Kia Ora!

In this newsletter:

Hot tip of the month – What the banks don’t tell you about their products

Did you know –What happens if you can’t afford your loan payments…

First-home buyer tips – Banks have funds for you – get in there!

Property – Are we there yet? The race to the bottom has slowed

KiwiSaver –Get your free money!

Banks – The banks are in the mood to spend, are you in a position to benefit?

Hot tip of the month

Lending structures – What the banks don’t tell you about their products

We’ve recently had several new clients that have all been working directly with their bank. The bank that they are with is the best choice for them based on their spending and saving habits. The only problem is that the lending products that the bank has recommended IS NOT the best option for the client.

Fortunately, these clients came to Elise for a review rather than just refixing their loans online through their internet access. At no cost to the client, we changed the loan products and their loan structure, taking months off the term of their loans. In all cases, the bank did mention the product ultimately recommended by Elise, but they didn’t explain it, leaving the clients leaning towards sticking with the status quo. These are just some recent instances of how dealing directly with a bank can cost you!

Did you know?

It is tough out there – what happens if you can’t afford your loans

Interest rates have been going up, and so inevitably, loan repayments are as well. With inflation costs are going up for just about everything. In these circumstances you may find yourself struggling to pay your mortgage. If so – and we can’t stress this enough – you need to adjust your mortgage before you get behind on payments.

When you start missing loan payments the bank will work with you to come up with some options but by this time you will be incurring late-payment charges and penalty interest. At this point your options are reduced.

It can take time to assess your options so be proactive and address the issue as soon as possible. There is an application process to go through to change the terms of your loan as the bank needs to ensure that you have ongoing affordability not just for now but for the life of the mortgage.

You don’t need to figure everything out on your own! Just ask for help as soon as you are aware of the problem. We can find the best option for you, whether it is renegotiating your loan or refinancing to another lender.

First-home buyer tips

Banks have funds for you – get in there!

The Reserve Bank has LVRs (Loan to Value Rules) that limit how much high risk lending the banks can do. Recently, The Reserve Bank increased the limit, meaning that the banks will have more money available for first home buyers!

Having a 20% deposit is the ideal minimum deposit, as this means you are eligible for the special interest rates and will not need to pay a low equity margin. But you don’t need to have 20% deposit to get started. Work your budget (make a spending and savings plan) and set up a separate savings account for your deposit. This will clearly show lenders your ability to save and to fund the loan. We have access to a pretty cool product that will get you a better return than just having your funds in a bank on call account, get in touch for more info.

Thoughts from Elise

So, the Covid finally got me! I pretty much lost my voice for 2 weeks, which made it difficult to do calls and negotiate with the lenders. But not to worry, I am back on track now.

For all the business owners out there, Building on Basics is joining forces with Mount Pleasant Law and Gerrards to host the event “Pivot for Profits – Unique Ways to Maintain a Business in a Recession”. We have a great evening planned with speakers, networking and food and drink. Only $5 entry, with all proceeds going to Youth Hub! So, book it in your calendar; 5:30pm 21 June, TSB Space, Turanga and get your ticket today!

No real surprises in the May budget and OCR announcements, with the exception of the policy change to give free childcare hours from the age of two. Front and centre is the issue of navigating New Zealand through the economy’s downturn – it’s going to be a slow road to recovery.

I was interested to find a key budget issue wasn’t discussed by both major parties, or in any large degree, in the media. The government’s tax revenue has been less than forecast. If this continues as a trend, the budget will have over committed and could cause more pain as government debt rises above expected levels.

Can I use my KiwiSaver to Buy a House?

KiwiSaver is primarily for retirement savings. The other cool feature of the KiwiSaver system is that you can use your funds towards the deposit for your first home.

What documentation do I have to complete to get a mortgage in New Zealand?

We know that mortgage documentation sounds like a dry topic! But knowing in advance the admin you may need to do to get a mortgage can reduce anxiety and make you feel more in control.

