Hi!

Spring has sprung and the daffodils are up and out. Happy Father’s Day this Sunday to all those fathers out there. I will be remembering my mischievous dad this coming Sunday.

Our thoughts go out to all those that have been affected by the floods and slips around the country in the last few weeks. ASB have offered support to those affected, and I would expect other banks will be following suit. If you need relief with your loans, it is best to talk to us as soon as you think you may be in trouble. It is easier to come up with solutions before you default on loans. We can help.

In this newsletter we are going to talk about:

Summary of August blogs

Property

KiwiSaver

Banks

Reserve bank

Hot tip of the month

First Home Buyer Tips

Did you know…

With all the bad news out there, here is a stat that is good news. In the first Quarter of the year there were only 6 Mortgagee sales and in the second Quarter there were 21. This shows that the banks are willing to work with people and as the increase in interest rates and other inflationary figures put more pressure on peoples budgets, we can expect more defaults.

In other Bob news, Eroica has resigned after 3 years with the business. She will be missed, Wednesday mornings just won’t be the same in the office.

Self Employed and Need Finance?

What do you need to know about getting Finance when you’re self employed?

Changing a Home to an Investment Property?

Moving out of home, and planning on renting it? Read on

Hot tip of the month

If you move out of your home and turn it into a rental then you should talk to your accountant, get a valuation of your property and change your insurance. Check out the blog… This could potentially save you tens of thousands of dollars in income tax should you sell your property if the bright line test applies.

Did you know?

Accidents and illness do not care if you have your affairs in order or not. If you have an accident or get sick and are not able to operate your bank accounts and pay your bills who can do this on your behalf? If you are not able to make decisions about your health and well being who can make these decisions on your behalf?

A Last Will and Testament deals with your estate when you die. Enduring Powers of Attorney (EPOA) allow someone to act on your behalf if you are incapacitated. There are 2 types

Health and Wellbeing; and

Property

If you do not have these documents in place it can take 3-6 months and an awful lot of paperwork and stress to get one set up. It could also cost up to 3 times the amount it would cost if you have put the paperwork in place before you need it.

Most people think that these documents are only needed for the elderly when they go into residential care. The fact is Accidents and Illness due not discriminate with age. Something can happen at anytime. Are you ready to protect those that you love? Talk to us about getting that underway.

First Home Buyer Tips

Buying your first home can be an overwhelming process. This is our tips section to help you get into your own home.

How much can you pay for a property?

Talk to your Mortgage Adviser about how much, and then get a pre-approval from the bank. Not all banks and lenders will provide a pre-approval for finance and if they do it will be a conditional pre-approval especially if you have not decided on a property yet. If the banks are super busy they may not process your loan pre-approvals, unless you are an existing bank client. The bank may also require a live sale and purchase agreement.

When the bank does a pre-approval they are pre-approving the loan based on:

- Your character – do you pay your bills on time and will the bank get their money back?

- Your ability to service the debt – how much do you earn and what are your expenses?

- The security you are offering the bank – is the property weather tight, does it have insurance and what does the building report say about the property?

- How much are you looking to borrow compared with the value of the property – the Loan to Value Ratio (LVR)– ideally the banks want to lend less then 80%, but they can lend up to 95% depending on your ability to service the debt.

Pre-approvals are not limited to First Home Buyers, talk to us if you’re looking to get pre-approved for a loan.

Have a read of the First Home Buyer section of our website for more information.

KiwiSaver

The Morning Star Q2 report noted that approximately $6.3bn was wiped off KiwiSaver funds due to the volatility of the markets. This is an issue for the people who are needing to access their funds now, but those that do not need to access their funds for the next 5-10 years needn’t worry as there is time for your investment to recover.

In August the Financial Markets Authority (FMA) put out a paper on a Product Review of Managed Funds Documents. It highlighted a number of areas where KiwiSaver Products need to provide clearer information. The information needs to be made clearer for investors to be able to review and understand the risks when assessing non-financial factors relating to an investment. This may include Ethical and Socially Responsible investments. With no agreed standard for reporting and measuring the non-financial factors it is difficult to assess how a funds is doing and whether it is just marketing ‘green-washing’. The FMA also commented that relevant information about funds needed by Investors to make an informed decision is spread across multiple documents and sources. Over the coming months and year ahead, we can expect to see some changes to the way the results are reported.

