Kia Ora!

In this newsletter –

Hot tip of the month – Spring clean your finances and free up your cash

Did you know – 600,000+ daffodils

First-home buyer tips – Think you can’t get there? Think again!

Property – Spring listings are blooming

Investments – Market downturns can benefit your KiwiSaver in the long term

Banks – Reduced stress test rates may mean you can borrow more

Reserve bank – OCR drops by 0.25 in August

Insurance – The best time to get insurance

Business – Your accountant isn’t just valuable at financial year – end!

Hot tip of the month

Spring clean your finances and free up your cash

As the seasons shift, it’s the perfect time to give your finances a spring clean. Just as clearing out the garage or garden shed can reveal forgotten items, tidying up your financial matters can reveal forgotten subscriptions, outdated insurance policies, or missed savings opportunities.

Here’s how to start:

- Audit your accounts – review your bank statements for recurring charges you no longer need.

- Update your budget – adjust for seasonal expenses, like heating bills or school costs.

- Check your insurance – make sure your cover still meets your needs and life stage.

- Review your KiwiSaver – is your fund still aligned with your goals?

Recently, during a review of a client’s spending, we unearthed over $350 per month in outgoings that the client either didn’t want, need, or had forgotten about. This was an immediate opportunity to save, without affecting his lifestyle!!

Did you know?

600,000+ daffodils

Over 600,000 daffodils are picked or donated each year for Daffodil Day, the central fundraising effort for the Cancer Society. This fundraiser helps support volunteer drivers, accommodation, counselling, and cancer research. These services are vital, with one in three New Zealanders diagnosed with a form of cancer at some point in their life.

First-home buyer tips

Think you can’t get there? Think again!

Elise often speaks to people who have tried to save for a home but then lost confidence. They thought they couldn’t afford it and gave up, without first getting professional advice.

In a high percentage of these cases, Elise can come up with a plan and some options for people to get into their dream of a home by making small adjustments and getting their resources working more effectively for them. This is also often without penalising their lifestyle.

Don’t decide you CAN NOT afford a home without getting that verified. Elise has got people into their first homes at 57 and older, so it is never too late.

Thoughts from Elise

As I’m not a skier, I say this knowing not everyone will relate, but I am really hopeful the worst of the cold weather is over! I’m looking forward to the increasing daylight and the warmer weather.

Rhi has been soaking up information like a sponge and putting it to use. I am going to need to run to keep up with her!

August was a full-on month at BoB. With three months until the Christmas period and decreasing interest rates, we are seeing the seasonal increase in enquiries as people take action to make the most of lower interest rates and achieve their goals before the holidays. Rhi and I are enjoying working together to make things happen.

At home, we have made progress on the renovations with the new heat pump hot water system installed and more of the under-house drainage work completed. I look forward to coming home to work on the house in the evenings as the days get longer.

Sarah’s dad is celebrating his 95th birthday this month, and I am off to see my mum in Australia and enjoy the fruit of her many citrus trees. As per usual, I will be available and working while spending quality time with mum.

With Christmas approaching, now is the time to review your spending plan to ensure you are staying within your budget and managing your cash flow effectively.

Wishing you all a happy spring season.

Property

Spring listings are blooming

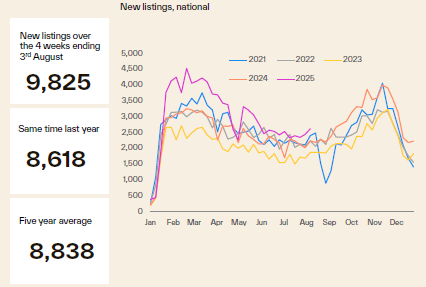

With interest rates decreasing, more people are becoming eligible to purchase their next home or investment property. As expected, more buyers are entering the market, and listings are now above the 5-year average. Everything looks better in a bit of sun!

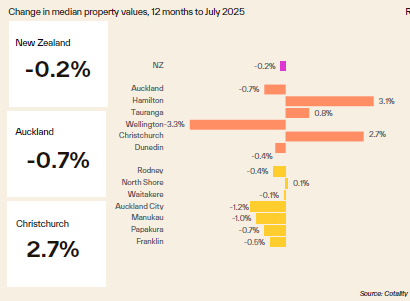

Listings being up is not the same as the values being up. Across the country property values on average are still flat, with the exceptions of Hamilton, Tauranga and Christchurch being up and Auckland and Wellington since in reverse.

