What is an offset facility?

There are many types of home loans and then there are variations within the loan types.

A home loan is also called a mortgage and is effectively a loan that is secured against a property.

You can have multiple home loans secured against a single property. The most common loan configurations are

Revolving Credit (also called a Flexi Loan); and

Fixed loans.

Loans may also be ‘interest only’ or ‘principal and interest’. An Interest only loan is where you pay for the interest cost for the use of the funds and do not pay any of the principal (the borrowed funds) off. Without paying any of the principal off the longer you have the loan the more the loan will cost you. Interest only loans are a topic for another day – they are a great tool in some limited circumstances.

The Revolving Credit is great if you are good at saving money, and you are not a big spender. If you are a spender then a Revolving Credit facility can keep you in debt or encourage spending as you may have funds available to spend.

Many banks have a marketing name for their revolving credit facility, for example ASB call these an Orbit facility. Some banks allow you to have a non-reducing limit for your Revolving credit facility and others have a reducing lid, which means you pay some principal off with each payment, so the maximum lending reduces with each payment.

The revolving credit is a great facility to have available for emergency funds. By ensuring that you always have funds available within your limit you can then access these funds should something unexpected arise, like the need to replace the washing machine.

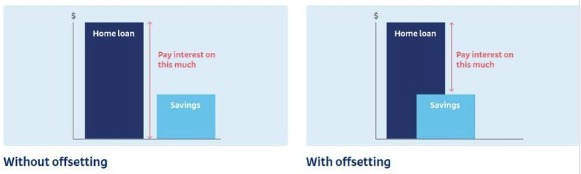

An offset facility is a variation of the revolving credit

Depending on the bank may be limit reducing or have a fixed limit. You also have savings or funds sitting in other accounts. These savings and funds can be used to reduce the amount of the interest you pay, as the savings are subtracted from the home loan funds drawn, and you pay interest on the difference rather than the full amount drawn.

This means with your usual loan payment more of your payment goes to paying principal and you pay less interest. This effectively pays your loan off faster. The money sitting in your savings is available as the emergency funds.

Usually, you can access the principal that you have paid off faster (the “extra” bit) if needed, but it may require an application with the bank.

Got questions? Get in touch with us and we can chat about your best options for paying off your mortgage.

Picture courtesy of BNZ.