Kia Ora!

In this newsletter –

Hot tip of the month – Use Powerswitch and save money

Did you know – Your will is not registered

First-home buyer tips – Avoid catastrophes: get your own building report

Property – How affordable is it to own a home in NZ?

Investments – Will your term deposits and savings accounts keep up with inflation?

Banks – Why are they so picky??

Reserve bank – Another OCR drop is expected

Hot tip of the month

Use Powerswitch and save money

The power market is constantly changing, so it pays to regularly check what’s on offer to get the best deal. Powerswitch is an independent and free service brought to you by Consumer NZ to save you money!

Powerswitch’s calculator compares over 3,000 power plans from 16 providers, covering 98% of the market. They report that over 90% of people who use Powerswitch find they can save, with average savings of around $400 a year. So a switch could pay for Christmas!

In the example below, Powerswitch compares plans for a four-person household. These were the cheapest and most expensive power plans available:

Did you know?

Your will is not registered

In September, Elise participated in a discussion about Advanced Care Plans and estate planning. One of the questions asked was, “Is your will registered? ” The surprising answer is NO. So be clear with your next of kin regarding how to access your will. When you have completed your will, it does not need to be held by a lawyer, although this is a good idea as they have safe, fireproof storage for legal documents.

A will is vital to ensuring that your wishes are carried out after your death and saves untold confusion, stress and discord among those left behind. Talk to us if you need one, and we can arrange a simple will or connect you with someone who can assist.

First-home buyer tips

Avoid catastrophes: get your own building report

Once you own your home, you are solely responsible for its maintenance. While friends and family may come and give you advice, it’s uncommon for anyone to offer to pay! And as you’ve just bought your first home, you are unlikely to have much accessible equity in the property to get a top-up to cover any big maintenance surprises.

Of course, you know all this. But getting into your first home can feel like a game of musical chairs, where you’re tempted to grab a home in case you’re left out when the music stops. It pays to list out mandatory actions and parameters from the outset. This helps keep your decision-making in check when emotion and FOMO threaten to take over.

Engaging a building inspector is an excellent example of a mandatory action. The vendor may supply a building report to give you an idea of what maintenance is required and to talk about the state of the building. It is common for buyers to accept this report instead of paying for their own building inspection.

But taking that approach leaves you open to considerable risk. If the vendor’s property inspector has missed anything, you cannot take the inspector to task as you have not engaged them to do the report. Also, you do not know what the vendor briefed the inspector on. They may have indicated that they would immediately remedy something, so the inspector may have excluded it. Or the inspector may be a mate who does not do a full report.

By getting your own report, you can direct the building inspector to be thorough and hold them to account if they miss anything.

Thoughts from Elise

Sarah and I are building a shed to store all the tools and supplies I have used to work on the house and section for the last eight years. The joys of living in Lyttleton on a steep hill with only walk-on access mean that all the shed materials must come in by hand. Fortunately, we have had some help; moving over 6m2 of builders mix, and other materials is quite a job! I’m happy to share that we have the foundations complete. I love building and seeing the project progress.

There are 55 days until Christmas, and everything is ramping up as it does every year as people try to complete projects before they go on a break. For many, life has been stressful enough with job cuts and the high cost of living. Reach out for help if you need it; we can often provide support and options you did not know you had.

On the business front, I am super excited to introduce Rebecca Thompson-Looij to the team. Rebecca has taken over as Admin Superstar from Mandy, who has gone to work with her husband in their courier business. Mandy will be back in the new year as our accounts person. Meanwhile, we wish Mandy and Jeremy luck with the crazy Christmas courier months!

Rebecca has slotted easily into the team and business. While there is a lot to learn, she is quickly ticking off the training plan. Already, she is working with some clients and making a difference.

Rebecca has her Level 5 Investments Qualification and a real passion for finance and investments; she has a bright future with us. She is enjoying meeting clients and looking forward to supporting your financial goals. Feel free to drop her a welcome message at support@bob.kiwi.nz. I enjoy working with her, and I know you will, too.

Property

How affordable is it to own a home in NZ?

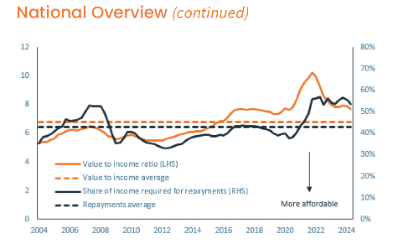

CoreLogic has released a housing affordability report for the quarter ending August 2024. It shows minor improvements across all the measures. However, affordability remains an issue, so the recent interest rate reduction is a welcome relief for many households.

Key takeaways from the report:

- Value to income across NZ is now at 7.7, down from the peak of 10.2 in late 2021.

- The average time spent saving for a deposit is 10.2 years, down from 13.4 years in 2021.

- The average mortgage payment as a percentage of income is 54%, down a little from the worst reading of 57% in Q2 of 2022. The actual payment average for a household is 43%, which means that some households are struggling to make payments.

Investments

Will your term deposits and savings accounts keep up with inflation?

Interest rates for lending are decreasing, as are the returns for term deposits and savings accounts.

While stable, term deposits and traditional savings accounts often struggle to keep up with inflation when rates drop, potentially eroding the actual value of your money over time. As we return to a low-interest-rate environment, many savers face the challenge of maintaining their purchasing power.

