Kia Ora!

In this newsletter –

Hot tip of the month –Last chance to get $521.43 free from the government

Did you know –Banks will give you money, but not save you money

First-home buyer tips –Help is available to make buying your first home possible

Property –First-home buyers making the most of the market

Investments – Big changes to KiwiSaver – Employer and employee minimum contribution is set to increase in 2026

Banks –Now may be the time to start fixing

Reserve bank –OCR drops again; how low will it go?

Hot tip of the month

Last chance to get $521.43 free from the government

The government contribution for KiwiSaver will reduce from 1 July 2025 to $260.72 yearly. So, this is your last chance to get the full free $521.43 added to your KiwiSaver. If you are aged between 18 and 65, make sure you have put $1,043.86 into your KiwiSaver in the last 12 months to get the full government contribution.

Did you know?

Banks will give you money, but not save you money

Going directly to the bank may give you a faster answer on what you can borrow, but it may not give you the option that will get the debt paid back fastest.

For example, if you borrowed $100,000 at 5% for 30 years, you will pay interest of $93,123. If that same $100,000 is paid off over 29 years, you will save $3,646 in interest over the life of the loan. Typically, when you purchase a home or an investment property, you are borrowing more than $100,000. We have strategies that can reduce your loan term by 10-12 years. The banks won’t teach you this.

First-home buyer tips

Help is available to make buying your first home possible

Elise was recently reminded of how overwhelming it can be to purchase your first home and the amount of conflicting advice on what to buy, where to get your financing, and when to do things yourself to save money versus using a team for their expertise.

Moving house is one of the biggest stressors for people, but choosing where to live and buying a property is even more stressful. We strongly believe in the benefits of building a team around you of trusted experts who can guide you through the complexities. Look for team members who are invested in you and your dream of home ownership, not just there to clip the ticket on the way through.

Your team will consist of:

– Building inspector

– Financial adviser(s) – lending, personal insurance and house insurance

– Valuers (the banks dictate who and how the valuation is done)

– Property manager – for investment properties

– Lawyers – conveyancing, wills, relationship property agreements

– Accountant – financials (for self-employed), tax minimisation advice (investment property)

– An adviser, such as Building on Basics, to guide you through that process, and help you interpret the information from all the various experts

Don’t give up on your dream of home ownership. Talk to us to help you get ready; you may be ready now, but you don’t know it!

Thoughts from Elise

Winter is officially here! I am up in St Arnaud, Lake Rotoiti for King’s Birthday weekend, and the 4-degree temperature is refreshing to say the least. We are hopeful there will be some breaks in the rain so we can get out and enjoy some of the walks.

On the home front, we’ve finished the studio we’ve been building and have moved in Sarah’s mealworms. Sarah’s retirement project is breeding mealworms as a sustainable food source for chickens, reptiles and fish. With the studio complete, I’ll be able to get back to working on the house projects.

May was a big month, with time up in Wellington seeing clients and family, as well as keeping across the government’s budget month. The budget has seen significant changes to the KiwiSaver scheme and the new Investment Boost scheme for businesses.

They have called it a growth budget, but I think it’s a wait-and-see. It’s a big challenge to balance the budget when government revenue is down due to struggling businesses, the past high inflation, and uncertain global trading conditions. Add to that the decades of underinvestment in infrastructure, on top of earthquakes and weather events. It is not a challenge I would want! It’s difficult to balance the personal budget, let alone so many worthy and just needs as a nation.

I continue to see opportunities for clients to get their debt cleared faster, to provide them with more choice, ease their cash flow and better manage their risk. I am grateful for your trust in me and the team to support you on your journeys.

I am looking forward to the Matariki celebrations and the 20th of June Matariki Taonga Awards, supported by the Lyttelton Harbour Business Association.

Wishing you all the best for June.

Property

First-home buyers making the most of the market

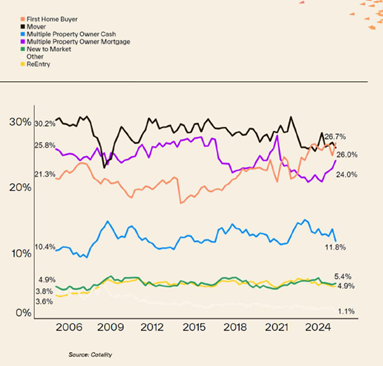

CoreLogic has rebranded to its Global brand Cotality. The work they do and the data are just the same.

First home buyers continued to account for 27% of the market in April, a solid result above the average 21-22% norm.

Property investors are heading back into the market, with the number (24%) now at levels we have not seen since 2021. Elise’s take is that the number of investors would be higher, but investors are still uncertain about job security, interest rates and, more importantly, government stability for future tax deductibility of mortgage interest.

CoreLogic has rebranded to its Global brand Cotality. The work they do and the data are just the same.

First home buyers continued to account for 27% of the market in April, a solid result above the average 21-22% norm.

Property investors are heading back into the market, with the number (24%) now at levels we have not seen since 2021. Elise’s take is that the number of investors would be higher, but investors are still uncertain about job security, interest rates and, more importantly, government stability for future tax deductibility of mortgage interest.

Investments

Big changes to KiwiSaver – Employer and Employee minimum contribution is set to increase in 2026

From 1 July 2025, the government contribution will drop to 0.25c for every dollar you contribute to your KiwiSaver, to a max of $260.72 p/a. If you earn over $180,000, this is the last year you will receive the contribution, as you will be excluded from receiving it from the 2025/26 year.