Investments

Market downturns can benefit your KiwiSaver in the long term

When you invest in KiwiSaver or Managed Funds, you’re not buying dollars—you are buying units. Each unit represents a slice of the fund’s total value. As the market rises, the value of those units increases. So, the more units you hold, the faster your investment grows.

Here’s the key insight:

Putting money in when unit prices are low means you’re getting more units for your dollar. It’s like buying shares on sale. Over time, this can significantly boost your returns.

But that doesn’t mean you should wait for the market to drop—timing the market is risky and often ineffective. Instead, consider regular contributions or topping up when markets are quieter. This strategy, known as dollar-cost averaging, helps smooth out volatility and builds wealth steadily.

Banks

Reduced stress test rates may mean you can borrow more

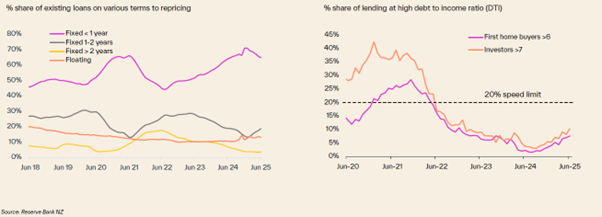

With the OCR reduction to 3% in August, the banks have started reducing their stress test rates, which enables people to “afford” a little more debt. While this will allow people to borrow more money, the ability to do so will be kept in check by the DTI (Debt-to-Income) ratio restrictions.

The banks and other lenders are managing their books well, and on average, less than 10% of their clients are borrowing above the restrictions.

The majority of borrowers’ debt is due to be refixed within the next 12 months, allowing them to take advantage of the dropped and dropping interest rates.

10 to 20% of lending is floating, allowing borrowers to take advantage of the dropping rates. Most lenders offer a 2-year rate under 5%, and many also have a 3-year rate under 5%. This is great for ensuring cash flow certainty if needed.

Reserve Bank

OCR drops by 0.25 in August

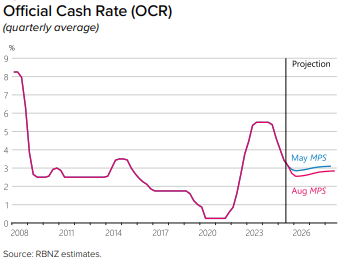

Elise’s July prediction of the OCR and interest rate movements was correct this time round, with the Reserve Bank Monetary Policy Committee choosing to drop the OCR by 0.25 basis points to 3%.

The committee considered dropping by 0.5, but they expressed concern that while inflation is within the band of 1-3%, it is at the high end. Furthermore, economic activity indicated that the recovery is stalled, with household and business spending constrained.

Depending on inflation, household/business spending and employment numbers, we are likely to see at least one more drop this year, in October or November.

As a result of the OCR announcement, we saw drops to the floating rates (although not fully for the offset loans) and a slight decrease to short-term rates.

Insurance

The best time to get insurance

The best time to get insurance is before you need it. Whether it’s health, life, or income protection, acting early means lower premiums and fewer exclusions. Typically, people only take out cover when they have a significant event, such as:

- Starting a new job or business

- Taking on a mortgage

- Starting a family

These are key moments to review your cover. Insurance isn’t just protection—it’s a tool for certainty, cash flow, and control.

Starting early can give you the benefit of a level premium, which can reduce your overall insurance premium costs over the term of the cover. For parents, taking out free cover for your children can enable them to get full cover without exclusions in the future.

Business

Your accountant isn’t just valuable at financial year – end!

Historically, accountants have taken your shoebox (or drop box) of receipts and completed the end-of-year accounts. By the time they do your accounts, it’s too late to adjust anything to get the best out of your numbers – or your business.

Today, your accountant can be so much more than a number cruncher. They can be a strategic partner who helps you:

- Track your performance monthly so you can spot trends early.

- Forecast cash flow to avoid surprises and seize opportunities.

- Review margins and pricing to ensure profitability.

- Plan for taxes rather than react to them.

The key? Engage early and often. Don’t wait until the end of the financial year. Book quarterly check-ins, share your goals, and ask for insights that go beyond compliance.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team