Hi!

The big news for us is that we have been granted our full licence!

This means that we are now back to the business of focusing on you, and not our business processes!! We are excited to announce that Daniel has joined our team and is getting settled in. More about us later.

Winter has struck and the ski fields are looking glorious and those that love the snow and the cold are rubbing their hands with glee. Those that don’t like the cold, like me, are grateful we are past the shortest day but wary of the frosty mornings ahead.

The weather is a bit like the economy, dark and ragey! Inflation is high, interest rates are rocketing up, and credit is tightening. Employment is high and wages are slowly increasing for some. There is talk of a recession… In a recession people stop spending people, people lose their jobs and costs rise, interest rates are high and money supply is often tight. The overall economy suffers and economic outputs reduce.

On the good news front the first phase of adjustments to relax the CCCFA is due to come into effect on 7 July. The changes are fairly subtle, giving some more flexibility to the way that the lenders assess expenses and giving the borrower the opportunity to certify their ongoing expenses. In my view it will make little difference to the way that the main banks are assessing loans but will give greater flexibility to the alternate lenders.

We will be blogging about what this means

In this newsletter we are going to talk about:

Summary of June blogs

Property

KiwiSaver

Banks

Reserve bank

Hot tip of the month

First Home Buyer Tips

Did you know…

Getting our full licence was a one off activity and now that it’s done we are set up to focus on you!!

With that in mind we have a new recruit – Daniel Montgomery.

Daniel is a qualified Accountant who has joined the team as a trainee Loan Writer. Daniel is excited to be part of the team, broadening his skills to become a Financial Adviser and utilising his past accounting experience to help our clients to achieve their financial goals.

Can I save money with an offset facility?

How does an offset facility work? Use your savings to pay off your loan faster

Should I buy a house, or wait?

Is this a good time to buy? Are the rising interest rates putting you off?

Hot tip of the month

Buy No Pay Later (BNPL) systems like After Pay, ZIP, Genoapay, LayBuy all allow you to apply at the store and get approved for a small limit. You spend maybe $50 at the time of the purchase and take home the item, and then spend the next 3 fortnights paying off the item. So, for $50 you get what you want and now you have the debt and a commitment for additional payments over the next 3 fortnights.

It is an interest free transaction as long as you make the payments on time. If you fail to make the payments then you will be charged late penalties.

The penalties can be up to 25% of the purchase price, but the bigger penalty will be the effect on your credit rating and may be the thing that will stop you getting a loan for your home. If you have BNPL accounts the banks will take up to 4% of the limits and use that as a regular monthly expense, reducing the amount of debt that you can service.

Did you know?

If you are renting your landlord needs to have property insurance. This covers the chattels of the property, including the carpets, blinds, ovens and anything that is screwed into the property. If the landlord provides whiteware they will need to have contents insurance for these items.

You are responsible for your contents – clothes, appliances, kitchen things, furniture etc. If something happens and you as the tenant are responsible for the damage to the property (for example in the event of an accident, like forgetting to turn the stove off and starting a fire), the house owners insurance company may come to you for reparation of the damage caused.

If you have contents insurance, this comes with a level of liability insurance which will take care of those reparations for you. Having contents insurance even if you don’t think you have anything of value can protect you from the stress of this situation.

First Home Buyer Tips

Buying your first home can be an overwhelming process. This is our tips section to help you get into your own home.

The value of your Lawyer

We like to do things ourselves (being a nation of DIYers) but during the property purchasing game there are some things that require specific expertise. Transferring the title into your name is one of those tasks that requires an expert. A lawyer is essential for the process of transferring the title, but they are also a huge asset well before then. Your lawyer will help:

Provide you advice on the entity to purchase the property (sometimes in conjunction with your accountant)

Make sure you have any relationship property issues identified and managed

Check the Sales and Purchase Agreement to ensure you have all the right clauses in the contract to make sure you can perform your due diligence so that you don’t purchase a lemon

Perform the title search and check that there are no caveats or encumbrances on the title that could affect what you are planning to do with the property

Check that the title has no defects – if the title has a defect, lenders may not provide finance for the purchase, this is particularly relevant for cross lease properties

The lawyers will also manage the loan documents with the bank and provide the independent legal advice regarding any guarantees

Confirmation of AML (anti-money laundering) checks for the title transfers

Updating of the LINZ land register and the council for rates

Most of the work that lawyers do for property purchases is not seen by you. You come into the office and have a chat, sign a bunch of papers and then get the invoice for the $1,200-$2,500 depending on how complex your transaction was. Money well spent!