Make sure you have invested $1043.86 into your KiwiSaver in the last year, either as employee or voluntary contributions. If not, do so before 30 June to get the full $521.43 government contribution! If you need help checking if you have done so, feel free to contact us.

16-17-year-olds will be eligible to receive the government contribution from 1 July 2025, and employers will need to start contributing to their KiwiSaver from 1 April 2026.

Employer and employee contribution minimum rates will increase to 3.5% from 1 April 2026 and to 4% from 1 April 2028. If take-home pay is an issue, employees can opt to reduce their contribution rate to 3% for 12 months. While the initial increase is 9 months away, it’s worth calculating the impact on your budget now to give you plenty of time to prepare.

Talk to us to ensure you are getting your full KiwiSaver contribution. If you have a business and need someone to talk to your team about the changes, book a team info session with Elise.

Banks

Now may be the time to start fixing

Banks responded quickly to the OCR drop announced on May 28th. Nearly all of the big banks indicated on the same day or the next day that they were dropping their floating rates by 0.25% to match the OCR drop.

We are seeing the first of the 18-month rates drop below 4.9%, but the 3+ year rates are staying doggedly over 5%, mainly because they are closely linked to the overseas bonds and swap rates. It’s a good idea to split your lending to help protect against future uncertainty. If you’re wondering whether to fix now and for how long, contact Elise for personalised advice.

Elise had a great question recently at a networking event. “If the banks are getting the funds from the Reserve Bank at 3.5%, why are they charging floating interest rates of 6.5%? That’s almost 3% more.”

The answer: First, banks like to make money for their shareholders, which is great because we need them to stay in business! The bigger reason is that floating rates are often used for a flexible facility, such as a revolving credit. The banks can only charge interest on the funds that are drawn, so they may only be making income on half or less of the funds that are available on credit.

For a facility of $100,000 where only $50,000 is used, the bank will only be getting interest on half the funds, but the remaining $50,000 of undrawn funds are not available for them to lend out, as the borrower could draw the funds at any time. The higher interest rate offsets the bank’s inability to lend the money to anyone else.

If a good portion of the funds haven’t been accessed, those with revolving credit and other flexible facilities will be paying well under the OCR rate for the loaned amount.

Reserve Bank

OCR drops again; how low will it go?

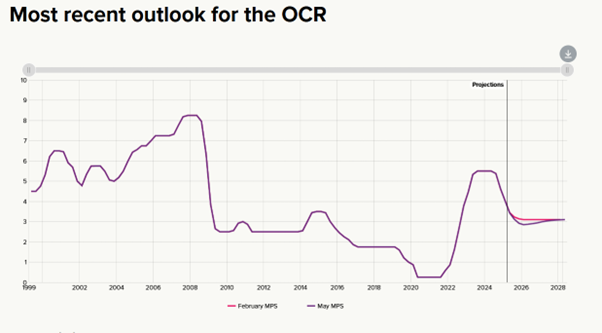

The Reserve Bank lowered the Official Cash Rate (OCR) to 3.25% on May 28th, a drop of 0.25%. Unlike the last few changes, the Reserve Bank were not as confident about when the next drop would be.

That said, the first indication that the OCR could drop below 3% has been given, which gives hope for the short term. However, considering the long-term is more challenging with so much market uncertainty.

Image: RBNZ

The Reserve Bank has indicated that it expects inflation to remain at the high end of the 1-3% range they are tasked to manage. It is currently 2.5%.

They also advised that the uncertainty of the global tariffs will continue to hinder some businesses’ investment and hiring plans. At the same time, other businesses may benefit from trading in markets where tariffs are higher on other countries. A US Federal Court has ruled that Trump’s implementation of the tariffs has been an overstep, so the uncertainty continues.

You can find the full RBNZ May Monetary Policy Statement here.

Insurance

Why trauma cover matters

Personal risk insurance can ensure that you will be able to retain your quality of life when the unexpected happens. Although we all think we are bulletproof, life can change in an instant.

Insurance can be a complex area to navigate, and it is very personal. The right policy depends on you and your desires and dreams for your life. One of the products to protect those dreams is trauma cover, also called critical illness insurance.

Trauma cover provides a lump sum payment if you’re diagnosed with a serious illness like cancer, heart attack, or stroke. One of our clients used their trauma payout to cover medical costs, reduce debt, and take time off work to focus on recovery without financial stress. It’s not just about surviving the unexpected; it’s about having the freedom to recover on your terms.

How much trauma cover you need depends on the full solution you are seeking to protect your quality of life. It may seem counterintuitive, but having multiple covers in place can sometimes reduce your overall premium as you get higher discounts.

To find out how trauma insurance can help secure your future, contact Gordon Bell at 022 503 9094 for a free insurance review. Let’s keep your dreams moving forward, no matter what life throws at you.

Business

Investment Boost – a couple of catches!

Investment Boost is a new deduction for businesses announced in the May 2025 budget. It enables you to deduct the first 20% of a big purchase as an expense in the first year and then depreciate the remaining 80% over the remaining life of the asset. Note this is for “new” things and not second-hand goods; however, if imported second-hand goods are new to New Zealand, they may be deductible.

The Investment Boost deduction excludes land and residential property. However, it can be used towards capital expenditure on property if it relates to strengthening.

This initiative is a great idea for businesses seeking to invest in new equipment to boost their productivity. But be careful; even though you can expense the first 20% of the expense, you still need the cash flow for the purchase.

Xero and other accounting packages need to adjust their systems to account for this new deduction. Here is the information sheet from the IRD, which gives more information. Talk to your accountant before making any big purchases, and if you need finance, talk to Elise.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team