Kia Ora!

In this newsletter –

Hot tip of the month – How to avoid burnout this Christmas

Did you know – New Zealand’s emergency management system is changing

First-home buyer tips – 5 mistakes first-home buyers make (and how to avoid them!)

Property – Property Pulse: Spring listings rise, but not roaring

Investments – Look after the pennies…

Banks – Rates continue to trend downward

Reserve bank – Another OCR reduction expected in October

Hot tip of the month

How to avoid burnout this Christmas

As the festive season approaches, many of us feel the squeeze – emotionally and financially. Here are three simple strategies to help you stay energised and in control:

- Plan your spending early: Set a realistic budget for gifts, events, and travel. Prioritise meaningful experiences over expensive purchases.

- Protect your downtime: Block out time for rest and recovery. Even short breaks can help recharge your energy and improve your decision-making.

- Say “no”: You don’t have to attend every event or meet every expectation. Choose what aligns with your priorities and well-being.

Did you know?

New Zealand’s emergency management system is changing

New Zealand’s emergency management system is undergoing a major shift. Currently, the system relies solely on councils or civil defence authorities. Under the proposed Emergency Management Bill, local communities, including iwi Māori and rural groups, will play a more active role in managing emergencies

This change aims to strengthen community resilience, clarify local responsibilities, and ensure that emergency planning reflects the needs and voices of those on the ground. In the Whakaraupo Basin, we have seven new local groups to manage our area.

First-home buyer tips

5 mistakes first-home buyers make (and how to avoid them)

Buying your first home is a big milestone—but it’s easy to trip up without the right guidance. Here are five common mistakes we see, and how to steer clear of them

1. Skipping the budget reality check: Many buyers focus on the deposit, but overlook ongoing costs, such as rates, insurance, and maintenance. Know your full financial picture before committin

2. Not getting pre-approved early: House-hunting without pre-approval can lead to heartbreak. Get your lending sorted first, so you know exactly what you can afford. Factoring in the banks’ delays at the busy times is also important.

3. Overlooking KiwiSaver and gifts: Some buyers miss out on thousands in support. Make sure you understand how to use your KiwiSaver and check if you have any family support to help you get on the property ladder.

4. Letting emotion drive the purchase: Falling in love with a property is easy, but make sure it fits your long-term goals and financial plan.

5. Going it alone: Buying a home involves legal, financial, and emotional decisions. Surround yourself with trusted advisers who can guide you through the process.

Thoughts from Elise

Daylight savings brings more light to the end of the day, great for getting out and about for walks and doing things outside in the evening.

As we step into the final stretch of the year, I’m reminded how important it is to pause and take stock — not just of our finances, but of our energy, our goals, and our well-being.

October often brings a mix of momentum and fatigue. We’re pushing to meet targets, planning for the holidays, and juggling life’s demands. But it’s also a great time to ask: What’s working? What needs adjusting?

Whether you’re reviewing your insurance, considering a property move, or just trying to stay on top of your spending, remember — small, intentional steps now can set you up for a smoother, more confident end to the year.

Let’s finish strong, but not burnt out.

Property

Property Pulse: spring listings rise, but not roaring

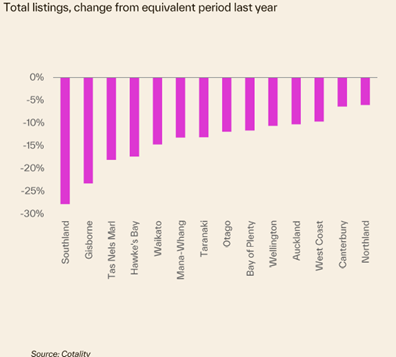

Spring has arrived, and with it, the usual seasonal lift in property listings. However, this year’s rise is more of a gentle swell than a surge.

According to recent data, new listings are up compared to winter but still down compared to the same time last year, and are only just tracking near the five-year average.

Despite the government’s move to reduce the bright-line test back to two years —a change intended to encourage more investor activity — the impact has been muted. Many investors remain cautious, and the expected flood of listings hasn’t materialised.

In regions like Canterbury and Otago, stock levels are higher, giving buyers more choice and helping to ease price pressure. But in places like Northland, listings remain tight.

