Kia Ora!

In this newsletter –

Hot tip of the month –The government’s KiwiSaver contribution has halved, but it’s still worth it!

Did you know –Many are doing retirement tough; plan for your own now

First-home buyer tips –Build your 5% deposit, but don’t forget to save for due diligence

Property –Still plenty of rental stock on the market – what does it mean for rental returns?

Investments –Are you keeping up with inflation?

Banks –Approval times are blowing out with interest rates coming down

Reserve bank –Will we hold steady?

Hot tip of the month

The government’s KiwiSaver contribution has halved, but it’s still worth it!

While the KiwiSaver government contribution has halved to $260.72 this financial year, it’s still free money that will grow over time. In fact, if you were to do a single deposit of $1,043 per annum to qualify for the full government contribution, and you had your funds in a growth investment, the Sorted.org.nz calculator says that you would have $33,237 in your KiwiSaver after 20 years.

16 and 17-year-olds now qualify for the government contribution. We strongly recommend setting up an automatic payment for them to help them grow their house deposit sooner. Even if you can’t put aside the full $20.10 per week, the government will contribute 25 cents for every dollar you deposit, up to the maximum of $260.72.

Did you know?

Many are doing retirement tough; plan for your own now

The Retirement Commission has released findings on retirement living costs. There’s no fixed cost for retirement, but the commission found financial strain is rising.

- 39% of retirees rely solely on NZ Super, with no other savings or KiwiSaver.

- 37% say their finances have worsened in the past two years.

- Many are cutting back:

- 28% buy less food

- 26% delay medical care

- 46% reduce social activities

Being mortgage-free and having additional income sources (such as KiwiSaver or other investments) greatly improves your financial resilience. Renters and those with health issues are most at risk. No matter your age, let’s make a plan together to get you on the right track for a secure retirement.

First-home buyer tips

Build your 5% deposit, but don’t forget to save for due diligence

Getting enough of a deposit together can feel like a big mountain to climb. But the old cliché is true: every journey starts with a single step. In other words, the sooner you can start saving, the better. Setting your KiwiSaver employee contributions as high as possible is a good way to get there.

As you near your deposit goal, remember that you also need some savings outside of your KiwiSaver to fund your purchasing due diligence (such as builder reports). When saving money that you need to access, we recommend an investment tool such as Booster Savvy, which will accelerate your savings. Click this link to get started and use code: C37846P518826. Although their interest rate has been falling and is now at 3.25%, it is still higher than what you would get from a savings account in a bank. The funds are on call, and a debit card is provided for your use.

Elise has been working with several clients who implemented Booster Savvy into their money management systems. They’ve been surprised how much they are saving and earning, even when working with small sums.

For alternative saving systems recommendations, contact Elise.

Thoughts from Elise

Storms and natural weather events continue to dominate the headlines, and my thoughts are with those in the upper South Island who are dealing with the latest floods.

June has been a busy month personally. With two long weekends, I took some time for myself, completing a jigsaw or two and catching up with friends. Sarah and I also did some planning for the next steps of the renovations.

Lyttelton Harbour Business Association hosted the inaugural Matariki Taonga Awards on June 20th, which was a huge success. The number of nominations and the quality of the entries were inspiring. The awards recognised many incredible people who give their time and energy, contributing substantially towards making our community and the Whakaraupo Harbour thrive.

On the work front, we have some changes in the words at Building on Basics; more to come as we work through the details. As for the finance landscape, I continue to see some people working through challenges and others who are thriving. Lenders are being particular about the properties they fund, and having insurance is now a critical requirement.

Wishing you all the best for July.

Property

Still plenty of rental stock on the market – what does it mean for rental returns?

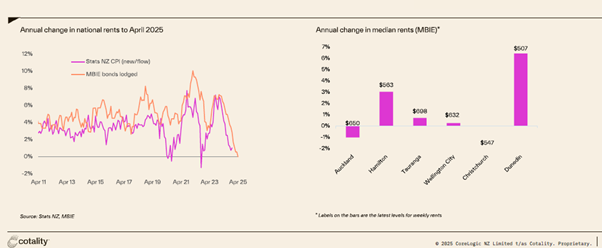

Cotality (formally known as CoreLogic) has reported that the rental stock available for rent remains elevated, leading to subdued growth in rental incomes. Net migration was around 26,000 in March 2025, significantly lower than the peak of 132K in November 2023.

Regional differences in rental trends are significant, with Auckland experiencing rent drops and Dunedin experiencing high increases, while Christchurch’s market remains relatively flat.

Cotality’s commentary on the market in their June Housing Pack Report is “All in all, the property market continues to tread water, and this may remain the case for most of 2025. Lower mortgage rates will be an upwards influence. But the flipside, listings remain high, the economy and labour market may not necessarily rebound quickly, and debt to income ratio limits for mortgage lending are an added restraint.”

Elise is seeing investors pausing to make decisions as they worry about job security and the tax implications should there be a change of government in the next election.

Investments

Are you keeping up with inflation?

