Kia Ora!

In this newsletter:

Hot tip of the month – Make the most of your vote

Did you know – How long will you live?

First-home buyer tips – The property market is on the move – get in now

Property – Not a lot of choice – is it a good time to sell?

Investments – $4.2B worth of KiwiSaver funds have been withdrawn!!

Banks – Defaulting loans are on the rise; don’t get caught out

Reserve bank – Fiscal control is critical to get inflation in check

Hot tip of the month

Make the most of your vote

When voting this month (and make sure you do), you get two votes – an electorate vote and a party vote.

Your electorate vote is for the candidate that you think will best represent you in your local area. Your party vote is for the political party whose policies align best with your values and interests.

If you are unsure which party most closely reflects your views, check out https://votecompass.tvnz.co.nz/nz2023 and do the quiz. It will help you decide who to vote for. Go to a party’s website for detailed information on their policies.

Voting starts from October 2nd through to October 14th. Those overseas can vote remotely from September 27th. Visit www.vote.nz to find out more.

Did you know?

How long will you live?

Recently, Elise has been helping some clients answer those big questions: “When can I retire?” and “Will my funds last me through retirement?”.

The process involves several figures and some assumptions. The biggest assumption is the number of years you can expect to live. Death is, of course, typically unplanned, so it’s not like a date you can mark in the calendar. Stats.govt.nz have a cool tool to give you a starting point that you adjust up or down based on health factors.

https://www.stats.govt.nz/tools/how-long-will-i-live/

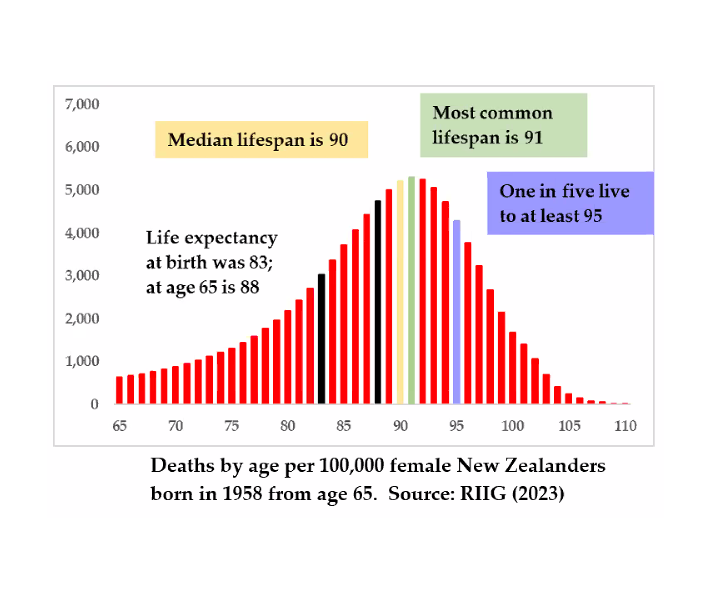

It’s certainly interesting! If your estimate seems long, check out this graph from the Retirement Income Interest Group (RIIG). One in five women will live to 95, and more are living to 105 and even 110.

First-home buyer tips

The property market is on the move – get in now

CoreLogic reports that we are at the bottom of the property cycle in many areas and that the property values in some areas are already starting to creep up. The banks can lend up to 85% of the property value or the sale and purchase price without breaking any rules with the Reserve Bank.

If you meet the servicing criteria, now is your best opportunity to get in before the prices quickly increase. Elise predicts the interest rates are going to continue at current levels or slightly higher for another 12 months.

If you are struggling with a deposit, talk to us about a Kāinga Ora Home Partnership Loan.

Thoughts from Elise

Mandy Noble has joined the team as our admin superstar, and I am very excited to be working with her. Mandy has extensive experience with customer service support and has worked as a bookkeeper and administrator for various trade businesses. I am sure many of you will get to know Mandy in the coming months.

Theo (the office cat) has given Mandy the tick of approval and is monitoring her progress while resting in the in tray.

Sarah and I have been planting a herb garden and have three new hens to go with our lonely one. We are still hunting for the eggs and are hoping to find some before Easter!!

