Kia Ora!

In this newsletter –

Hot tip of the month – Keep your fuel tank full in summer

Did you know – Kiwis hit the road during Christmas

First-home buyer tips – Avoid these first-home purchase mistakes

Property – Investing in a changing landscape

Investments – AI investing – bubble or boom?

Banks – Get a share of the banks’ profits!

Reserve bank – Are we there yet? It seems that we are!

Hot tip of the month

Keep your fuel tank full in summer

Top-ups aren’t only good for your mortgage and investments, they’re good for your car too!

As the weather heats up, fuel evaporates faster in cars with partially filled tanks. This not only wastes petrol but can also increase pressure inside the tank. Keeping your tank closer to full reduces evaporation, saves money, and helps your car run more efficiently.

Did you know?

Kiwis hit the road during Christmas

Most Kiwis travel between 2–5 hours by car for their Christmas holidays, often heading to beaches, lakes, or camping spots within their own island.

With so many on the move, the risk of accidents increases. Before heading out this Christmas, check your tyre pressure and oil, fill your windscreen wiper fluid tank, and make sure you’re well rested and alert.

First-home buyer tips

Avoid these first-home purchase mistakes

Below are some of the most common purchase mistakes that first-home buyers later regret:

- Budget blowouts – Forgetting legal fees, rates, and moving costs leaves buyers financially stretched.

- Skipping inspections – Hidden dampness or wiring issues can cost thousands after purchase.

- Overstretching deposits – Using every cent upfront leaves no buffer for emergencies or furnishings.

But don’t worry! You can avoid any of these mistakes by planning, budgeting and working with a mortgage advisor. Let’s talk: you might be ready sooner than you think!

Thoughts from Elise

Hard to believe this is the last newsletter of 2025!

This year, we have helped more clients achieve their goals and secure funds to buy a home or investment property, or to support their business, as well as helping them with their insurance, KiwiSaver and investments. I am grateful for the trust that you all place in us to support you on your journey.

Unfortunately, Rhi has had to leave the team for personal reasons. I thank her for all her great work during her time at BoB. I have engaged Lynnette Baird to give me a hand in the short term to ensure I have the support I need, and I will be looking for a long-term solution in the new year.

At home, Sarah and I are scoping out and getting quotes for completing the downstairs part of our home, and we’ve started on little tasks while finishing the clear-out of the lower level.

During Canterbury Show weekend, we went up to Sarah’s family bach in St Arnaud for a working party. While there, we straightened the garage, which had gone on a lean and reclad a small section of the exterior and freshened up some of the paint. It was good to hang out with family.

We will be shutting the BoB office from the 19th of December and reopening on the 5th of January. Sarah and I are looking forward to a good break.

In the meantime, I look forward to helping those who are aiming to get a property this side of the holiday season and working with you all in the new year.