If you are concerned please get in touch.

Reserve Bank

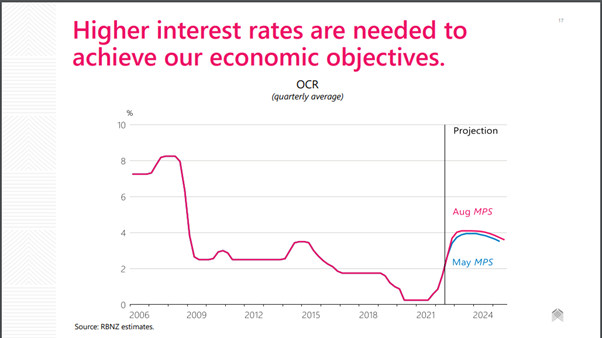

The OCR is now at 3% with the next update due on 4 October. The RBNZ is working to fight inflation and in their announcement on 17 August, they indicated that they think that the worst of the inflation is over. Of course it takes time for the work that they have been doing to turn the inflation ship.

The RBNZ indicated that

- The acute domestic labour shortages, and supply-chain bottlenecks are limiting and delaying production.

- Global and domestic inflationary pressures have contributed to higher CPI inflation. International events have disrupted international trade patterns and sharply increased commodity prices, although these have eased recently. Domestically, growth in wages has added to business costs while supporting household spending.

- Inflation is higher than target, and employment is well above its maximum sustainable level. The New Zealand economy needs to go through a period of more moderate growth to better match demand with production capacity

What this all means is that the interest rates are going to continue to go up and that they expect the OCR to be up around 4% by mid 2023 if not sooner and for it to remain at that level through 2024.

Banks

The next level of the CCCFA changes came through and while it relaxed some of the requirements the main Banks have not changed their requirements. Alternate non-bank lenders have been taking a larger share of the market. The main banks have for some time been looking for vanilla deals – Properties that are a safe bet with low debt to value ratios. Lending over 90% has mainly been restricted to First Home Buyers or clients with large incomes and massive surpluses.

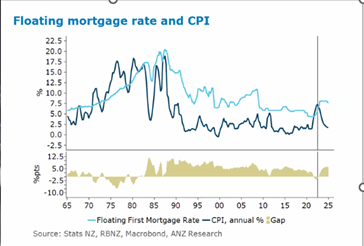

These are largely self-imposed restrictions, by the banks, which has forced the main banks to buy business through cash incentives and reducing the short term interest rates. Economists including Sharon Zollner from ANZ and Cameron Bagrie have commented that the reduction in interest rates is a temporary easing while the inflation is high. This has set mortgage interest rates at a negative level.

Property

NZ still has a housing shortage. As the tourism market has opened up, the need for short term rentals has increased. While we saw many properties that were short term rentals (used as Air BNB) moved to long term rentals at the beginning of the pandemic Lockdowns, many of these are now moving back to being used as Air BNBs which is again reducing the number of long term rental options.

Houses are still being built and with a large number of people now heading out of the country on their OE, this will reduce some of the demand for property. Rents have been increasing and seem to be stabilising for now.

Property

“When the going gets tough the tough get going”. Since Covid over 300 new agents joined the industry. It was easy to be a Real Estate Agent in a hot market. Now the market has turned, some 235 Real Estate Agents have left the industry this year.

Spring typically sees more properties coming on the market. The average days to sell a property is now up to 47, which is up 16 days from this time last year. Property values are dropping, and some economists are expecting property values to drop up to 20% from the same time last year. Some property investors are seeking to put their properties on the market, then finding that the property is not selling as fast, and are then renting the property out again.

Rents are also holding steady as there are more properties on the market available to rent.

We are always available for a chat about your situation. Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team