I’m off to Wellington at the end of October for three days and then attending a conference on the 3rd of November. I’m looking forward to catching up with some of my Wellington clients. To book a consult, use the Calendly link or flick me an email and we will find a time to catch up.

At the end of November, I will be heading to Australia to visit my mum and bring her back to NZ for the first time since Feb 2020.

Credit Card Crisis? A Credit Card Balance Transfer May Be Your Answer

Whether you’re deciding on the structure of your 1st mortgage or your 10th, it’s worth thinking things through. It could save you from a mortgage unfit for purpose, costly restructuring fees and even thousands in interest over the long term.

5 Things to Think About When Structuring Your Mortgage

Whether you’re deciding on the structure of your 1st mortgage or your 10th, it’s worth thinking things through. It could save you from a mortgage unfit for purpose, costly restructuring fees and even thousands in interest over the long term.

Property

Not a lot of choice – is it a good time to sell?

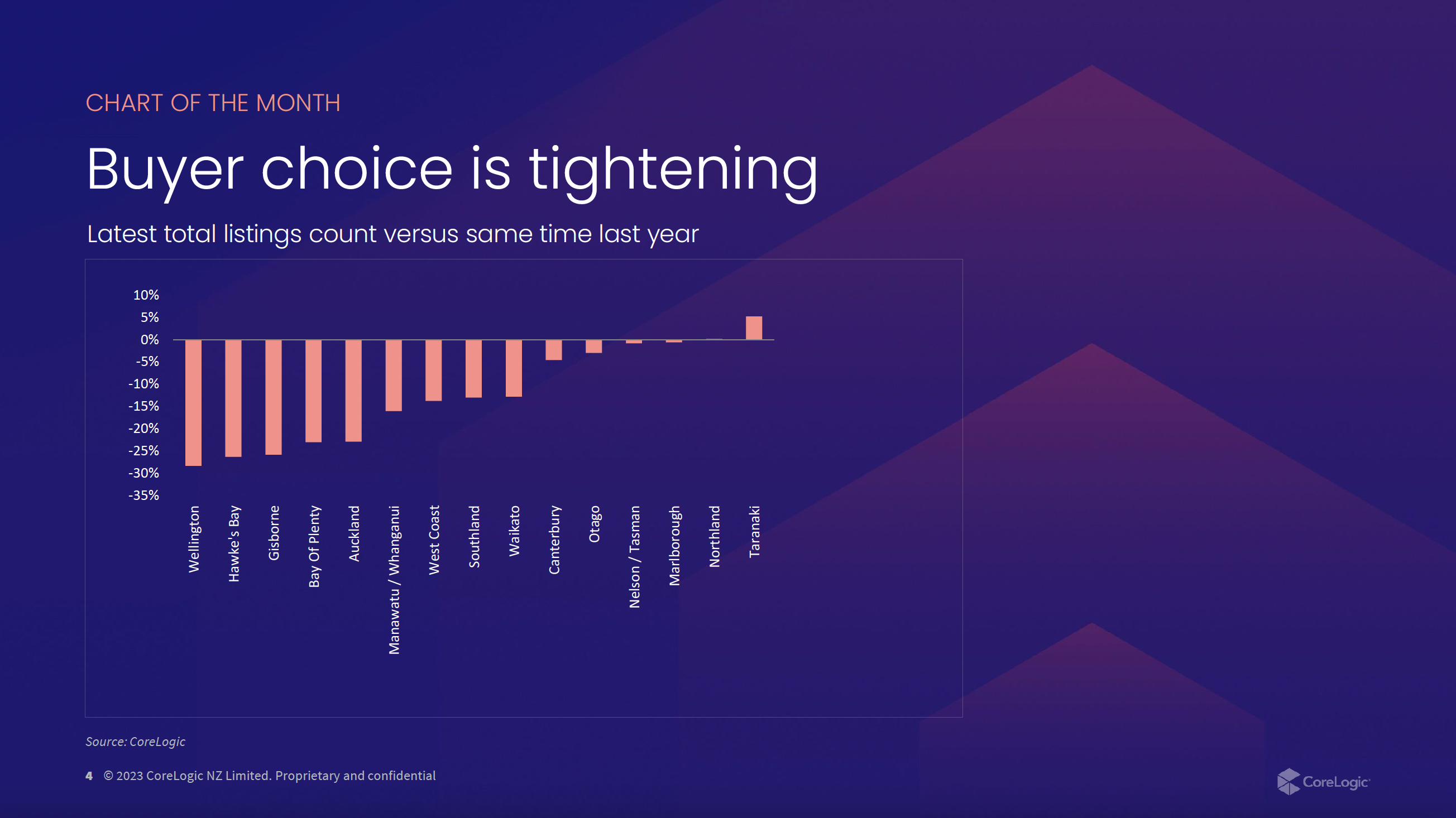

The number of properties listed on the market is down from last year. At the same time, buyers are coming back into the market. Any quality properties are being snapped up, and multi-offer situations are on the rise.

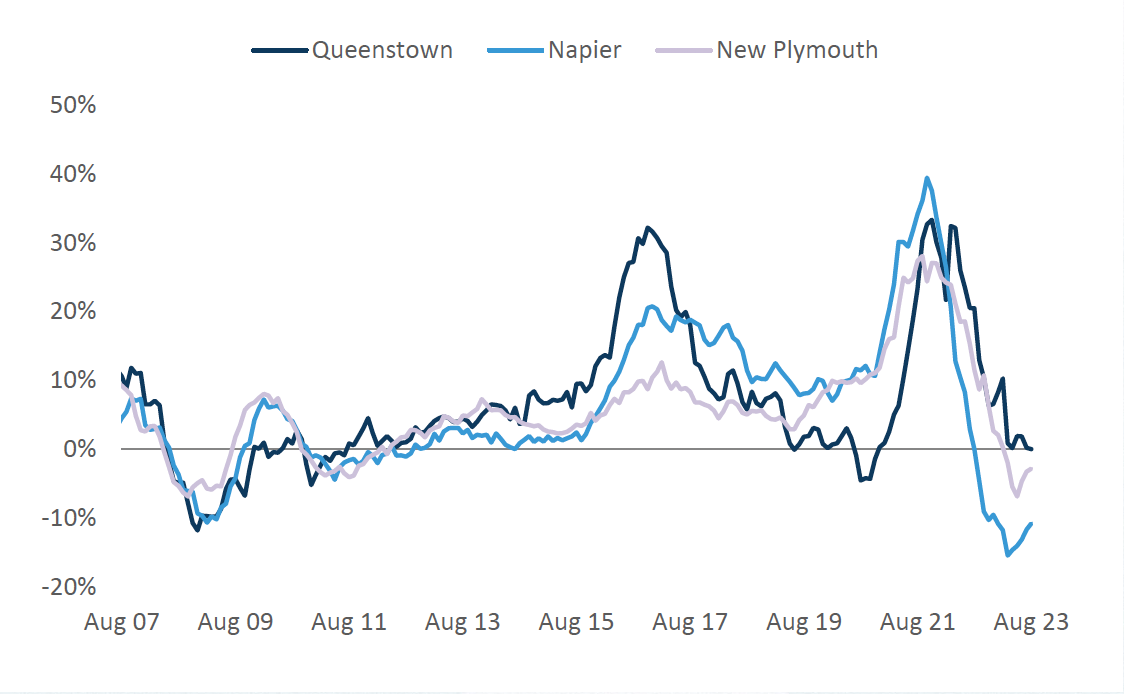

We are seeing signs that the property market is going up. Last month CoreLogic reported that the Wellington market was on the move and some of the regions are also showing signs of an upward trend.

If you’re thinking of selling your home, you need to consider the fact that there are not a lot of listings. If you sell and the property values go up before you find your new home, you may not be able to buy a property of the same standard for the same amount.

You are best to prepare your home for sale and then go hunting for what you want. Then when you find something to buy you can make an offer conditional on the sale of your existing home. Once your offer is accepted, you can go ahead with the sale of your house. Always seek legal advice as part of the offer process.