Property

Investing in a changing landscape

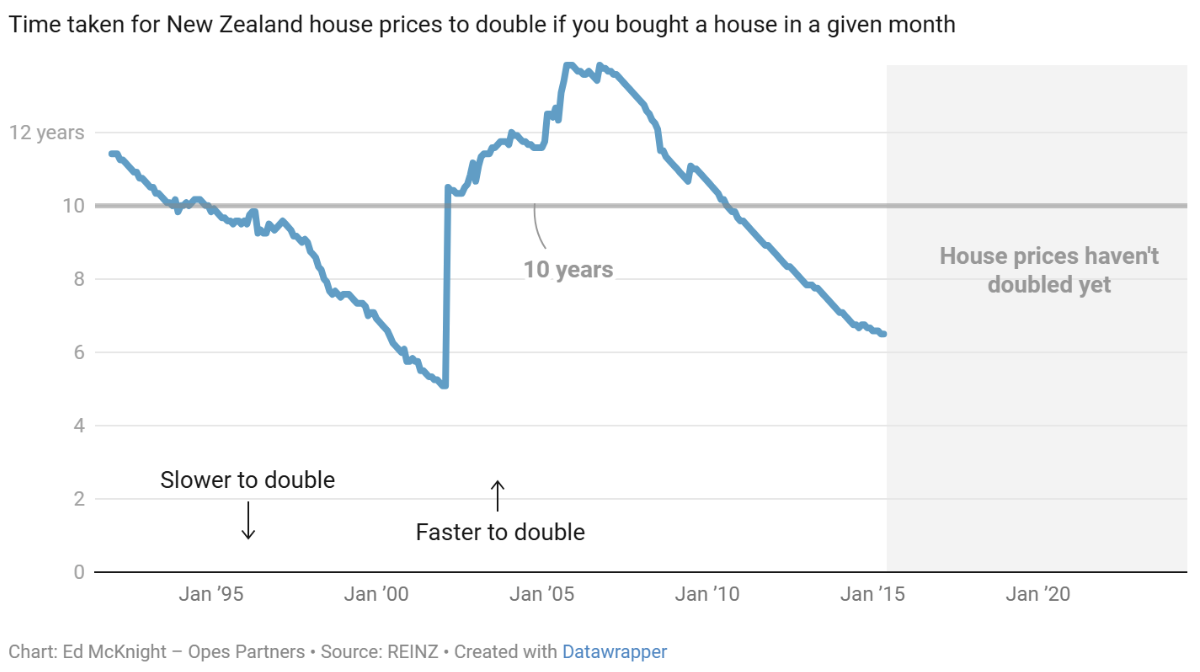

Kiwis love to invest in property, primarily for capital gains to help fund their retirement. Historically, capital gains consistently doubled every 10 years, but those days are now over. Nevertheless, property is still a worthwhile investment for many.

So, what should you keep in mind when deciding whether to invest in property?

- Uneven regional growth: While some smaller districts (such as Kawerau or Horowhenua) saw values more than double over the past decade, major centres such as Auckland rose by only around 29.5% between 2015 and 2024. This shows that location now matters far more than in the past.

- National averages: Across New Zealand, the average asking price rose about 60% over the last decade, not 100%. That’s strong growth, but far short of the “doubling” myth.

- Interest rate cycles: The low-interest environment of the 2010s fuelled rapid price rises. With higher rates in recent years, borrowing power has dropped, slowing demand and price growth.

- Affordability limits: Wages haven’t kept pace with property prices. Buyers simply can’t sustain the same level of growth, especially in expensive urban markets.

- Policy and regulation: Government interventions, such as tighter lending rules, brightline tests, and restrictions on investors, have cooled speculative demand.

- Supply pressures: New housing developments, especially in growth areas, have eased shortages. More supply means less runaway price inflation.

- Global economic shifts: Inflation, migration patterns, and international investment flows all affect property markets. The past decade has been marked by volatility, making steady increases unrealistic.

Ed McKnight is a prolific property investor who has done some analysis to back this up. Click here for his OneRoof article on the subject.

If you’re considering starting or growing your property portfolio, get in touch with Elise. She can help you identify your next steps.

Investments

AI investing – bubble or boom?

AI is everywhere and in most things these days. Some AI tools are making our lives easier, while others are causing harm by giving misinformation (known as hallucinations) or by people asking their AI tools the wrong questions, leading them to make decisions without the whole picture.

Most investment portfolios include AI stocks, which have delivered some great returns over the last 12 months or so. The concern is that it is a bubble, and bubbles always burst. Smart investors separate the hype from the fundamentals.

So, what are signs that there’s an AI bubble?

- Soaring valuations

- Hype cycles

- Speculative capital chasing “AI-powered” labels.

What are the signs that AI has solid fundamentals?

- Real earnings growth

- Widespread adoption

- Transformative potential across industries.

We’re likely in an AI boom, with real, long-term value to be gained, but with significant pockets of overvaluation. Some firms will thrive; others may collapse. If you are considering investing in AI, focus on the fundamentals when looking at an AI company, and be prepared to bear the risks.

Banks

Get a share of the banks’ profits!

We’ve said it before, but given this is a time of great opportunity, we’re saying it again! With record profits rolling in, the big banks are fighting hard for market share. Right now, most are offering 1.5% cashback on new lending – effectively paying you to bring your business to them.

Hot Tip: Don’t just stop at cashback. We can help you push for more bonuses, such as better rates, fee waivers, or contributions to costs. When banks are competing, you hold the power.