In other words, the challenge is whether the returns on today’s money will enable you to purchase the same value of items in the future. To safeguard your savings, consider options like inflation-linked bonds or high-interest savings accounts that offer slightly better returns. Diversifying into low-risk investments might also provide a cushion against rising prices, allowing your funds to grow or, at minimum, retain their value despite inflation.

Talk to us about low-risk investments that provide some level of inflation protection.

Banks

Why are they so picky??

Interest rates are going down, and the banks are starting to compete more for business. However, they are being very picky about what they accept as security for a mortgage.

Banks set strict criteria for properties used as security for mortgages. Beyond just valuing the property, they assess factors like location, property type, and marketability.

Mortgage security is important to banks because they need to know that if something goes wrong, they can sell the assets used to secure the loan to recoup their money. For first-home buyers, lenders want to know that the purchasers can afford the mortgage and property maintenance (which helps the property retain its value). This is especially of concern to lenders in a dropping market.

Properties in high-demand, stable areas are often preferred as they retain value better and give the bank more certainty that there will be a market to buy the property should the owners default on their mortgage. Unique properties, like apartments under a certain size or leasehold properties, may face closer scrutiny or even be ineligible. For buyers, knowing what types of properties banks prefer can make the mortgage approval process smoother and avoid unexpected hurdles.

Lenders are also wary of lending for uninsured or underinsured properties. Make sure that the property has full insurance and no exclusions. If there are exclusions, they need to know you have the funds and a plan to rectify any issues.

Reserve Bank

Another OCR drop is expected

The next review is on 27 November, and most banks are picking a further 0.5% basis drop, although the Reserve Bank Governor suggested that this is still contingent on inflation continuing to go down and stabilising. Unemployment is increasing, and the number of companies going into liquidation is growing. Some households may have a bit more cash in their pocket after the tax cuts and as fixed and floating rates come down for homeowners.

Construction costs are starting to come down, but the time to build is still too long, putting pressure on the pipeline. Meanwhile, rates and insurance are continuing to climb.

If you are a homeowner, Elise can help you take advantage of the dropping interest rates. And if you are struggling with the cost of insurance, our insurance adviser, Gordon Bell, can help you to review your personal risk covers such as life, disability and critical illness. We also have partners that we work with for reviewing your general risk insurance such as house, contents, landlord and business covers.

Insurance

When are you most likely to need insurance?

This is a tricky question because insurance is about protecting you from the unexpected! However, we know that you are more susceptible to health conditions as you get older. And since the COVID-19 pandemic, the rate of side-effect conditions has increased, even among the young.

The sooner you get cover, the fewer loadings on/exclusions of conditions you’ll have. That means you can get better cover for longer.

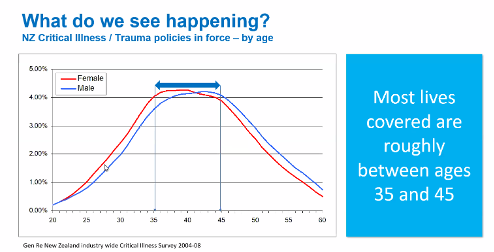

One of the providers that we work with, Asteron, has done some research. The following graphs highlight that people aren’t covered for Critical Illness (Trauma) when they are most likely to need it. While the data is from 2004-2008, the statistics have only increased.

In New Zealand, the number of people with Critical Illness (Trauma) cover is relatively small, and we can see that most people who have cover have it between the ages of 35-45.

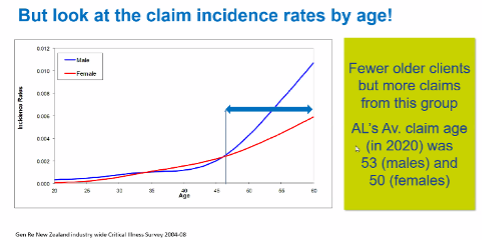

Many people cancel the cover after 45, but we can see from the graph below that the number of claims accelerates from the age of 50.

From 45 on, the cost of the cover can be prohibitive to retain the cover if the cover has not been set up using the level premium option. Levelling your cover is a smart way to enable the cost of the cover to be levelled so that it is affordable for the lifetime that you need it!! We can level your cover without needing underwriting. The change can save you $100,000’s and provide protection when you need it.

We don’t want you to be one of those who cancel their policy and then need to make a claim just months after the cancellation. If you’re reconsidering your insurance, contact Gordon Bell at gordon@bob.kiwi.nz or 022 503 9094 for a free insurance review.

Business

Elise shares the value of outside perspective

I am a business owner, and I walk my talk. I have a business coach, a business vision, and a plan. I sometimes struggle to follow the plan, but I always return to the vision and work the plan. My business mentor keeps me on task and provides a sounding board when I lose focus or become distracted, as we all do occasionally. We are all human!

I am part of some fantastic groups, and one of them recently provided a half-day business planning focus day. The focus was on everything I had included in our newsletter last month—lucky!

So, having written about it in last month’s newsletter, I had already reviewed my business’ vision, purpose and why. I was clear on my strengths and weaknesses. In the session, I was challenged on why I was still spending time on areas I could outsource to my team so that I could focus more on my strengths that deliver value to you, my clients.

Just as writers need someone else to edit their work, business owners need outside perspectives to optimise their business. You don’t need to go it alone, and there are many ways to get support, including belonging to networking and other groups.

I offer business mentoring for when you need help getting your business on the right track. Contact me for more details.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team