Investments

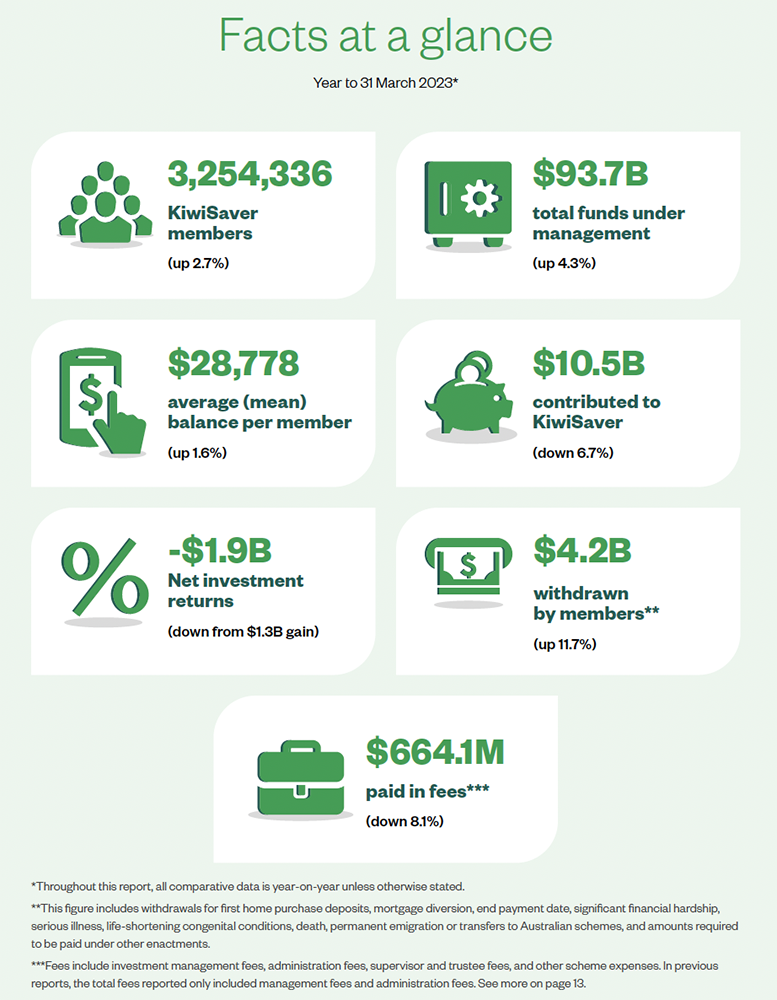

$4.2B worth of KiwiSaver funds have been withdrawn!!

KiwiSaver is primarily for your retirement, which means your funds are locked away until you are 65. You can sometimes get access earlier to buy your first home, or for undesirable reasons, such as having life-shortening congenital condition.

The Financial Markets Authority has just put out the KiwiSaver Annual Report 2023. It makes for some fascinating reading if you are a geek like Elise!

Some key things that Elise noted from the report were that the KiwiSaver fees deducted from KiwiSaver funds was down 8.1% on the previous year. This means that more of your money is working for you. Providers are getting more efficient, a trend that should continue as portfolio values grow.

The report states $4.2B was withdrawn from KiwiSaver in the year to 30 June 2023, up 11.7% on the previous year. The total is made up of:

- $2.8B of withdrawals from those over 65.

- $144.9M of financial hardship withdrawals. This number is up 36.7% and has reached the same level as when Covid hit. Financial hardship does not include being behind in payments. So, if you are finding yourself in need, call Elise or book a meeting as soon as possible.

- $925.6M of first-home buyer withdrawals, down 35.6%.

More members contributed to their KiwiSaver, but less overall was put into KiwiSaver, with contributions down 6.7%. While this is partly due to the larger number of people over 65, it’s also a sign of the tough financial conditions for many people out there. The lower contribution rate will have a long-term impact that won’t be felt until retirement.

