Kia Ora!

In this newsletter –

Hot tip of the month – How to grow your garden

Did you know – 85 days till Christmas! Budget now and keep the fun in the festive season

First-home buyer tips – How to use your KiwiSaver as a deposit

Property – Property sales volumes are rising. Is the market heating up?

Investments – Reviewing your KiwiSaver – how to balance growth with security

Banks – Restrictions have eased, but processing times have increased

Reserve bank – The OCR is dropping; how low will it go?

Insurance – Ask an expert for a solution before you opt to cancel cover

Business – Do business owners need to be an expert at everything?

Hot tip of the month

How to grow your garden

There is something special about eating food grown in your garden. Planter boxes are a great way to maximise your space if you have a small garden.

Four ways to make the most of your planter box:

- Find a sunny spot: Position your planter to get 6-8 hours of sunlight daily, as most vegetables need full sun to thrive.

- Opt for quality soil: Use a nutrient-rich, well-draining potting mix specifically for vegetables and add compost or organic matter to boost soil fertility.

- Plan out your plants: Group vegetables together based on their watering needs.

- Water wisely: Ensure your planter has proper drainage holes. Add mulch to help retain moisture and reduce evaporation. Water plants according to their needs and increase regularity in warmer months.

Did you know?

85 days till Christmas! Budget now and keep the fun in the festive season

Christmas comes every year, predictable and on time. But it can surprise a household’s budget, with added shocks of high cost of living and inflation. This double whammy may have eaten into the reserves you have set aside for gifts and the little extras around Christmas time.

If you can buy a little something each pay day to stock up for Christmas, start doing so now so that you don’t need to use credit at Christmas and start 2025 in debt. If the budget does not allow for these extra purchases, then start looking at things that you can make and create with resources around home for gifts.

First-home buyer tips

How to use your KiwiSaver as a deposit

If you plan to use your KiwiSaver towards the deposit for your first home, then it’s essential to ensure that you qualify and can access your KiwiSaver when needed.

To qualify to use your KiwiSaver towards your first home deposit, you must have been a member for three or more years. This is a good reason for parents to enrol their children in KiwiSaver early. Get that clock ticking.

You can withdraw everything except $1,000 from your KiwiSaver if you qualify. Having certainty about how much is in your KiwiSaver is essential. You need to know how much of the deposit will be covered by KiwiSaver and how much shortfall you will need to fund.

As your KiwiSaver balance will fluctuate depending on the state of the markets on the day, it is important that you set your KiwiSaver fund into a defensive or cash fund before you start looking for a home.

Remember to leave funds for other purchase costs, such as conveyancing, when allocating your savings towards a deposit.

Thoughts from Elise

The 2024 Paralympics were full of inspiration, and the NZ team secured an impressive nine medals. Well done to the team; it was not just the medals won but the numerous personal bests and national records achieved that showcased our team’s resilience and talent.

The big snow dumps down south in September were welcomed by the skiers!! Gardeners have needed to be cautious with the frost. Overall, it seemed like a cool and wet spring. This has not stopped me from starting my shed-building project. The shed will give us the storage to clear out the underside of the house so we can start the renovations.

Interest rates are easing, and looking at the short term in conjunction with the long term is the wise thing to do. We expect two more rate cuts before the end of the year, but it will very much depend on what happens in October. The reversal of some more of the CCCFA changes from 2021 has given banks more flexibility, and some common sense is coming back into their policies. The stress test rates are coming down very slowly as the floating rates are still hovering at 8-8.5%.

Christmas is on the horizon, and the focus is on getting things done before it arrives, although the immediate focus for most families is surviving the current school holidays!

I am looking forward to the warmer weather, and now that daylight savings is here, making the most of the longer days.

Property

Property sales volumes are rising. Is the market heating up?

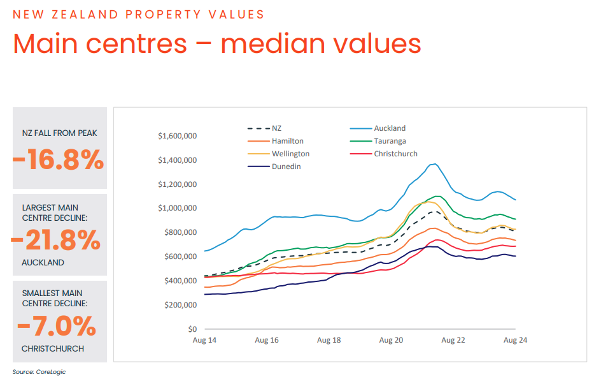

CoreLogic reported in their September property report that while property sales volumes are up on last month, they are still slower than the same time in 2023. Property values have been declining in most centres, with Christchurch seeming to be bucking the trend.