Investments

Look after the pennies…

You’ve heard the saying: “Look after the pennies and the pounds will take care of themselves.” It’s a timeless reminder that small, consistent financial habits can lead to big results over time.

This month, we encourage clients to:

- Review recurring expenses: Cancel unused subscriptions and renegotiate bills.

- Automate savings: Set up a weekly transfer—even $10 adds up over a year.

- Invest in knowledge: Taking a little time to understand your KiwiSaver or managed fund options can unlock better long-term returns.

Smart investing isn’t always about big moves; it’s about building momentum through mindful money choices. Tools like Booster Savvy, where every dollar earns 3%, and utilising your mortgage products can make significant differences to your results.

Banks

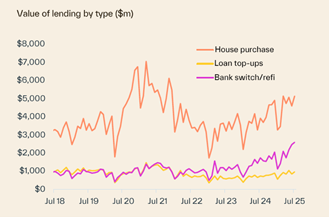

Rates continue to trend downward

Most banks have been adjusting rates in anticipation of the next RBNZ rate cut. Floating rates are still hovering around the 6% rate, and the 6-month – 3-year rates are sitting under 5%. TSB is the first bank to have a rate drop below 4.5%, offering a 2-year special of 4.49%, with BNZ offering this for the 1-year rate.

The lead times for applications are starting to extend again, and pre-approvals are becoming more challenging to get if you are new to the bank. There is still an advantage to switching lenders in certain circumstances.

Source: Cotality

Reserve Bank

Another OCR reduction expected in October

Dr Anna Breman has been appointed the new RBNZ Governor, taking over from the caretaker Christian Hawkesby. Dr Breman was recently the First Deputy Governor of the Swedish Central Bank and comes with vast experience.

The next Official Cash Rate (OCR) review is set for 8 October, with the current rate sitting at 3% following a 25-basis-point cut in August. This decision was made in response to subdued domestic activity and declining inflation pressures, although headline inflation is expected to touch the upper limit of the RBNZ’s 1–3% target band in Q3. The expectation for October is that there will be another 25-basis-point cut, with some economists suggesting a 50-basis-point cut would be best.

Inflation watch: Annual CPI inflation rose to 2.7% in Q2 and is forecast to hit 3.0% in Q3, driven by rising food and administered prices. While core inflation is easing, the risk of inflation creeping above the target remains, especially with global uncertainties and cautious household spending.

GDP performance: New Zealand’s economic recovery stalled in Q2, with weak household and business spending. Analysts expect similar softness in Q3, keeping pressure on the RBNZ to potentially cut rates again in November, unless a 50-basis-point cut is made in October.

Insurance

More cover, same cost

During a recent insurance review, one of our clients discovered that her existing bank-issued policy covered significantly fewer conditions than what’s currently available on the market.

While the premium she was paying seemed reasonable, the level of protection was limited, leaving her exposed to gaps in coverage that could have serious financial consequences.

After a thorough review, we presented her with alternative options that offered broader coverage — including more critical conditions and better income protection — without increasing her premium. The result? Greater peace of mind and a policy that truly supports her lifestyle and long-term wellbeing.

This is a great reminder that not all policies are created equal, and a regular review can uncover opportunities to improve your protection without stretching your budget. Give Gordon a call to review your cover and suss out any gaps and opportunities – gordon@bob.kiwi.nz or 022 503 9094.

Business

Work smarter, not harder

As the year winds down, energy levels dip—but your business doesn’t have to. Boosting productivity isn’t about doing more; it’s about doing what matters most, more efficiently.

Here are four insights to help you finish 2025 strong:

- Batch your tasks

Group similar tasks together — such as client calls, admin, or content creation — to reduce mental switching and increase focus. - Use the 80/20 rule

Identify the 20% of activities that drive 80% of your results. Prioritise those and delegate or defer the rest. - Protect your peak hours

Schedule your most important work during your highest-energy times. For many, that’s mid-morning, so save emails and admin for later. - Tools for efficiency

Join the many Kiwi businesses that are leveraging AI, automation, and export opportunities to drive growth despite recessionary pressures.

Small shifts in how you work can lead to big gains in how your business performs.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team