Term deposits give a much better return than just leaving your surplus funds in a savings account at the bank. However, while 12 months ago we were getting 6.3% returns for a 12-month term deposit, today we are lucky to get 4%, and the returns are continuing to go down.

When considering a term deposit, you need to look at whether the return is at least equal to inflation to ensure that the money you have invested today will, at a minimum, give you the same spending power when you go to use it tomorrow. $1 will still be $1, but it may not have the same spending power. As an extreme example, the average cost of butter is now approximately $8.42 per 500g*, up 51.2% on the previous year.

To effectively protect against inflation, you need to take a little risk and invest in funds that have some equities and or bonds to give yourself a higher return. They have the potential for capital growth, and the pricing will fluctuate up and down. A conservative fund will invest in equities, cash investments and bonds that are lower risk and will give conservative returns (with the industry average being 3.1% over 5 yrs), but some of the funds we work with have average returns of well over 15% for the same period.

Get in touch, and we will help you get your money working for you.

*pricing according to the ODT article – Butter prices on slippery slope

Banks

Approval times are blowing out with interest rates coming down

The banks have reverted to slower approval times. Some lenders are out to 11 days, and some are no longer doing pre-approvals for new-to-bank customers unless it’s a live deal. Most lenders are now offering a 3-year interest rate of 4.99%, which is a great rate if you are looking for certainty and there’s a portion of debt that you won’t pay off within that period.

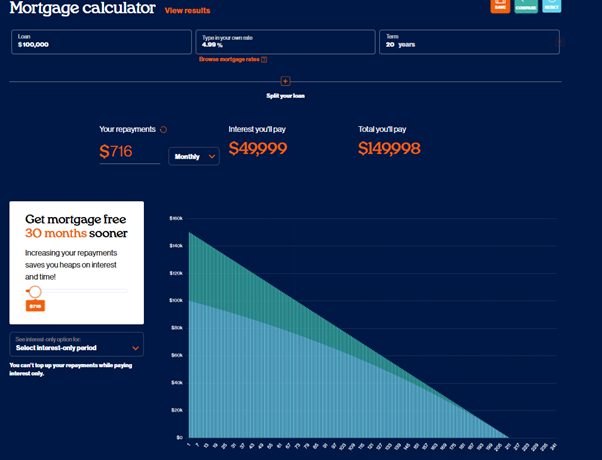

If you are coming off a higher interest rate and can afford to retain your repayment amount at that higher rate, you can take a huge chunk of time off the loan term. As an example, if you have $100,000 that was fixed for 5.99% with $716 per month payments, and you refix at 4.99% but retain that same $716 repayment, you will pay the loan off 30 months sooner and save over $8K in interest costs.

There are other tricks that we can do to accelerate your debt repayment as well, so have a chat when it comes time to refix.

Reserve Bank

Will we hold steady?

In late May, economists called for a 0.5% drop in the OCR. Ultimately, the Reserve Bank decided on a 0.25% drop to 3.25%. The May review was just days after the budget announcements, and the Reserve Bank was assessing the impact of the government policy announcements on the economy.

Price increases in food (0.8% in April and another 0.5% in May) and electricity (a 2.3% increase for two consecutive months) continue to put pressure on inflation.

Unemployment has risen to 4.6%, but down from the peak last year at 5.2%. Job security is a big factor in people’s minds when making financial decisions.

The next OCR review is scheduled for July 9th, with many economists predicting that the Reserve Bank will hold the OCR steady this month, before possibly reducing it in August. Some economists are calling for the Reserve Bank to move early to keep the economy moving. So, it’s a coin toss! Elise’s pick is that it will stand steady for this month.

Insurance

1 in 3 New Zealanders gets cancer

Cancer is the leading reason for trauma insurance claims in New Zealand – more common than strokes or heart attacks. A staggering 1 in 3 New Zealanders will get a form of cancer, with the average insurance claim age of 41. These claims often help cover treatment, clear debt, or support recovery.

Other high-claim covers include:

- Income Protection: For illness or injury preventing work

- TPD (Total & Permanent Disability): For permanent inability to work

- Life Cover: For death or terminal illness.

Understanding your cover type can make a big difference when life takes an unexpected turn. Contact Gordon on 022 503 9094 for a complimentary insurance review. Let’s keep your dreams moving forward, no matter what life throws at you.

Business

PAYE vs shareholder salary

31 March has been and gone, and many business owners are doing their business accounts to sort their taxes or to get finance for their business.

As part of your annual financial conversation with your accountant, you should talk through the best strategy for paying yourself a wage. Being on PAYE can help you take care of your tax throughout the year, but there may be advantages in taking drawings throughout the year and holding your tax money until tax time to save you interest on your home loan or to earn you interest in a high-interest savings account.

Paying yourself through drawings can also reduce your ACC bill and enable you to get more comprehensive insurance coverage.

This is not a simple topic, so it’s essential to consult your accountant about what is best for you. In general, working closely with your accountant and financial adviser to manage your risk can help you achieve your business goals securely.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team