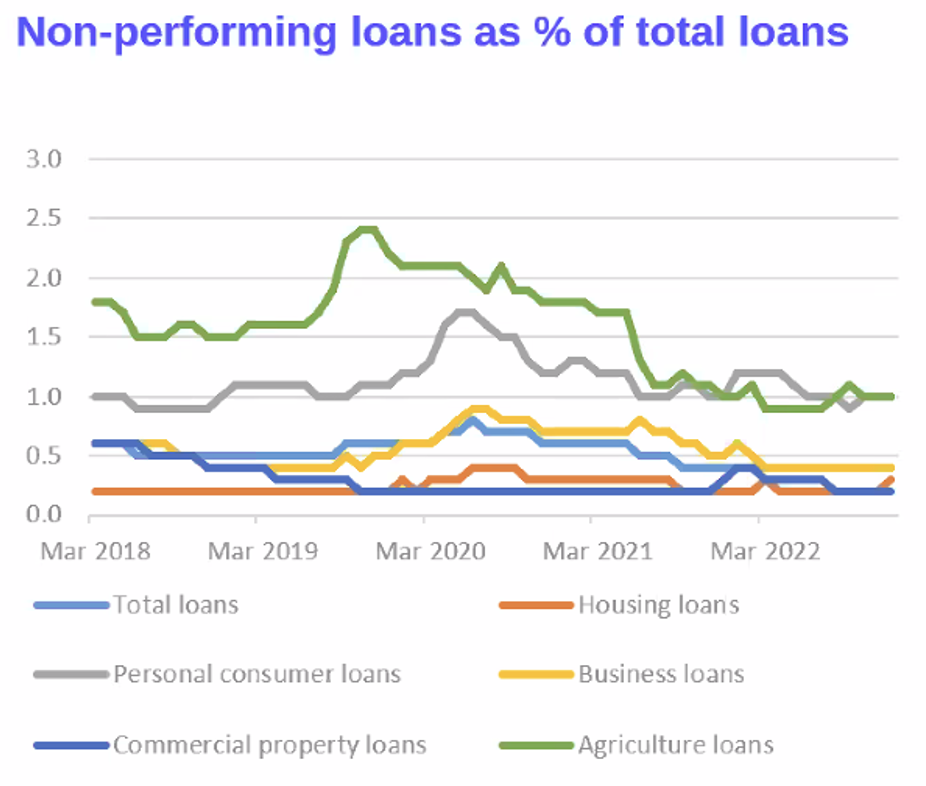

Banks

Defaulting loans are on the rise; don’t get caught out

As more loans come off the low fixed rates, the number of defaults is increasing. It is still a small percentage of loans, but proactive and early intervention is vital to protecting yourself from becoming a casualty. If financial pressure is making default possible, then call Elise ASAP before you default on a payment.

We have access to over 20 different lenders that can provide you with options and help you avoid a mortgagee sale. Recently, Elise has been working with several clients to help them proactively prepare their properties for sale and manage their payments.

The solution doesn’t always require refinance or sale, we have several different strategies to help ensure you go into Christmas this year in the best financial position.