Property

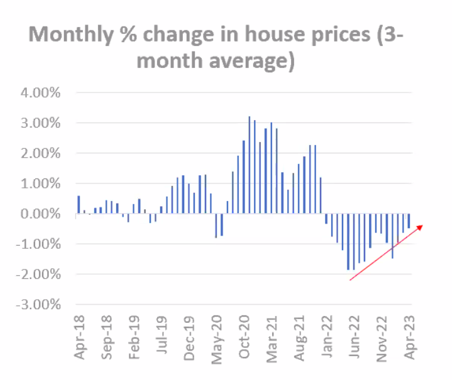

Are we there yet? The race to the bottom has slowed

The information about the status of the property values in the different regions is based on the sales that are registered. We all know that the length of time from making an offer through to settlement can be 2-3 months or more, especially if it is a construction deal.

The value of the sale is registered at the time of the settlement, so even though anecdotally we see the market flattening out, the sales data may not reflect this for a couple of months. We’re also seeing thenatural yearly cycle of a quieting of the market through autumn and into winter.

As investors complete their tax returns for the 2023 tax year, they will be finding themselves with a substantial tax bill to be paid by 31 March 2024. We will begin to see more existing investment properties coming on the market, due to the reduced ability of investors to claim interest costs. This is an opportunity for first home buyers and investors that are cashed up.

Source: Stats NZ

KiwiSaver

Get your free money!

Government contributions get paid out in the first week of July. To get the full contribution of $521.43 into your account, you need to have contributed $1,042.86, to your KiwiSaver, either through your employee contributions or as voluntary contributions.

If you need help to check this out, please do not hesitate to get in touch.

Banks

The banks are in the mood to spend, are you in a position to benefit?

Bank profits are huge and now they’re competing with each other for business by offering decent cash incentives for new customers We’re seeing cash incentives of between $3,000-$5,000 for first-home buyers and up to 1% of the lending as a cash back incentive for current homeowners.

However, lenders are still being picky about the properties that they offer finance on. And with the interest rates still rising the loan affordability tests are pretty tough, with income being tested against the scenario of interest rates around 8.6%.

Reserve Bank

Yet another OCR hike – are we at the top?

Last month the Reserve Bank increased the OCR by a further 0.25% to 5.5%. They have indicated that if things go as they expect it will be the last hike before they start to lower the rates.

Elise is not convinced and expects another increase in either July or August, depending on the how the construction sector and job market go in the battle of inflation. ANZ’s Sharon Zollner seems to agree.

Source: ANZ

Business

Be like a scout and be prepared.

By now you should be getting your 2023 accounts completed so that you know how you have gone in the last financial year. Looking forward, ensure that you are tracking to your budget for the 2023-2024 tax year.

Whether things are on track or not, you need to ensure that you have funds available to be able to take up opportunities and or reserves to get you through the potential recession heading our way.

Make sure that you have lending facilities in place for when you need it. Sort it out while your cashflow is good and you’ll have more options. We have some great line-of-credit offers available.

For other strategies to increase your business’ resilience, make sure to join Elise at “Pivot for Profits – Unique Ways to Maintain a Business in a Recession”, 5:30pm 21 June, TSB Space, Turanga.

Insurance

Why bother with insurance when we have a free public health care system?

We have a free public health care system in New Zealand and it used to be something we were proud of. These days the wait lists are growing along with the number of medications that are not covered by Pharmac.

Should you have a medical event, you need to get diagnosed and treated as quickly as possible to ensure a swift recovery and return to work and living life to themax. Having personal health insurance can be seen as an expensive option – until such time as you need to use it! The relief of being seen by specialists and getting access to medications that you would not be able to afford without private cover can be immense, reducing the stress and worry for you and your family.

The downside of health insurance is that the cost is linked to your age, so every year the cost of your policy will increase. The older we get, the more likely we will use the insurance. If you were to ask Elise, having access to medical professionals if something happens is the best peace of mind for ensuring she can get back to doing what she loves.

If you want to look at getting health insurance or review your current cover, get in touch.

We are always available for a chat about your situation.

Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team