How does rising inflation affect me?

In amongst all the talk of Covid-19 and the Russia/ Ukraine war we keep hearing the words “rising inflation” – so what does that mean and how does it affect us day to day? Let’s delve into it.

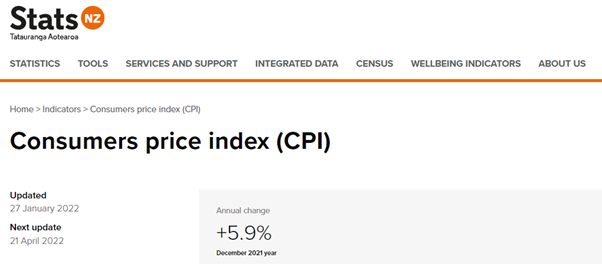

In December 2021 the Consumer Price Index was recorded at 5.9% which is the highest annual increase since 1990. In April we are expecting another increase in the CPI index.

If you have a home loan and you haven’t fixed it (or at least the main portion of your loans) for the long-term on some of the great rates under 4% then your home loan repayments will also be going up, as your low cost loan rates come off their fixed terms. If you are renting and find yourself looking for new accommodation then the chances are your rental costs have gone up, or you may have received a notice of a rent increase. Filling your petrol tank and your shopping cart are all costing more than it used to.

The Russia / Ukraine War, the COVID Pandemic and the global supply chain issues and the funds that the Government has borrowed and poured into the economy are all factors that are contributing to the increasing costs. Unfortunately, the interest rate increases, fuel and other costs for food, consumer goods and construction materials are going to continue to increase for the next 12-36 months.

The Media are reporting the impact of inflation on households.

Stuff says No Hacks For Low Income Households

While the NZ Herald reports Life Hacks for Making Your Money Stretch Further

And then there are the articles about developers in trouble – so it’s definitely not just “everyday people” struggling.

While I’m not wanting to be a doom sayer, it is important to remind you to not put your head in the sand and ignore the increasing costs and the impact on your household finances.

Some households will be able to just reduce their spending on things that are optional and that may include things like Netflix and other nice-to-have items, but for many households those luxuries have been cut long ago.

Everyone’s situation is going to be different and what will work for some households won’t work for others. With the increasing costs the biggest risk is that people use consumer debt tools like GEM Visa, QCard and Buy Now Pay Later systems, and then find themselves trapped in a consumer debt cycle.

The reality is that there are limited things you can do to increase your income. Many of us already have a second job. Thinking outside the norm and doing things like renting out a spare room in your house or getting a boarder in to help share costs can take some of the financial pressure off. While this may not be the ideal, it is a way to help get you through. Other options that are one off is to go through your home and clutter clear and sell any unwanted items on Trademe or Market Place.

Managing your debts and seeking advice with Financial Advisers is an option, you may be able to get cheaper rates by combining loans. Seeking budgeting advice from the likes of Citizen Advice Bureau or many other organisations is also a good option. Many people have lost their jobs and or their businesses in the last 2 or so years and many more businesses are likely to fail, so seeking advice and support is critical to see you through the tough times ahead.

We are always here to talk your situation through – please get in touch if you are feeling stressed about your finances, and we can work with you to find a solution.