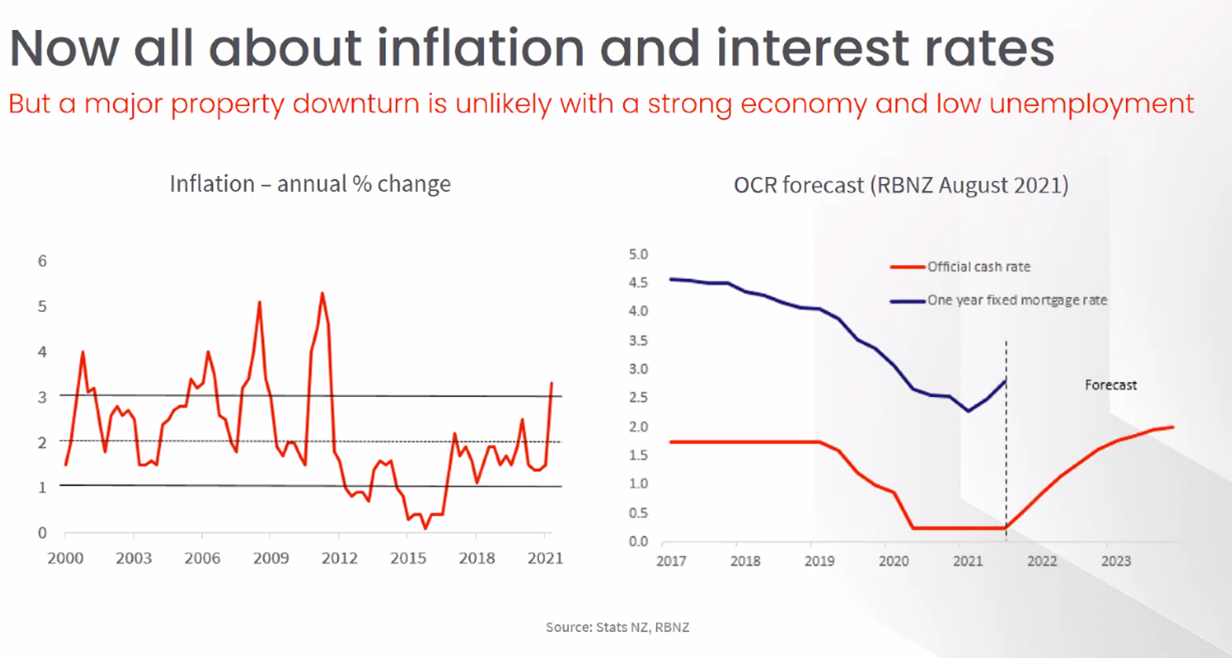

Over the last 18 months or so we have been enjoying an extended period of low inflation and super low interest rates. Property prices have been going crazy, and it’s never been cheaper to borrow money. Fine if you’re already in the market, but pretty hard going if you are looking to purchase your first house! Something had to give.

Leading up to the August Monetary Policy Review announcement from the RBNZ, the expectation was that the OCR was going to increase to help to counter the rampantly rising inflation and to help cool the property market. However, the community outbreak of the Covid-19 Delta variant in Aotearoa put a hold on that temporarily. In anticipation of the RBNZ putting up the OCR, some banks had already started to increase their interest rates. ANZ had put their rates up in anticipation of the August increase and then dropped the rates when the OCR did not increase. It was generally understood that that official cash rate would certainly be raised at the next announcement date – 6th October.

Yesterday that did indeed happen. The OCR has now been set at 0.50%, consistent with the RBNZ’s indications at the time of their August Statement. This is the first time the OCR has increased in 7 years! You can read more about it here.

In anticipation of the OCR increase in yesterday’s announcement, many banks had already upped their interest rates and some have indicated they expect a second round of increases before the end of the year.

The Reserve Bank have provided the following graph to show where they expect rates to be going. The banks are typically around 2 pts higher than the OCR so we can expect to see the fixed rates in the short term being closer to the 4%-5% and not just the long-term rates.

While we still have access to these low interest rates, talk to us about your plans so we can get your debt reduced before the rates go up much further. Make the most of low interest rates while they’re here! Get in touch by email, or book an appointment at the Calendly link at the bottom of the page.