How do you manage your cashflow with the increasing interest rates?

Inflation is on the rise and one of the tools the Reserve Bank has to manage inflation is to increase interest rates and reduce the supply of money.

What do higher interest rates mean for you?

You have a house and a mortgage. At the time you took out the mortgage you could afford to pay the loan and you may even have gone out and got some additional credit to replace a washing machine or to purchase some furniture or an EV. All affordable at the time!

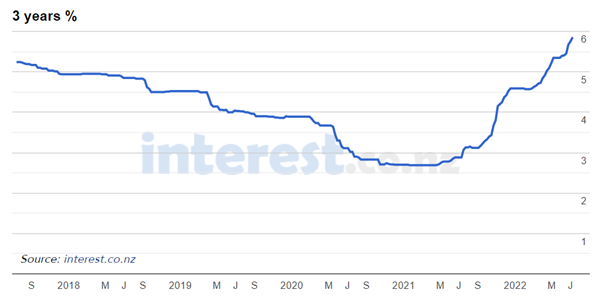

A couple of years ago rates were sitting around 3%, but those low interest rates are long gone. If your loan is due to be coming off a fixed rate within the next 6 months then you will find that the interest rates available today are probably at least 2% higher than the rate that you were on!

What does that mean for your weekly budget?

For a $100,000 loan with 25 years to run this will add another $98 per week to your loan repayment costs, and if the interest rate has increased by 2.5% this same loan will cost you a further $103 per week.

So, if the increase in rate of 2% is going to be a struggle when your loan comes off it’s current low interest rate, the big question is will you be able to afford an even greater increase in the rate?

The Reserve Bank will again increase the OCR by 0.5% on Wednesday 13 July 2022, which will take it to 2.5%. The banks have been increasing the short and long term rates since the last OCR increase on 25 May 2022 when it increased to 2.0%. The Reserve Bank has indicated that the rate is going to keep increasing and they are expecting the OCR to get up to around 3.9% by June 2023, which is a further increase of 1.4%.

The important thing is to ensure that you are able to afford to keep your home, and to have money for more than just paying the mortgage. You will need to manage your cashflow and give yourself as much certainty around your ability to pay your debts and put food on the table and meet your other obligations. Winter has definitely struck so your power and heating costs will be on the rise also. Inflation has hit food and fuel prices so it all feels rather bleak.

What can you do to manage your cashflow?

While you may be on a nice low interest rate that is fixed for the next 6-9 months, for some of you it may pay to break that rate and refix your loan for a longer term now. Fixing again while the rates are still affordable will allow you certainty of cashflow. It will feel counter intuitive to give up a low rate that still has time to run, but the expectation is that the rates are going to be increasing for the next 24-36 months. If this is the case locking in a rate now for the next 36 months may give you the certainty of at least managing your mortgage and then it is just the other inflated prices you need to handle.

Today’s rates are coming back to what the Reserve Bank would call closer to the ideal target rates, but unfortunately the rates are here for today and will be flying higher quickly. To get a bit of perspective check out these historical rates:

This may also be the time to put in place a safety net

Do you have a plan to help manage your finances should the unexpected happen? We have tools and ways to help you manage increased costs, and to plan for the future. Refinancing your debts to reduce your outgoing costs may also help.

We wrote a blog about debt last year, might be time to have a re-read.

Being aware of all your costs and securing affordable repayment amounts for as long as possible may be the key to sleeping at night.

Get in touch with us and we can chat about your best options for paying off your mortgage, buying your first home, or managing your debts.