Kia Ora!

In this newsletter we are going to talk about:

Elise has been making progress on her Investment Strand training and is working on the second assignment. On the home front, Sarah and Elise are starting to do some more work on the ‘munta to minta’ project. Completing some drainage is on the task list for November.

The Spring Challenge team, sponsored by Building on Basics, had an awesome event on 1 October. The team set off from the Te Anau foreshore at daybreak, crossing the finish line 13.5 hours later. They tested their resilience and determination by biking, rafting, tramping, running, kayaking, and bush-bashing through the breath-taking Fiordland wilderness. A fantastic effort by a team of three inspiring women.

Building on Basics’ 4 Step Process to Help You Manage Your Debt

Having personal debt can take a big toll on you, emotionally as well as financially. If the debt is due to overspending or mismanagement of finances, you may feel embarrassed or guilty. If the debts are large, you may feel overwhelmed. These feelings can be paralysing and result in avoiding the issue altogether, which can cause a spiralling down of circumstance.

Is 3% KiwiSaver Contribution Enough to Fund Your Retirement?

A question we get a lot is whether 3% KiwiSaver contribution is enough to fund retirement. Given the option of contributing between 3% and 10% of your salary to your KiwiSaver fund, it can be tempting to opt for the 3% so you have more cash in hand when your pay comes in.

Property

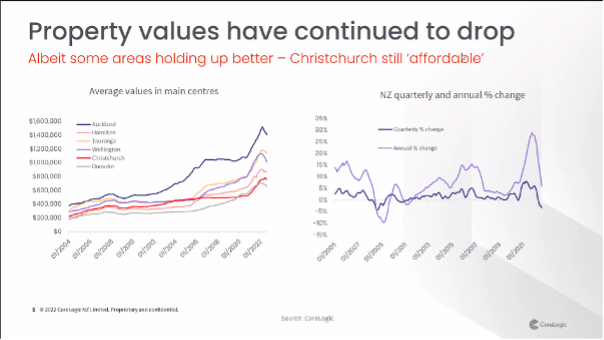

Spring has truly sprung, and more properties are coming on the market. That is not to say that they are all selling. In some regions the property values are still falling.

Some owners who have put their properties on the market are finding that they are not selling and so are turning them into investment properties. If you find yourself in this situation, seek advice from an accountant as the tax rules have changed significantly on the interest deductions.

While values are falling, there is no need to panic. Many predict that this is just the market correcting itself after the sky-high rise in values seen in the previous two years. CoreLogic reported earlier in the month that Kelvin Davidson, their NZ Chief Property Economist, said “Despite further falls in property values seeming likely in the coming months, there is a sense that the ‘mood on the ground’ has started to shift which could help sow the seeds of a floor for property values as soon as next year.”

Local government property rates were revised in July, with new rates applied from August. Please make certain that you have adjusted any automatic payments to reflect your new rates. If you find yourself with rates in arrears, get in touch with us asap. If your lender finds out you’re in rates arrears they may start the process to recall any lending.

KiwiSaver

Current market trends may be leaving you wondering if you need to change to a more conservative fund. But if you have more than 10 years before you need to access your KiwiSaver funds, then (depending on your risk profile) your funds will best serve you by remaining in a growth fund*. With the stock markets vulnerable over the last few months and likely to continue so for the coming year ahead, you’ll have seen your fund balances reduce in value, even though you’re still contributing. This can feel distressing! Here is the good news: For every $ you put into your KiwiSaver, you are getting more units in the growth fund at a cheaper rate. When the unit rates start to go back up you will own more units and so your portfolio will grow in value faster.

Stay the course and if you have questions, please talk to us.

*This is not specific advice, it is general strategy, talk to us if you wish to review your portfolio risk profile and investment funds

Banks

Interest rates have gone up, and with inflation being sticky at 7.2% we can expect the rates to continue to go up.