Have a read of the First Home Buyer section on our website too.

KiwiSaver

In the next few days you will be receiving your Government Contribution, which is always something we look forward to.

Many of our KiwiSavers can do with a bump, after the hit they are taking with the high volatility in the share market. It is not just the share markets that are experiencing the up and down movements. Many conservative and balanced funds have also taken a hit as many of them contain bonds. As the interest rates have risen so swiftly the value of the bonds have dropped. This has caused many investors some concern as they expected the conservative funds to be lower risk.

With the interest rates expected to continue to increase over the next wee while, if you may need to use your KiwiSaver within the next 3-4 yrs you are best to ensure that your KiwiSaver has no bonds. If you need help to understand what is in your KiwiSaver please reach out.

Reserve Bank

The Reserve Bank is tasked with attempting to keep inflation at a level that is affordable and that will promote steady economic growth as well as enabling employment to stay at maximum sustainable levels. Economics is complex!! The Reserve Bank is endeavouring to control the inflation by increasing the OCR which is in turn increasing interest rates.

The Reserve Bank controls seem to be counteracting the Governments spending and provision of funds that are due to given to those that are earning under $70K. The OCR is expected to continue to increase in the coming months.

Since the borders were locked down at the beginning of the Covid Pandemic in March 2020, NZ has had a shortage of skills resources in almost every industry. One of the saving graces has been the Kiwis have deferred their OE which has meant we still had some workers to fill some of the positions. As the borders have opened around the world, Kiwis young and old are now leaving for their overseas trips. In the coming months this will further exacerbate the skills shortage, putting more pressure on businesses.

Banks

The CCCFA changes have increased the tests on expenses for prospective borrowers and now with the increasing OCR and bank lending rates, the banks are increasing their stress test interest rates.

With interest rates expected to increase for the next 12 – 18 months, the banks want to be sure that they are not putting borrowers into positions that they cannot afford to service their loans. Read our blog on stress testing here.

Having said that, the banks are still keen to lend money and have been willing to pay up to 1% of the loan value as a cash back incentive. The banks are being picky about who they lend to and the property that is being used as security, and now with property values dropping they have reduced their appetite for high level lending. Loans over 90% LVR are now tougher to come by.

Property

CoreLogic are reporting that properties in 486 suburbs across Aotearoa have dropped in value over the last 3 months. This is up from 246 suburbs in the previous 3 month period.

The drops of between 1-5% over the last 3 months are patchy and are not a blanket reduction by region. Agents are reporting lower volumes of properties coming onto the market and the time to sell the properties is increasing.

So, if you are in the market to purchase it may ‘appear’ that there are more properties to choose from. Good properties that are marketed at a fair value will still go quickly, but some Vendors are still in the mood for getting maximum dollar based on the past property hype. With finance being tighter the banks are cautious especially in the high LVR space.

To see how your suburb is faring check out this CoreLogic map.

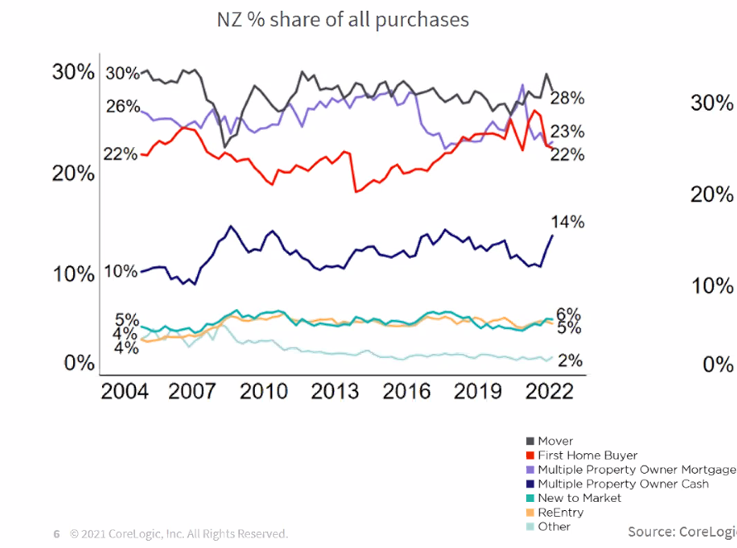

In this graph from CoreLogic we can see that First Home buyers have been affected the most by the recent changes to the CCCFA since December 2021, and more recently the increasing interest rates. Cash Buyers are having a field day as we would expect.

We are always available for a chat about your situation. Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team