Kia Ora!

In this newsletter:

Hot tip of the month – Is there a pot of gold out there with your name on it?

Did you know –There are better places to save your money than at your bank!!!

First-home buyer tips – Investors are selling; the opportunity is yours for the taking

Property – Investors are getting out of the market – is now the time for you to get in?

KiwiSaver – Exciting KiwiSaver changes for those going on parental leave

Banks – What’s going to happen and what should you do when it comes time to refix?

Reserve bank – We are in a recession – so what?

Hot tip of the month

Is there a pot of gold out there with your name on it?

Finding suprise money in a pocket or between the couch cushions always feels good. Well, what if you had a virtual wad of cash hiding from you? There’s a lot of unclaimed money being held in trust and some of it might be yours!

Unclaimed money may occur when you have funds remaining from a defunct bank account, a credit from a previous utilities company, or a number of other ways. People that have your funds have a duty of care to best endeavour to return the funds top to you, but it may be that you’ve changed your phone number and email address and the person or organisation is no longer able to contact you.

Eventually, the unclaimed money goes to the Crown to hold in trust until it is claimed. The type of unclaimed money determines how much time passes before becoming unclaimed as well as which Crown entity takes possession of it.

Some typical sources of unclaimed money are:

- Banks and financial institutions

- IRD Taxes

- Solicitors or Trusts

- Wages and Employee Benefits

- Dividends and Surplus Assets from liquidation

- Proceeds from Life Insurance policies

You can easily check if you have a pot of gold that you are not aware of. Go to the link below to find out how:

www.treasury.govt.nz/information-and-services/other-services/unclaimed-money

Did you know?

There are better places to save than at your bank!!!

If you have a mortgage, it makes sense to reduce your lending as quickly as possible to reduce the interest you pay and free up more money for living.

However, you also need an emergency fund for the unexpected, whether it be illness, car breakdown, appliance replacement, dental work, and so on! We should all have funds to cover at least three months of expenses.

Lenders offer some facilities that give you access to emergency funds, but if you are a spender and need the money to be less accessible, then we have the facility you need!! We have access to a PIE fund on-call account that pays more interest than the banks, and the tax is paid at your PIR rate, which is less than your income tax rate. Some of our clients are making good use of these facilities and are seeing their funds grow, ready for a rainy day, small projects, or savings for their home deposits. Give us a call if you want to find out how to take advantage of this opportunity.

First-home buyer tips

Investors are selling and the opportunity is yours for the taking

As some property investors leave the market due to increased interest rates and reduced taxable expenses, this will increase the number of first-home buyer properties available to buy.

The benefit of buying a rental property is that it will meet the Healthy Homes Standard, with adequate heating, ventilation and insulation in the ceiling and underfloor.

The downside is that the property has been lived in by tenants who may not have treated the property as if it was their own, and you may need to do some maintenance. This isn’t necessarily a deal-breaker; it just needs to be identified and allowed for as part of your due diligence.

Thoughts from Elise

June was a big month with running the Pivot from Profits event here in Christchurch and starting recruiting for our new Admin Support Super Star.

At the Pivot for Profits evening, we had a small group of people attend and enjoyed talking to people about their businesses, where they are at and what they want to do. We shared some valuable insights on things they can do to increase the business opportunities available to them and to build resilience during the recession.

We had some great feedback from the evening, including:

“A thoroughly enjoyable and informative evening, with a knowledgeable team.

No sales pitches, just good positive guidelines on thriving (not surviving) in a recession.”

Dave – Business Owner

The mortgage market is picking up in the community, with more people looking to see what they can do to get ready and purchase a property or seeking help to deal with loans due for review.

I’m looking for an Admin Superstar to support me with the business. If you or someone you know wants to be part of a team, would enjoy helping our clients and thrive in a relaxed and fun environment while delivering results, then get in touch. The role is Lyttelton based, part-time, with the potential for flexibility. The person must be an excellent verbal and written communicator for both internal and external communications and have great attention to detail! Ideally, they will also have a financial services background.

We are now past the shortest day and around 3.5 months from the election, so we will be increasingly bombarded with political commentary. It will be tempting to put decisions on hold until the elections are over. My advice is to make decisions based on what you know. Things may change, but you may miss out on opportunities if you wait. Some people have been waiting forever to make a decision based on the idea of a capital gains tax; they have missed opportunities for years because of the “what if”.

Yields vs. Capital Growth: What’s Your Investment Property Strategy?

Before shopping for an investment property, it pays to nail down your investment strategy. You can then narrow your search to the properties that suit your needs and not get overwhelmed by options.

5 Reasons a Bank Might Reject a Property for a Mortgage

KiwiSaver is primarily for retirement savings. The other cool feature of the KiwiSaver system is that you can use your funds towards the deposit for your first home.

Property

Investors are getting out of the market – is now the time for you to get in?

The tax changes announced by Labour in 2020 regarding the ability to claim interest as a deduction for tax purposes are starting to bite some investors.

