Kia Ora!

Here we are on the final countdown to Christmas. 2022 seems to have shot by in the blink of an eye!

Financial news continued to be negative with the Reserve Bank talking about a pending recession. Unfortunately that means we can expect more bad news for the next 18-36 months as interest rates continue to rise, property values drop, unemployment rises.

But as always, property investment is about the long term. We can expect house values to recover and continue to grow, just as they did after previous recessions. The key is to take positive steps to ride out the downturn. Now’s the time to look at where your money is going and tighten up your spending. Reducing spend as a country will get inflation back under control, and focusing on saving now will help you get through the recession.

In this newsletter we are going to talk about:

In early November Elise clocked up a lot of miles trying to land at Wellington airport for the Booster Conference. When she did manage to get there, she enjoyed meeting up with Wellington clients face to face. Elise is on track for completing her Investment Strand and is looking forward to being able to provide more investment advice in the new year.

The Building on Basics team will be taking a break from Wednesday 21st Dec – Monday 9th Jan 2023. If you have anything urgent during that time, please text Elise on 029 973 7911.

Whether you’re hoping to catch some waves, read some good books or make the best pavlova ever, we hope your summer is restful and rejuvenating.

6 Ways to Prepare for a Successful Mortgage Application

Knowing you want to buy a house is one thing, but getting there can feel like an overwhelming task. So, let’s keep things simple! Lenders look at three things when reviewing a mortgage application: income, deposit and financial history. Getting each of these areas into shape prior to applying for a mortgage will make the difference between a yes or a no from a lender. The steps below will help you get in the best position possible.

Building on Basics’ Guide to a Great Christmas on Any Budget

In a time of high living costs and financial stress, this Christmas could easily become the season to be jaded, rather than jolly. It’s lovely and natural to want to give your family a great Christmas and a fun holiday, but we don’t want you to have to spend the next year paying it off.

Property

Further OCR increases forecast for the periods through to at least May 2023 mean interest rates are yet to peak. The number of days it takes a house to sell is trending up and is currently at 48 days, well over the historical average of 39. If sales are slowing, chances are demand for housing is too. 81,000 additional dwellings have been established since the borders closed for Covid19, easing the housing crisis.

These factors indicate that house prices are likely to fall further. But ANZ’s research team forecasts that house prices will find a floor soon after the OCR tops out mid next year. As we noted above, property investment is long term and this market down turn is short term.

KiwiSaver

The Retirement Income Interest Group (RIIG) of the New Zealand Society of Actuaries have released a report that shows ongoing KiwiSaver contributors aged 50 will have an expected median balance of $124,400 in today’s dollars when they turn 65.

To give perspective on what this means, a balance of $124,000 in a balanced fund at the age 65 will pay out approximately $100pw*. This would supplement the pension but not significantly and will not ensure quality of life if you were to stop working at 65.

To find out what your estimated balance would be at 65, and what the corresponding weekly pay out would be, we highly recommend you use the Generate Wealth KiwiSaver calculator. You can also see how much you would increase the balance by if you increased your contributions.

*Calculated using the Generate Wealth KiwiSaver calculator, and the returns that the Government has set out as expected acceptable rates.

Banks

Floating rates are currently sitting between 7-7.45%, with 2nd tier lenders’ rates ranging between 5.99-8.19%.

Lenders are being wary about the properties that they are accepting as security and are continuing to increase their stress test rates. Prior to the CCCFA, we had lots of options, with lenders falling over themselves to lend money. As property values have been dropping, the banks are being picky about the securities they accept and the lending that they take on, even if you have been banking with them for decades.

If we have negotiated and locked in low rates, those people should now be upping their payments if you are able to take advantage of paying down your principal faster. Talk to Elise to make sure you are getting the best bang for your bucks.

Reserve Bank

Our prediction that the OCR would lift 0.75 basis points to 4.25% on 23 November was correct, with an indication from the RBNZ Governor that there will be more hikes in Feb 2023 and the country will likely be in recession by mid next year. We all need to cut spending and have been warned. Spending is permitted as long as we are not using debt to fund the spending!!

In the interim, inflation is holding steady at 7.2. Unemployment continues at the low rate of 3.3. The large number of vacant positions is driving wages up, which in turn is driving the price of goods and services up. A vicious cycle.

