enjoyed our first public holiday since June, and the property market has been going nuts.

Now we are at the start of November and with less than 8 weeks till Christmas the madness has already started – Suddenly it’s the time of year when people looking to achieve this or that goal before New Zealand shuts down for the Christmas holidays. Builders, plumbers and other trades are booked until after the Christmas holidays, work projects are being pushed to be completed, and the end of year celebrations will soon begin. Many kiwis will be glad to see the back of 2020, but we hope that this year has had some positives for you.

KiwiSaver

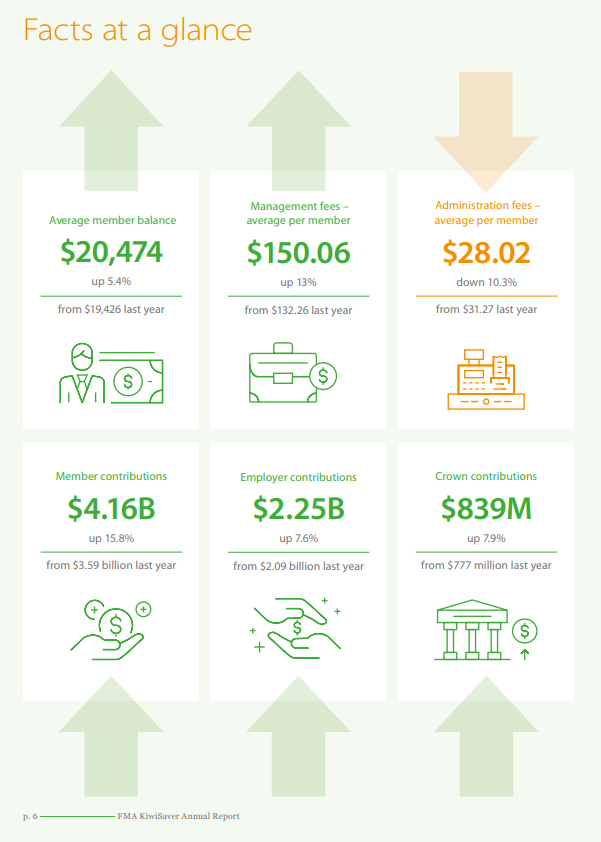

According to the Financial Markets Authority’s (FMA) annual KiwiSaver report released at the end of September 2020, first home buyers withdrew $1.19B – this is up 25% from $953 million last year. 256,393 people switched funds, up 54% from 166,109 last year.

While there are many valid reasons for switching funds, many people who work without a Financial Adviser switched without understanding the consequences. Especially during the initial stages of Covid-19, many people switched funds which resulted in locking in the losses.

We continue to see the average KiwiSaver balances growing, yet as a nation we are still not investing enough for our retirement.

Property Market

The property market continues to boom, with the combination of lack of supply and low interest rates continuing to fuel the market.

According to the CoreLogic Market Pulse report “More than half of property purchases in the third quarter of the year were made by either mortgaged investors or first home buyers (FHBs), with existing owner-occupiers still pretty quiet. In fact, the share going to FHBs of 25% was their highest figure on record, surpassing the previous peak of 24% in 2006-07 – KiwiSaver withdrawals remain one important factor in their ability to stay active in the market.”

The Reserve Bank of New Zealand (RBNZ) has its work cut out to attempt to slow the property market while stimulating the economy. There is a possibility that the RBNZ could reintroduce the Loan to Value restrictions to try to slow down investors in the market.

Banks and Finance

Low interest rates continue to keep the banks busy. Sale and purchase of properties is only part of the picture that the banks are dealing with, restructures and refinance of lending is another big chunk of their business.

The volume of requests and applications that the banks are receiving continues to mean long lead times for the processing of the requests. If you’re looking to purchase a house make sure you allow for at least 10 days to get finance.

Expect to hear more in the media about the negative interest rates as the RBNZ prepares us for the lowering of the OCR in the new year.

A number of banks are also starting to move interest rates down and I am anticipating some fierce competition from the banks for the business, with one key requirement from all banks – Income servicing capability!! Get that spending plan updated if you’re in the market, knowing where you are spending your money and how much is available is going to make the whole process a lot easier.

An update from us.

From 15th March 2021 the financial advice process will be changing as new laws come into effect. The team at Building on Basics are working on ensuring we are ready for the new regime, this includes Elise starting her training on the Investment Strand so that she can continue to provide KiwiSaver support when the new rules come into play.

Elise is heading down to Invercargill from 5th to 8th November to work with the Colombian community to provide some financial literacy training. It’s an exciting opportunity and lots of work has gone into organising the workshops. The main focus will be on gaining a better understanding of KiwiSaver, and how to access free money to help buy a home.

Until next month, take care and keep moving forward. Please do get in touch with us if we can help you in any way.

– Elise and the team