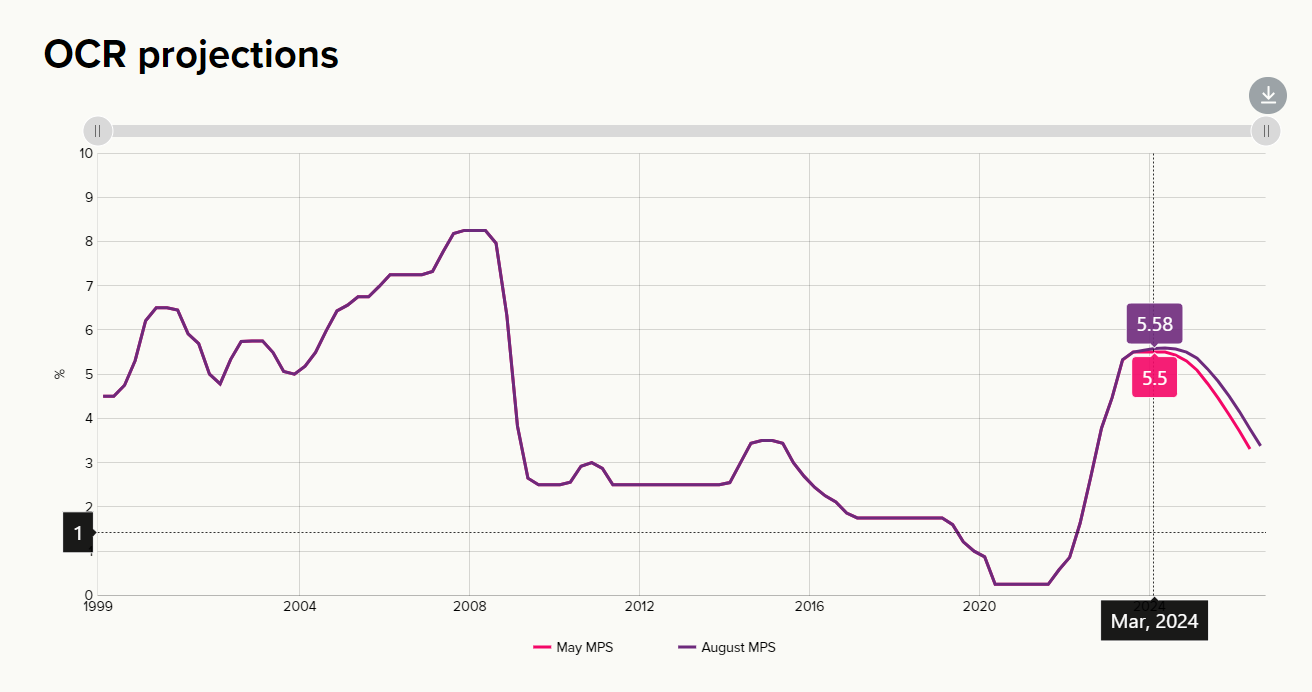

Reserve Bank

Fiscal control is critical to get inflation in check

The Reserve Bank indicated in May 2023 that they were intended to hold the OCR steady rather than seeking a further increase. So far, they have held true to their word. There is a rate review on the 4th of October and again on the 29th of November.

Elise suspects that the RBNZ may hold steady in the October review but will indicate that they will lift it in November. It’s a 50/50 call and the banks’ economists are finding it difficult to predict. As a result, the banks are continuing to put the rates up in anticipation of the OCR going up.

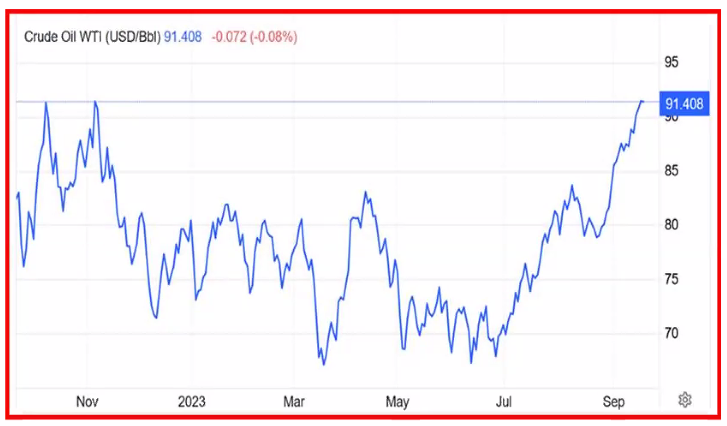

The cost of crude oil is continuing to go up, which is also affecting inflation; the cost at the pump is over $3 in some regions and creeping closer in others.

What will throw a spanner in the works are government policies that cannot be funded. Government revenue predictions are down from expected while government spending continues to be higher than expected. If we run our households like this, we get into trouble; the same can be expected for the government. Each party needs to verify the funding of their policies.

Business

Is your business a secret?

If you have a business, do people know what you do, and are you sharing your business story with everyone?

Here are 5 ideas to think about sharing your business.

- Put your business on Google Business and get your business address verified

- Get your clients to do a Google review of your business as part of your client process

- If you provide a professional service, join LinkedIn and make sure to take advantage of your About You profile

- Regularly share on social media

- Ask your clients for referrals.

No one will do business with you if they don’t know you are in business or how you can help them with your business services and products.

Insurance

Travel insurance may save you from bankruptcy

If you’re going overseas, DO NOT head away without travel insurance!

If something happens to you while you are away, you will need to get treatment overseas, as well as get back to Aotearoa. You may need someone to travel to you to help bring you home, and to have medical support in transit. Altogether it can be an extremely costly exercise, totalling hundreds of thousands of dollars. Don’t put a damper on your holiday by not having cover.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team