One of the big issues the RBNZ has is that many people have fixed their loans for super low rates until 2026, so any increases to the OCR only affects those that have floating rates or loans coming off in the short term. The OCR hike takes time to have any effect, but we can speed things up if we all reduce our spending in other areas, and focus on paying down debt and saving. This will also put you in a better position to manage future high interest rates.

Business

No matter how big or small a business is, there are several areas of expertise all businesses require:

- IT – email, file storage and management, cyber security

- Marketing – may include website, social media, physical advertising, (e.g. car signage) and other branding

- Advertising – Google ads, Facebook ads

- Accounting – Company annual returns, GST, payroll

- Health and Safety

- HR – Employment and contractor contracts, performance management systems

- Operational systems and processes

What is your role as the owner?

Vision, values and culture.

Everything else can be outsourced. Build your team as and when you need to – you don’t need to do and be everything!

Insurance

Are you aware that if you start building renovations on your property without notifying your insurer, your insurance is immediately invalidated and you are not covered?!

If there is an incident while you complete the renovations and the insurance company can attribute it to the renovations you will not be paid out. Check in with your insurance agent or insurance company about any renovation projects you have planned over Christmas.

Elise’s view is that if you are being forced to have an insurance deduction coming from your wages, then you should be able to choose the insurance cover you get and make sure that it best suits your needs. And if you already have insurance then you should be exempt from the added deduction.

Elise believes this policy is being rushed into legislation and is going to have more issues than the CCCFA. The negative consequences for household finances would come at a time when many are already struggling with inflation and high interest rates.

Hot tip of the month

Given that we need to spend less to get inflation down, it’s a good time to remember that an awesome Christmas and summer break doesn’t have to be expensive. Now more than ever it’s a bad idea to rack up debt for Christmas.

Gifting your time and skills to someone often has more value than a bought gift. A voucher for a day of helping in the garden or babysitting will likely be gladly received. It’s not being “cheap” – time is valuable and imagine what someone would have to pay to get a person for a full day of labour! Check out our blog Building On Basics’ Guide To A Great Christmas On Any Budget for more ideas.

Did you know?

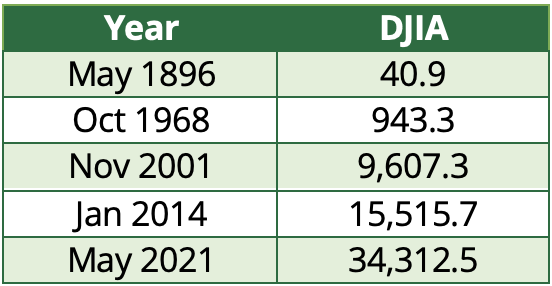

Dow Jones Industrial Average (stock market index).

The share markets have ups and downs, some of which are significant. Inflation and the number of investments that get registered on the market suggest that the market values will continue to go up over time. While individual investments may change and come and go, having a spread of companies and asset classes is key to successful investment in the long term. Picking investments for the short term is just a gamble.

We just chose some random dates for the above table, to show the journey of the index over time. To really understand the ups and downs of the market watch this cool video on YouTube that shows the market’s upwards movement over 125 years.

First Home Buyer Tips

What is a LIM Report and why is it important? A LIM report is a Land Information Memorandum.

This is the report that details:

- Historic protection orders

- Council services that go to or through the property, storm water, sewerage drains an rubbish collection

- HAIL registration – Hazardous Activities and Industrials List

- Land Zoning and conditions for use

- Notices issued by the council that relate to the property – by network utility operator

- Permits, building consents, certificates issued by the council by the building consent authorities or local council

- Flooding and erosion notifications

Basically, anything that relates to the land that the council would know about. It takes 10-14 working days get one as it goes around every department to gather the information. You should then get your lawyer to review for any issues that may be documented within the report.

If you’re planning to build or make fundamental changes, the LIM will contain important information about aspects such as storm water and sewerage drains that may affect what you are able to do with your property.

There is also something called a PIM report – Project Information Memorandum. This has more details about a proposed project relating to the property so will have building consent applications and related specifications and sign offs.

We are always available for a chat about your situation.

Book a meeting at the Calendly link, or send us an email.

Until next time,

Elise and the Team