Kia Ora!

Thoughts from Elise

The optimistic start to the year seems to have been blown out of the water. Coming straight after catastrophic flooding in the upper North Island, Cyclone Gabrielle blasted through the North Island and left behind the heartbreak of lost loved ones, homes, livelihoods and possessions. It has been hard to watch, it’s unimaginable how it feels for those directly affected.

Cyclone Gabrielle has and will impact us all. The food chain has been affected, and resources must be diverted to the affected areas to restore services and commence the rebuilds. As a nation, we are confronting the brutal reality of climate change.

But, alongside the stories of tragedy and concerns about the future, there are all the stories of communities helping each other. Many Kiwis have donated money, items, accommodation and labour. I’m reminded and proud of the resilience and proactive kindness we have in the people of Aotearoa. It is this spirit that will not only get the hard mahi done to repair and rebuild but hopefully drive the changes we need to make for the future. Kia kaha Aotearoa.

Don’t forget it’s Census Day on 7 March. You don’t need to wait; you can complete your form online now at https://online.census.govt.nz/. The census helps governments understand where funding is needed most in our health and education systems, as well as plan for and fund growth in other areas. Completing the census is for the benefit of our families and our people.

On the home front, I’ve been making great progress on my drainage; this feels more necessary than ever given recent events. I plan to take a week off and head to Brisbane in the last week of March. Meanwhile, Sarah is off to Alaska for a snow dog sled adventure.

In this newsletter we are going to talk about:

How Can I Reduce My Credit Card Debt?

If you’re struggling to reduce your credit card debt, you’re not alone. There are so many Kiwis out there with high credit limits that are maxed out every month.

How Do I Refinance My Mortgage?

Mortgage refinance is just another name for moving your mortgage to a different lender. Not to be confused with a restructure, which is just changing the structure of your mortgage with your current lender.

Property

Property prices continue to drop and the cash buyers are still on the sidelines, waiting for the market to flatten so they can come in and clean up. Property investors are now due to pay tax on rental income with the ability to claim on the interest costs reduced. This extra expense has some mum and dad investors putting their rental homes on the market.

KiwiSaver

The IRD has been sending letters to those they think are on the wrong PIR rate. If you receive a letter, please check in with us; we know of several people who were incorrectly advised to reduce their PIR rate.

It’s that time of year when companies listed on the stock exchange release their results, and there’s been some good news. The good results will help lift your KiwiSaver balances, though we still expect some market volatility. Now is still an excellent time to get some cheap units in your KiwiSaver to increase your returns as the market adjusts.

Banks

The government has relaxed the Credit Contracts and Consumer Finance Act (CCCFA) rules to enable lenders to provide short-term relief in the form of overdraft facilities for those that have been affected by recent severe weather. Many of the banks have also pledged donations to support the affected.

The banks are beginning to compete for mortgage clients, with BNZ offering a 1-year rate of 4.99% if accessed through a broker. Although this did not come with cashback to cover break fees or legal costs, it forced several banks to reduce refix interest rates. Westpac briefly offered lending over 80% LVR.

We saw some of the long-term 3-5yr rates coming down in anticipation of the rates peaking in June 2023 and we expect competition in this space to continue. The flood and storm-hit hit regions are wild cards; their impact on mortgage rates isn’t yet known.

Business lending through the banks is tight; we have several alternate solutions if you need finance for equipment or working capital.

Reserve Bank

The Official Cash Rate (OCR) was lifted to 4.75%, with the next review due on 5 April 2023. All lenders had already factored in the expected increase before Christmas.

Economists are picking that the OCR will be back down close to 3% by September next year implying there will be a swift shift down.

While indicators are that inflation will come down, don’t expect your grocery bill to reduce. The recent floods affected some of our highest food-producing regions. Whole crops were lost, and many will take time to replant and mature. This will hit our pockets in the medium term.

The Reserve Bank has done what it can to manage and influence inflation. The rest is up to government policy and us!

Business

Last month we talked about making sure that you get paid by having terms of trade in place. This month we’re looking at breaking even. Your break-even number is the amount of income that you need to generate and bring in each month to cover your basic outgoings.

Remember to include your income (including income tax) when calculating your minimum outgoings. Factor in regular, annual and irregular expenses. If you use work vehicles, include vehicle servicing costs and replacement tyres.