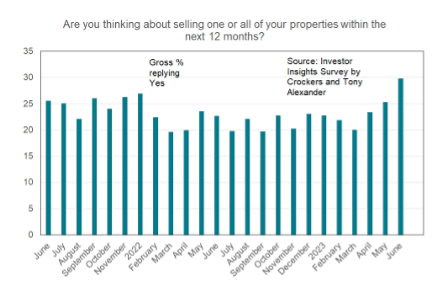

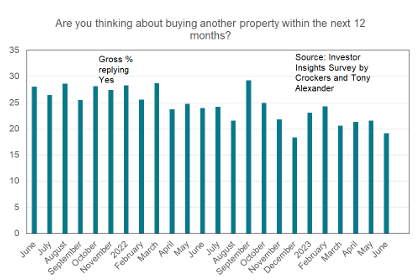

Tony Alexander, in conjunction with Crockers Property Management, surveyed 433 respondents. It shows that investors are increasingly thinking about selling as opposed to buying. It will not only be the changing tax rules that will be at play; it will also be the increasing costs of insurance, maintenance, landlord compliance responsibilities and higher interest costs. While rents have been going up, they are not increasing as fast as these other costs.

Source: Investor Insight June 2023 – Crockers Property Management & Tony Alexander

Remember that interest is still deductible for new builds. However, the yield returns will be low given the high-interest rate environment that we’re in. But property investment is almost always about the long term. Many people will benefit from buying now as the property market nears the bottom but ONLY do so if you can comfortably afford the loan.

KiwiSaver

Exciting changes to KiwiSaver for those going on parental leave

The government announced that from mid-2024, new parents will receive a three per cent government contribution to their KiwiSaver while on paid parental leave (if they continue their own KiwiSaver contributions). Additionally, paid parental leave entitlements will increase on 1 July 2023. This will make a difference to many families! Read more here.

Also, if you’ve contributed to your KiwiSaver over the last year, watch out for the government contribution landing in your KiwiSaver this month. It’s always great to see your KiwiSaver bounce up with the free money from the government.

Banks

What will happen, and what should you do when it comes time to refix?

While the conversation around property is “Are we at the bottom”, the discussion about interest rates is “Are we at the top”, closely followed by “How long will interest rates remain high?”

It is a challenging time to be an economist, with so much uncertainty in the local and global economies. With so many factors affecting the interest rates, the banks’ economists are making decisions using crystal balls while keeping an eye on their competitors to maintain their market share. This will make for some interesting times over the next six months, at least. At this point, it seems that the banks are hedging their bets that rates may still be going up for the next quarter and that it will be a slow road back to the target rates.

Making decisions about what to fix and how long to fix (if at all) becomes a calculated gamble and depends on your plans. You need to look at affordability for now and for the term of the fixed period. Consider splitting your loans to mitigate your risk. Building on Basics is here to help you decide your next move; get in touch, and we can talk it through.

Reserve Bank

We are in a recession – so what?

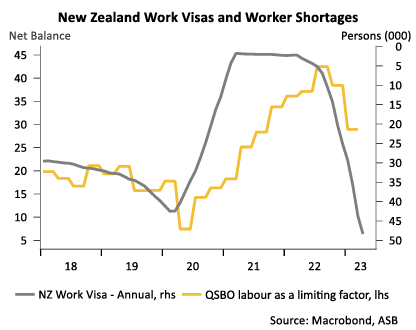

A recession is when the GDP – Gross Domestic Product – is negative for two quarters in a row. Statistics NZ reported that the expenditure on GDP fell 0.2 per cent in March 2023 quarter, following a decrease of 0.9 per cent in the December 2022 quarter. The negative quarters are less than 1%, which is encouraging. The Reserve Bank will keep an eye on the many factors affecting inflation, such as employment and migration.

That said, inflation’s effect on the economy is significant, and as other industry economists are at odds with how long things will take to recover, the Reserve Bank is most likely in a watch, wait and see mode.

If the migration improves the skill shortage issues, we may see an upswing, however minor, in the GDP in the next quarter leaving inflation as the Reserve Bank’s focus.

So, what does the recession mean for you? The recession means retail and discretionary spending businesses will likely struggle if they don’t think outside the square. For sales and services employees, job security could be impacted. For consumers, it could be an opportunity for some bargains.

Business

Three ways to keep your pipeline full

Businesses survive or thrive based on sales. To make sales, you need a pipeline of opportunities to convert. A full pipeline is critical in a high-inflation, recessionary environment.

Here are three ways to keep your pipeline healthy:

- Client care – be in touch with your clients and remind them about what you do and how you can help them and their community of friends and family.

- Develop strategic partnerships with businesses and people in similar and supporting industries. This will help build your opportunities to support your clients, share offerings and build each other’s companies and has the added benefit of providing client care for both businesses;

- Keep marketing!!! Let people know you are still in business and looking to help them. It’s hard to fill a pipeline if you keep your business secret.

Insurance

Should you pay your insurance up front?

Personal risk insurance, such as life, trauma, and medical covers, are always charged monthly, so there is not much choice with these policies.

Paying upfront will save you any finance costs for personal car, contents, and house insurance cover. However, if you haven’t saved for your insurance when the annual review and bill becomes due, you will need to finance the cover, and the added cost of the finance fees will be worth ensuring that you have the proper protection in place.

For business covers, whether it be vehicle insurance for your Uber business, property insurance for your residential investment property or full business covers such as statutory, employer liability, indemnity or material damage, then the answer is almost always to use finance. This leaves money in your war chest to cover other costs, build your pipeline or provide cash flow for sales.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team