Now is a good time to buy before the market really moves. As funding becomes a little easier for most people, more investors are likely to return to the market.

Investments

Reviewing your KiwiSaver – how to balance growth with security

There are two primary planned uses of your KiwiSaver:

- Deposit for your first home

- Retirement savings to supplement the government pension (while it is available).

For your first home deposit, the sooner you start contributing to your KiwiSaver, the better. Also, the more often you contribute, the better, as you reap the benefit of compounding interest.

It is also critical to adjust your fund structure depending on whether you are growing your investment or nearing the time you will use the funds. If you are thinking of applying for finance and your funds are still in a growth fund, switch to a defensive fund immediately. If you have just purchased your first home and you are more than ten years before retirement, then make sure that your funds are in a growth or aggressive fund, taking into consideration your risk profile.

If you already own your home, the fund type is important, as you will need to maximise your savings for retirement. Make sure that you have switched from the conservative cash fund into a growth type fund, dependent on your risk profile and when you will need your KiwiSaver for supplementing your retirement income. Also consider investments outside of your KiwiSaver that you can access prior to the age of 65. Chat with us if you want to ensure your funds are working for you.

Banks

Restrictions have eased, but processing times have increased

The recent reversal of the CCCFA (Credit Contracts and Consumer Finance Act) changes has meant that lenders have been relaxing some of the restrictions. While they may not need us to send as much information through for an application, they still require us to collect loads of information and do an assessment.

The responsible lending code requires us to ensure you can afford the loan for the entire term.

As the number of property transactions starts to heat up again, the banks are back to lead times of 5-10 days for processing, and they’re not processing applications over 90% unless you are an existing bank customer. However, banks are still fighting for their share of the business with cashback of up to 1% under certain conditions, but most are still floating around 0.8% of the loan amount.

Reserve Bank

The OCR is dropping; how low will it go?

In September, the US Federal Reserve dropped its rate by 0.5bps, which has excited many of the banks here as they have access to cheaper funding.

The economy is still limping, and the GDP growth stats were negative in the March quarter and marginally positive in the June quarter. Company liquidations are growing slowly, so businesses are still doing it tough out there.

Most economists expect the OCR to fall by at least 0.25bps on October 9th, and some are hopeful it will drop by 0.5.

Elise’s pick is a 0.25bps drop, while she would love to see a 0.5bps drop.

Insurance

Ask an expert for a solution before you opt to cancel your cover

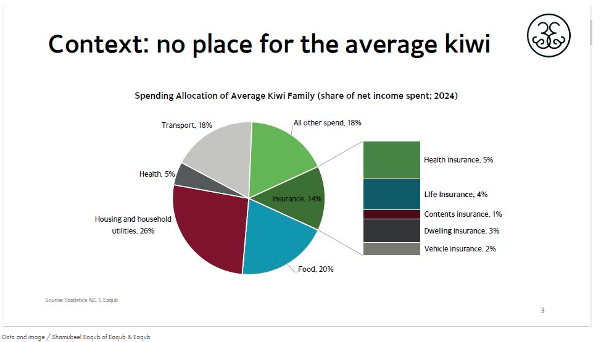

Economist Shamubeal Eaqub has been analysing household spending and found that the average Kiwi Family spends 14% on insurance.

He noted, “The life insurance market is shrinking with bill-payers stuck with recurring high needs.” General risk covers such as house, contents, and vehicle costs are rising along with all other expenses, and consumers feel they can do without life insurance if something has to go from the budget.

Before cancelling any of your insurance covers, review your complete picture with an expert adviser. Many options are available, including suspending your cover for up to 12 months and changing the configuration of your cover to be more affordable. Your needs change as you journey through life, which may mean you are overinsured. Contact Gordon Bell at gordon@bob.kiwi.nz or 022 503 9094 for a free insurance review.

Business

Do business owners need to be an expert at everything?

NO! Well, that is the short answer. The long answer is that there are not enough hours in the day for you to be an expert at everything, and if you are the smartest person on your team in every area of your business, then you are in trouble.

Here are the three things that you should be an expert at in your business:

- The business vision, purpose and why – if you don’t know these, no one else will.

- Your strengths and weaknesses – play to your strengths and outsource your weaknesses.

- Leadership – empower your team, both staff and contractors, to deliver your vision and serve your clients.

Many people spend more time procrastinating than getting things done when dealing with an area of weakness. If you outsource the areas where you lack confidence or capability or, more importantly, the things that you don’t enjoy, you will find that you have more time to spend on the areas of your business where you have passion, confidence, and capability. Those wasted hours will turn into productive time, which will result in higher income to overcome any outsourcing costs.

If you need help to get your business on the right track, Elise offers business mentoring. Contact Elise for more details.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team