Kia Ora!

In this newsletter:

Hot tip of the month – Check your credit report; any inaccuracies could cost you!

Did you know – Your bank probably doesn’t really love you…. who knew?

First-home buyer tips – Now is as “good as it gets”. Seriously!

Property – Is the decline in house prices overhyped?

KiwiSaver – Should you buy more quality stuff when it is on sale? We think so

Banks – Common sense coming back to lending… it is easing

Reserve bank – The recent OCR hike is likely to burn a hole in your pocket

Insurance – Costs are on the up… let’s get ahead of it before it gets ahead of you

Hot tip of the month

Check your credit report; any inaccuracies could cost you!

If you’re considering getting a loan of any type, you should check your credit report. Your credit rating is a significant factor in determining whether you can get a loan and the terms of that loan. You can access your credit report for free from either of the two primary credit reporting agencies, Centrix and Equifax.

The report will show your credit history for the last 36 months. It will identify any open credit facilities, such as loans, credit cards, overdrafts and buy now, pay later facilities, along with facilities that have been closed over the last 36 months It may also include power and phone accounts.

It’s up to you to ensure the data is correct; accounts you thought you had closed may not be, and you could have accrued fees and penalties. We can assist with getting these cleared.

Did you know?

Your main bank is the one where your primary income gets deposited. But you don’t need to get your home loan at that bank. By approaching your main bank directly, you limit your options which could cost you thousands of dollars in the short term or add years to your loan, which will cost you in the long term. We have a view of multiple banks and lenders and will match your needs with the best lender to suit your needs.

First-home buyer tips

Now is “as good as it gets”. Seriously!

With a dip in property prices and sellers struggling to find buyers, now is the time to enter the market! Property values may or may not drop further over the next twelve months, but that doesn’t matter if you intend to live in the property for more than a year! Waiting for a more perfect time, may see you never purchasing.

Be clear on what you’re looking to purchase and talk to us about pre-approvals. The Reserve Bank is relaxing the LVR rules, which will give you more access to funds if you have a small deposit.

If you need help finding a home, let us know; we have teams of people keen to help you find your next home.

Thoughts from Elise

I recently discussed financial well-being with the folks at Trade Aid in Christchurch. There were some great conversations and questions, and I’m told there has been much discussion among the staff post the session. It’s so rewarding to get people talking and to let them know the support that is out there. I’m happy to chat with other groups; get in touch and we can set something up!

The news of inflation coming down to 6.7% is a good starting point. However, it is still way too high, and the ongoing pressure on the limited food supply, damage from weather events, and the shortage of workers continue to impact families, communities, and the economy.

On the home front, I’ve been busy in Australia supporting my mum’s recovery from an accident. Now back home, I continue to do this from afar. We had a lot of fun celebrating Sarah’s mum’s 89th birthday with family at Isolation Bay, Lake Tekapo. There were fifteen in the group, with ages spanning from 2-92!

What documentation do I have to complete to get a mortgage in New Zealand?

We know that mortgage documentation sounds like a dry topic! But knowing in advance the admin you may need to do to get a mortgage can reduce anxiety and make you feel more in control.

Is Health Insurance Worth It?

Your health is the most important asset you will ever own. It determines whether you can work and is a massive factor in your lifestyle and relationships. This being so, it’s worth protecting as much as you can.

Property

CoreLogic reported the lowest number of sales since 1981 for the month of February. This tells us that that the market is slow. House values throughout New Zealand are for the main part still above pre-covid values; this is only important if you are selling or seeking to access the equity in your property.

CoreLogic’s Kelvin Davidson is attributing the slow down to tighter lending rules and higher interest rates. Cash buyers are still sitting on the side lines as they are expecting further price drops as more investors seek to put their properties on the market in the coming 6-12 months. The up-coming election has some property players waiting to hear what is going to happen with the property investment tax rules.

In the property investment space, rents are continuing upwards in most areas and the availability of quality affordable rental properties is still an issue for tenants.

If your property has dropped in value since you purchased it and your debt level is now over the 80% LVR threshold you may find that you are not eligible for special rates, but this is only important if you have loan accounts coming off fixed terms.

New Zealanders have a long-standing love affair with property. Despite the continuing downward trend across most of Aotearoa, the values are still above pre-COVID-19 pricing, and it’s positive to see that some people previously priced out of the market can now buy their own homes. Even with the downward trend of prices, now is still a good time to buy if you intend to keep a property for the medium to long term.