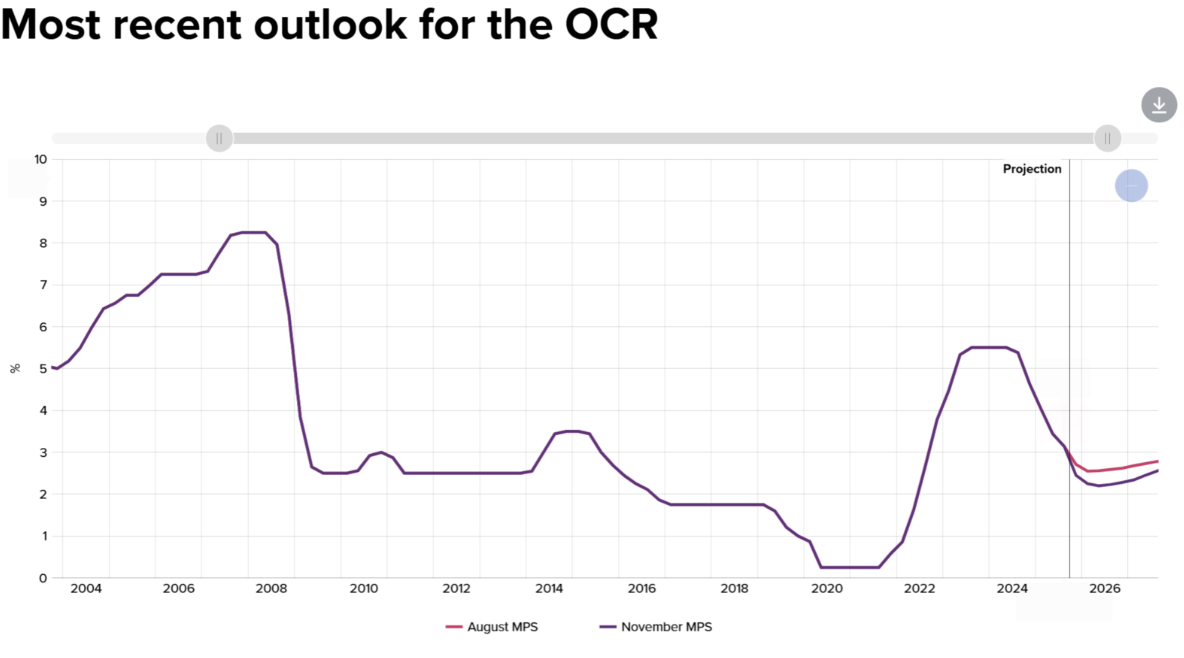

With forecasts predicting we are at or near the bottom of the interest rate cycle, and banks keen to sweeten their deals, now is a great time to consider making a move.

At BoB, we secure cashback and legal deals, optimise loan structures, and avoid traps. Book a review with Elise to see if refinancing is the right move for you.

Reserve Bank

Are we there yet? It seems that we are!

The Reserve Bank has cut the Official Cash Rate (OCR) to 2.25%, signalling this will be the last cut for the year – and possibly for the foreseeable future.

Their view is that inflation is finally under control and the focus is now on stability. It’s expected the OCR will remain at this level for some time – potentially all through 2026.

What this means for you:

- Borrowers: Lower rates ease mortgage repayments, but don’t expect further relief anytime soon.

- Savers: Returns on deposits may stabilise at current levels.

- Businesses: Certainty around rates helps with planning, though growth pressures remain.

Insurance

What’s the one asset you can’t afford to lose?

It’s not your house, your car, or even your savings — it’s your ability to earn an income.

Every day, we rely on our pay to keep the lights on, cover the mortgage, put food on the table, and plan for the future. But what happens if illness or injury suddenly stops that income? For most of us, the reality is simple: without it, we can’t sustain the lifestyle we’ve worked so hard to build.

Income protection provides a safety net — replacing a portion of your income so you can focus on recovery, not bills. It’s not just for modest earners. In fact, the more you earn, the more you stand to lose. Higher incomes often mean bigger mortgages, larger commitments, and greater financial responsibilities.

Protecting your income means protecting your family, your lifestyle, and your peace of mind. Don’t leave your greatest asset unprotected.

Give Gordon a call to review your cover and discover any gaps and opportunities – gordon@bob.kiwi.nz or 022 503 9094.

Business

Stay afloat over the holiday season

The festive season is a time to recharge, but it also brings unique challenges for businesses. Here are five things you should do to stay on top of your finances and commitments over Christmas:

- Plan cash flow early

December and January can be unpredictable. Factor in reduced trading days, client payments slowing down, and holiday expenses. Build a buffer so you’re not caught short. - Communicate with clients and suppliers

Give plenty of notice of any change to office hours and service delivery over the holiday period. Clear communication avoids last-minute surprises and stress for everyone involved. - Review staff leave and rosters

Ensure you have coverage for essential tasks. Balance holiday requests with business needs so operations run smoothly. - Check insurance and risk cover

With many businesses closing or operating at reduced capacity, make sure your protections (including income protection and business interruption cover) are up to date. - Set goals for the new year

Use the quieter period to reflect on wins and challenges. Map out priorities for 2026 so you start strong.

Do you want to make 2026 a fantastic year for your business? Good business starts with a good plan. Book a strategy session today.

We are always available for a chat about your situation.

Book a meeting or send us an email.

Until next time,

Elise and the Team