The rates that we are seeing now are the rates that Elise would consider “a normal average” over the long term. For those that have bought in the last 5 years the rates will feel high! Elise’s first mortgage was at a rate of 14.9% and she remembers a time her parents were paying over 21% on their home loan. Don’t worry, she doesn’t see standard rates reaching those levels! Her prediction is that we could see the rates get as high as 8-9% which is less than the height of the GFC (Global Financial Crisis) in 2008. The war in the Ukraine and the global energy and work shortage will continue to affect the rates and are factors that we cannot control.

Seek help well before you need financial support, remember Building on Basics operates with no judgement. There are several factors that are outside of your control that you need to battle, we can help.

Reserve Bank

The OCR is at 3.5%, with the next review due on 23 November. Good Returns reported in mid-October that “Westpac economists Michael Gordon and Satish Ranchhod predicted the Official Cash Rate to now peak at 5%, significantly higher than their previous forecasts of 4.5%… the pair are forecasting a 75-point hike in the OCR in November, an increase which is an outlier in recent history.”

Business

We’ve added this section to the newsletter as Elise works with many business owners on optimising their businesses.

Let’s start with an understanding of what a business is:

“A business is a cash machine,” says Loral Langemeier, Live Out Loud, a mentor of Elise’s.

This means that if it is not making money then it is a hobby, or a business that needs some help and direction. Marketing, accounting and delivering products or services are the main things that small business owners think about. But there is so much more to being in business.

Building on Basics offers a business audit to help you identify the areas you need to focus on.

Insurance

Insurance is risk management. We transfer the risk to the insurance company, so they have financial responsibility if something happens. We pay an insurance premium for them to cover this risk.

But the Kiwi attitude of “It will never happen to me; accidents happen to others” has led NZ to having one of the most under insured populations globally. Insurance is “just a cost” …until you need to call on the insurance to cover an event.

To try and correct this lack of cover, the government has proposed a scheme for another deduction from your wages for employment insurance. Check out the Good Returns’ article on the topic.

Elise’s view is that if you are being forced to have an insurance deduction coming from your wages, then you should be able to choose the insurance cover you get and make sure that it best suits your needs. And if you already have insurance then you should be exempt from the added deduction.

Elise believes this policy is being rushed into legislation and is going to have more issues than the CCCFA. The negative consequences for household finances would come at a time when many are already struggling with inflation and high interest rates.

Hot tip of the month

Run your credit report before you need to borrow money.

Whenever you apply to borrow money, the lender will check your credit report. They are checking to see if you have been making payments on any registered loans on time, and that you have no debt judgements or outstanding debts that have been sent to debt collection.

When you run your credit report, you may find that an account that you thought was closed is still open or find other anomalies that need correcting. Recently Elise worked with a client that had just sorted out a bunch of debt and in the 3 months between us sorting out some debts and improving their situation, Sky had lodged a debt collection. Yet she had received NO communication from them, and her phone number and email were all still valid with Sky. So, through no fault of the client, Sky had damaged her credit rating!! It is a simple fix but will sit on her credit report for the next 3-5 years.

Run your report for free here. If you need help to interpret the report, get in touch with us.

Did you know?

The minimum 3% employee contribution may not be enough for a comfortable retirement, check out our blog for more information.

If you’re self-employed and just contributing the minimum $1,042.86 each year to get the government contribution, this is not going to be enough to retire on. There are other options for investing your 3% or preferably more towards your retirement, which allow you access to the funds prior to 65 if you wish to retire earlier – get in touch for more information.

First Home Buyer Tips

If you have belonged to KiwiSaver for 3 years you can withdraw all but $1,000 of your KiwiSaver towards your first home deposit.

Note: There are some circumstances where you can withdraw your KiwiSaver to buy a home even if you have owned a home previously. Conditions include not having used your KiwiSaver previously and not currently owning any land or property.

If you haven’t already joined KiwiSaver, get in touch with us to get you joined today! The sooner you start your KiwiSaver contributions, the sooner you become eligible to withdraw the funds towards your deposit.

We are always available for a chat about your situation.

Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team