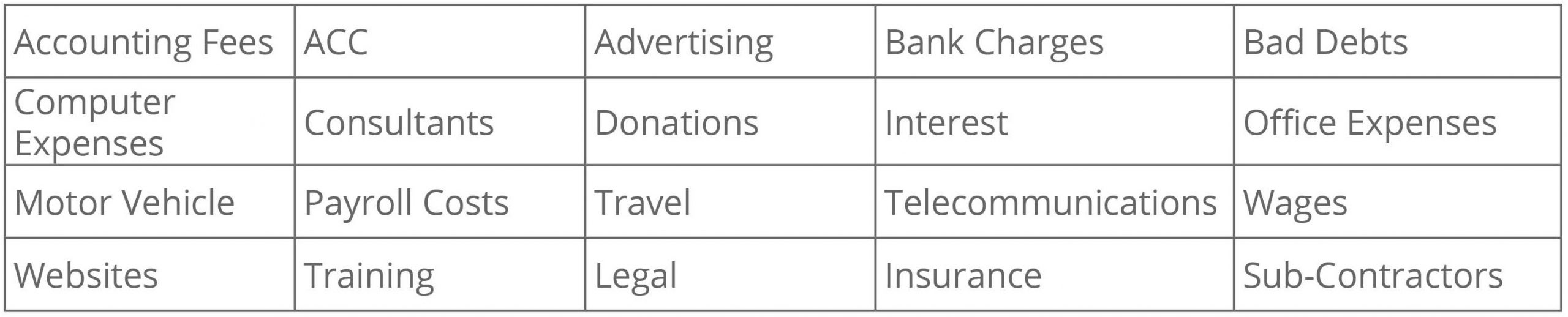

Typical costs can include:

Your base costs should drive your income targets. Next month we will talk about things to consider with income targets.

Insurance

Given recent flood and cyclone damage, talking about general risk insurance is timely. When you get house or car insurance, you transfer your financial risk to the insurance company. In exchange for the transfer of risk, you pay the insurance company a policy fee.

Be aware that if your car insurance only has 3rd party cover, you’re insured for the damage you may do to other people’s cars. You’re not insured for damage to your vehicle.

Property insurance cost is dependent on the value of the property and the risk of an event occurring at the property.

Risk factors include:

- Trees over 2m situated close to the property

- Flood-prone area

- Retaining walls

- Situated near the edge of/under a hill,

Check your policy to make sure that it has no exclusions for repeated events such as flooding or land subsidence.

Insurance companies need to make profits to ensure that they can pay out when we need them. To do this, they need to price the risk appropriately and then manage it. One necessary risk management strategy is to not insure properties or situations that are 100% likely to happen. Places like Esk Valley are likely to find insurance becomes unaffordable or impossible.

The inability to get insurance will be a significant part of the managed retreat conversation as we adapt to climate change. This is a complex and emotional issue as our connection to our whenua runs deep.

Hot tip of the month

Civil Defence is unsurprisingly top of mind. If you’re not already prepared, now is the time to put together an emergency go-bag. Pack clothes for a couple of nights, sensible shoes, passports and copies of important documents, and some cash. Emergency blankets, disposable rain jackets, heavy-duty work gloves and water bottles are good additions but remember you’ll need to be able to carry the bag easily. Keep the bag somewhere accessible – i.e. not up high in the back corner of a packed shed!

Include copies of your insurance policies so that the information is handy should you need to make a claim. You may not have access to online files, and relying on your memory at a stressful time will only exacerbate the strain. Hopefully, you are working with an insurance adviser, in which case all you need is your adviser’s contact details.

Did you know?

Government valuations or quotable values (QVs) are used by the local government to in part generate property rates. QVs are updated every three years and are worked out by a complicated formula that includes any permits issued for the property, the completion of permits, and recent sales of similar properties in the vicinity.

The higher your property valuation, the more you pay in rates. If you feel your valuation is incorrectly high, you can challenge it with the council. However, keep in mind that in the event of a disaster, the QV may be used to determine the amount of government compensation unless you have an independent registered valuation.

First Home Buyer Tips

Lenders require a minimum of 5% for your first home deposit. You can use your KiwiSaver, gifts (i.e you’re not required to repay the money) and savings. The lenders like to see that you’re saving some surplus funds. This is tricky; it’s your money and you deserve to be able to use it however you like!

You may feel now’s the time to use spare funds to live it up prior to being tied down with a mortgage, rates and property insurance. But despite what you may think, owning a home is not a lifestyle death sentence. It opens doors to other opportunities, and there is so much enjoyment to be had in your own home.

Three benefits of saving more than the minimum are:

- funds for pre-purchase due diligence

- proof to the lender that you’re good with money and therefore a low risk customer

- a larger deposit, which means you can borrow less or afford to purchase something more expensive.

Work out how much you will be paying in future living costs in your own home versus now, remember to include rates and insurance costs. Once you know the numbers, start saving the difference. This will both establish good homeowning spending habits and grow your savings, as well as give you an idea of what your budget will be as a property owner.

We are always available for a chat about your situation.

Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team