KiwiSaver

Should you buy more quality stuff when it is on sale? We think so

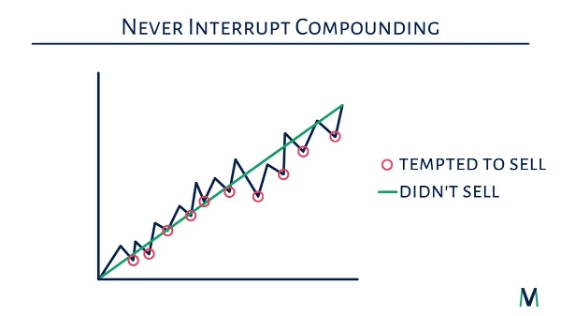

Many Kiwis are commenting that they do not like KiwiSaver at present because the markets are down and their KiwiSaver funds are going backwards, despite them putting money in regularly.

But KiwiSaver is a long-term investment, and unless you need to access your funds in the next five years, there is no need for concern over the current numbers. When the funds’ unit values are down, you can buy more units cheaply, so when the markets recover (as they always have), your funds will grow faster as you own more units.

The government superannuation’s increasing burden on the taxpayer in an aging population is an ongoing issue. Interestingly, recent research from Otago University found that a majority of Kiwis see raising the retirement age as the worst solution. You can read more about the study here.

Banks

Common sense coming back to lending… it is easing

The Reserve Bank has announced changes to the LVR rules from 1 June 2023. This will allow lenders to provide more funding at the higher LVR rates, assisting primarily first-home buyers and investors.

Banks need to meet a certain level of capital (cash in the bank) to support the lending they offer. To help manage the banks’ risk, the Reserve Bank limits high-risk lending by setting LVR restrictions and the percentage of business that a lender can have at the high LVR levels. The announcement from the Reserve Bank has increased by around 5% all the LVR restrictions, which is great news for first-home buyers and investors, as there will be more opportunities for borrowers to access funds.

Specifically, lenders will be able to have up to 15% of their mortgage balance sheet available for loans above 80% LVR for owner occupiers. The current limit is 10% of total loaned funds The borrowers will still need to meet the servicing criteria.

In more good news, some common sense has been applied to the CCCFA rules! Some discretionary spending items are now explicitly excluded from the testing criteria. This gives the lenders some flexibility to approve applications where it is evident that the prospective borrowers can afford the debt.

If you’ve been putting off applying for a mortgage out of dread of all the red tape, now’s the time to take action and get in touch with us.

Reserve Bank

The recent OCR hike is likely to burn a hole in your pocket

The Reserve Bank stunned us all by increasing the OCR by 0.5 instead of 0.25, bringing it to 5.25%. This will help our exporters but has increased the short-term interest rates for lending.

The March report from Centrix reported 430,000 people were in arrears with their debts, an increase of 20,000 since December 2022. We can expect this number to grow as more mortgages come off the super-low rates of previous years.

As well as affecting interest rates, you’re likely to see your food bills increase and shopping trips cost more due to the OCR hike.

The next OCR review date is 24 May. Elise predicts that the rate may go up a further 0.25 to try and continue to support the exporters.

Business

Know your “why”!

Previously we talked about revenue streams and the importance of income targets. Now you need a plan to attract the clients and deliver the income.

Be clear on your Business Why and how it relates to your customers’ “What’s In It For Me?” (WIIFM). Why you? Why your business? Why your products or services? If you’re not clear on these things, there’s a good chance that your clients aren’t either.

Simon Sinek is the master of the why. Check out his Ted Talk and get your planning underway.

Insurance

Costs are on the up… let’s get ahead of it before it gets ahead of you

Insurance is a transference of risk. The sad and bad news is that it will only get more expensive with the increased and increasing risk of climate events. New Zealand is part of the Asia Pacific, and our costs are affected by events in the region as well as on our shores.

The commentary within the insurance industry is that we can expect increased premiums of around 30% over the coming year.

The scary thing is that I am hearing people talk about letting covers go due to affordability. Let’s chat if that is where you are heading! I recently listened to a news story on the radio about a business that was affected by the cyclone. They had just let their business cover lapse due to affordability. Now they have no cover to see them through their crisis.

Financial management is a juggling act, but you don’t have to find the answers on your own; talk to us!

We are always available for a chat about your situation.

Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team